- Car finance Car finance

- Motorbike finance Motorbike finance

- Van finance Van finance

- How it works How it works

- FAQs and guides FAQs and guides

- About us About us

Home > Motorbike finance

Home > Motorbike finance

Motorbike finance

We can walk you through the entire motorcycle finance process. To get started you will need:

Monthly earnings over £1,000 (after tax)

To be aged between 20 and 75

Valid A1, A2 or A UK motorbike licence or CBT certificate

2 consecutive months of payslips

Motorbike finance

We can walk you through the entire motorcycle finance process. To get started you will need:

- Monthly earnings over £1,000 (after tax)

- To be aged between 20 and 75

- Valid A1, A2 or A UK motorbike licence or CBT certificate

- 2 consecutive months of payslips

Showing our 4 & 5 star reviews

Showing our 4 & 5 star reviews

What is motorbike finance?

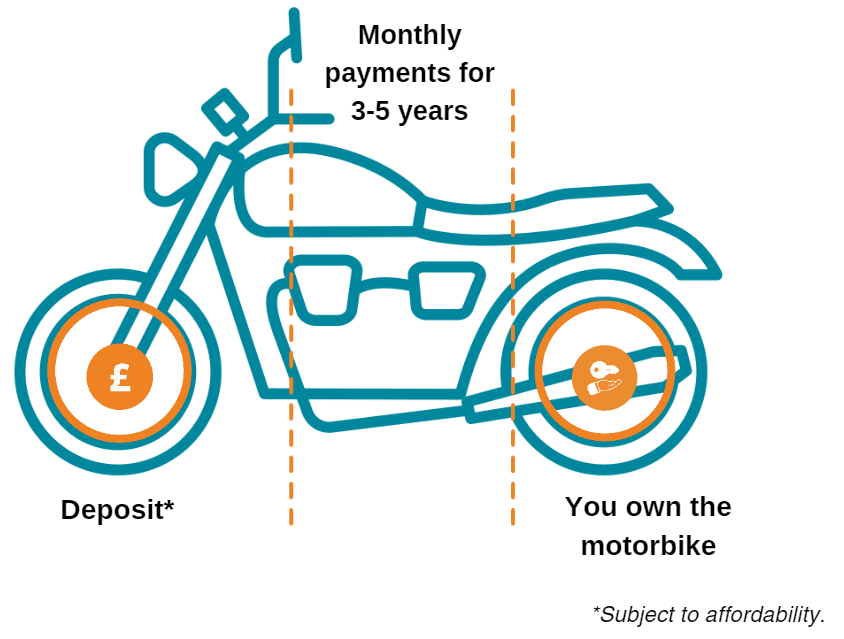

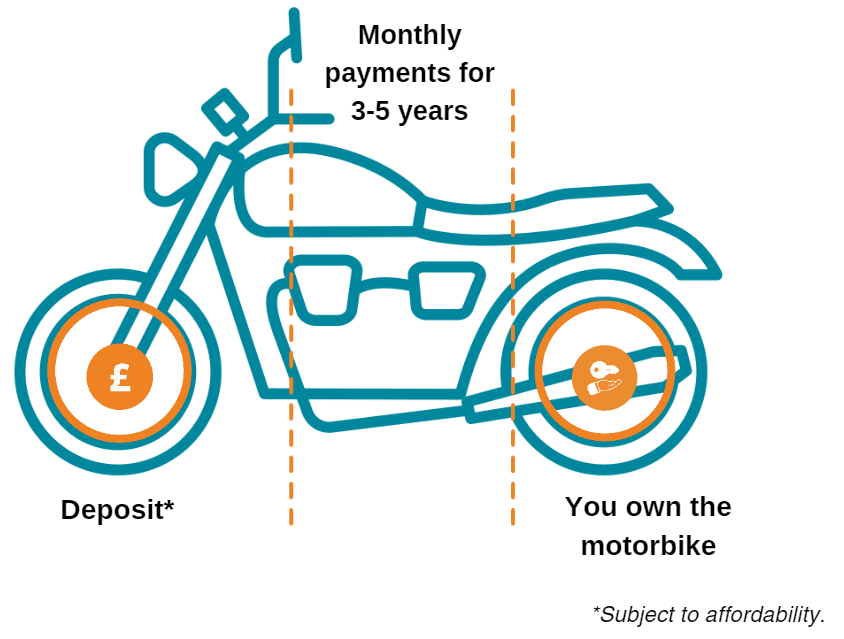

Motorbike finance is a way of borrowing money to buy a new motorcycle without having to pay for it all at once. Instead, you can make monthly payments until the finance has been paid off.

With our Conditional Sale agreement, once you have made your final payment, you will legally own the motorbike.

What is bad credit motorbike finance?

Bad credit motorbike finance is designed for people with low credit scores or poor or limited credit histories.

As a specialist lender, we could help you get motorbike finance even if you have been declared bankrupt, or have a IVA or CCJ.

How to get a motorbike on finance

We know that owning a motorcycle is an important part of your life. Whether you use it for commuting, traveling, or leisure, we can help you if you want to finance your new bike.

What is motorbike finance?

Motorbike finance is a way of borrowing money to buy a new motorcycle without having to pay for it all at once. Instead, you can make monthly payments until the finance has been paid off.

With our Conditional Sale agreement, once you have made your final payment, you will legally own the motorbike.

What is bad credit motorbike finance?

Bad credit motorbike finance is designed for people with low credit scores or poor or limited credit histories.

As a specialist lender, we could help you get motorbike finance even if you have been declared bankrupt, or have a IVA or CCJ.

How to get a motorbike on finance

We know that owning a motorcycle is an important part of your life. Whether you use it for commuting, traveling, or leisure, we can help you if you want to finance your new bike.

To get motorbike finance, you’ll need:

- Monthly earnings over £1,000 (after tax)

- To be aged between 20 and 75

- A valid A1, A2, or A UK motorbike licence or a valid CBT certificate

- 2 consecutive months of payslips

- Find out more about our lending criteria

We can finance motorbikes that meet our lending criteria:

- Priced between £3,600 and £15,000

- Minimum engine size of 125cc

- Up to 30,000 miles on the clock

- The motorbike must not be older than 25 years old at the end of the agreement

- Must be road-legal and not an import

We know that owning a motorcycle is an important part of your life. Whether you use it for commuting, traveling, or leisure, we can help you if you want to finance your new bike.

To get motorbike finance, you’ll need:

- Monthly earnings over £1,000 (after tax)

- To be aged between 20 and 75

- A valid A1, A2, or A UK motorbike licence or a valid CBT certificate

- 2 consecutive months of payslips

- Find out more about our lending criteria

We can finance motorbikes that meet our lending criteria:

- Priced between £3,600 and £15,000

- Minimum engine size of 125cc

- Up to 30,000 miles on the clock

- The motorbike must not be older than 25 years old at the end of the agreement

- Must be road-legal and not an import

How to access our finance

If you need vehicle finance, we’ve got you covered. Thanks to our wide network of trusted credit brokers you can sit back and focus on what truly matters.

When you apply with our credit brokers, they will have a range of lenders that could offer you finance including ourselves. To make it simple, they will handle the paperwork, vehicle searching, and everything in between. Credit brokers may charge an administration fee.

How to access our finance

If you need vehicle finance, we’ve got you covered. Thanks to our wide network of trusted credit brokers you can sit back and focus on what truly matters.

When you apply with our credit brokers, they will have a range of lenders that could offer you finance including ourselves. To make it simple, they will handle the paperwork, vehicle searching, and everything in between. Credit brokers may charge an administration fee.

Join thousands of monthly customers like David

As soon as I applied with Moneybarn everything was quick and straightforward. I’m very happy with my vehicle and the service that Moneybarn has given and would 100% recommend them to a friend or family member – David.

Join thousands of monthly customers like David

As soon as I applied with Moneybarn everything was quick and straightforward. I’m very happy with my vehicle and the service that Moneybarn has given and would 100% recommend them to a friend or family member – David.

How does motorbike finance work?

If you have ever financed a car before, you’ll be happy to know that financing a motorbike works in a very similar way.

We offer a Conditional Sale agreement, which means that you can use the bike fully during the finance agreement. The motorbike will be registered under your name, and you’ll be responsible for its maintenance and servicing.

Once you make your final payment, you will legally own the motorbike.

You might have heard about other lenders who offer Hire Purchase (HP) or Personal Contract Purchase (PCP). Read our guide to learn more about the types of motorbike finance.

We’re proud to have over 30 years of experience helping people onto a better road ahead. We help thousands of customers up and down the UK each month, even if other lenders have refused them.

How does motorbike finance work?

If you have ever financed a car before, you’ll be happy to know that financing a motorbike works in a very similar way.

We offer a Conditional Sale agreement, which means that you can use the bike fully during the finance agreement. The motorbike will be registered under your name, and you’ll be responsible for its maintenance and servicing.

Once you make your final payment, you will legally own the motorbike.

You might have heard about other lenders who offer Hire Purchase (HP) or Personal Contract Purchase (PCP). Read our guide to learn more about the types of motorbike finance.

We’re proud to have over 30 years of experience helping people onto a better road ahead. We help thousands of customers up and down the UK each month, even if other lenders have refused them.

Conditional Sale at a glance

Your interest rate will be fixed so your payments are the same each month.

Finance is subject to status and affordability checks.

There are no mileage restrictions like other types of finance such as PCP.

You won’t own the motorbike until the final payment is made.

You’ll own the motorbike at the end of the agreement.

You will need the correct type of motorbike licence to be eligible.

There are no late payment charges or hidden fees during your agreement.

The motorbike may be repossessed if you can’t make payments.

Conditional Sale at a glance

There are no mileage restrictions like other finance types such as PCP.

You’ll own the motorbike at the end of the agreement.

There are no late payment charges or hidden fees during your agreement.

Finance is subject to status and affordability checks.

You won’t own the motorbike until the final payment is made.

You will need the correct type of motorbike licence to be eligible.

The motorbike may be repossessed if you can’t make payments.

How much does motorcycle finance cost?

The cost of motorcycle finance can vary for each person, depending on their specific circumstances and eligibility criteria. It’s not possible to compare costs as a like-for-like, because everyone is different and so is their motorbike finance agreement.

To get an idea of what motorbike finance might cost you, try our motorbike finance calculator. Simply enter the amount you wish to borrow and the repayment period, and it will give you with an idea of the monthly payments needed.

How much does motorcycle finance cost?

The cost of motorcycle finance can vary for each person, depending on their specific circumstances and eligibility criteria. It’s not possible to compare costs as a like-for-like, because everyone is different and so is their motorbike finance agreement.

To get an idea of what motorbike finance might cost you, try our motorbike finance calculator. Simply enter the amount you wish to borrow and the repayment period, and it will give you with an idea of the monthly payments needed.

Why choose Moneybarn?

Great customer service

We support thousands of people up and down the country each month with the vehicle they need. Our customers rate us as Excellent on Trustpilot.

Award-winning finance

We continue to win industry awards for our approach to responsible lending, including ‘Vehicle Finance Provider of the Year’ and ‘Sub-Prime Lender of the Year’ for 2023.

Leading specialist lender

We have over 30 years of experience and have helped nearly 400,000 customers with vehicle finance. As a direct lender, we want to help you get on a better road ahead.

Why choose Moneybarn?

Great customer service

We support thousands of people up and down the country each month with the vehicle they need. Our customers rate us as Excellent on Trustpilot.

Award-winning finance

We continue to win industry awards for our approach to responsible lending, including ‘Vehicle Finance Provider of the Year’ and ‘Sub-Prime Lender of the Year’ for 2023.

Leading specialist lender

We have over 30 years of experience and have helped nearly 400,000 customers with vehicle finance. As a direct lender, we want to help you get on a better road ahead.

Useful motorbike guides

Useful motorbike guides

Buying a motorbike

Make sure to consider these important factors before buying your new motorbike.

What motorbike should I buy?

With so many different types of motorbikes on the market it’s important to know which one would be right for you.

Motorcycle finance explained

There are lots of different types of motorbike finance available. Read out guide to learn more about them.

Buying a motorbike

Make sure to consider these important factors before buying your new motorbike.

What motorbike should I buy?

With so many different types of motorbikes on the market it’s important to know which one would be right for you.

Motorcycle finance explained

There are lots of different types of motorbike finance available. Read out guide to learn more about them.

FAQs about motorbike finance

What types of bikes do you finance?

We can help you finance a range of motorbikes as long as they meet our lending criteria.

Are motorbikes hard to finance?

Everyone’s eligibility for motorbike finance varies based on multiple factors, such as credit history and affordability. Therefore, it’s not possible to say whether it will be easy or difficult for you to get motorcycle finance.

Can you get finance on a motorbike without a licence?

It may be possible to insure a motorcycle in the UK even if you don’t have a licence, but getting finance without the appropriate licence is usually not possible. The type of motorbike licence required varies depending on the lender, their criteria, and the bike you want to buy.

You can read more about the different types of bike licences on the GOV.UK website.

If you’d like to finance a motorbike with Moneybarn, you’ll need a valid A1, A2 or A UK motorbike licence or CBT certificate. If you have passed your Compulsory Basic Training (CBT) or have the right licence, we could help.

How long should I finance a motorbike for?

Our motorbike finance options range from 36 to 60 months (3 to 5 years), so you can choose the agreement term that suits you best. Our friendly experts are ready to help you find an agreement that suits your needs.

If you prefer to spread out the cost over a longer time period, you can choose a longer agreement term. This will reduce your monthly payments, but keep in mind that it will also increase the overall cost of the finance. This is because there will be more interest over a longer term, compared to a shorter term.

To get an idea of what your payments might look like, try using our motorbike finance calculator.

Should I pay off my motorcycle loan early?

Fully paying off your motorcycle finance early is called an early settlement, which can save you money in the long run by reducing the interest you pay.

If you want to pay your bike finance off early, you should discuss this with your lender because there may be extra fees to pay.

Depending on the lender and type of finance you have, it may be possible to make larger payments to repay part or all of your loan. Read more in our guide that explains how you can make additional payments on finance.

Can I get a motorbike on finance with no deposit?

It is possible to be approved for motorbike finance without making a deposit, but this depends on your credit history and affordability.

While not putting a deposit down can make it more affordable at the beginning, it can end up costing more in the long run. This is because borrowing more money means paying more interest over a longer period of time.

Can I finance a motorbike for my partner?

No, it isn’t possible to finance a motorbike for a partner or family member. This is known as ‘fronting’ which is illegal. You can read more about why you can’t apply for finance for someone else in our guide.

Each application for motorbike finance is unique, as everyone’s circumstances are different. If you were to apply for someone else, your application would be misleading, as the lender would not be able to verify whether the finance is affordable for that person.

If you’re looking to apply with someone else, have you considered a joint finance application? This is where you apply with someone who lives with you.

FAQs about motorbike finance

What types of bikes do you finance?

We can help you finance a range of motorbikes as long as they meet our lending criteria.

Are motorbikes hard to finance?

Everyone’s eligibility for motorbike finance varies based on multiple factors, such as credit history and affordability. Therefore, it’s not possible to say whether it will be easy or difficult for you to get motorcycle finance.

Can you get finance on a motorbike without a licence?

It may be possible to insure a motorcycle in the UK even if you don’t have a licence, but getting finance without the appropriate licence is usually not possible. The type of motorbike licence required varies depending on the lender, their criteria, and the bike you want to buy.

You can read more about the different types of bike licences on the GOV.UK website.

If you’d like to finance a motorbike with Moneybarn, you’ll need a valid A1, A2 or A UK motorbike licence or CBT certificate. If you have passed your Compulsory Basic Training (CBT) or have the right licence, we could help.

How long should I finance a motorbike for?

Our motorbike finance options range from 36 to 60 months (3 to 5 years), so you can choose the agreement term that suits you best. Our friendly experts are ready to help you find an agreement that suits your needs.

If you prefer to spread out the cost over a longer time period, you can choose a longer agreement term. This will reduce your monthly payments, but keep in mind that it will also increase the overall cost of the finance. This is because there will be more interest over a longer term, compared to a shorter term.

To get an idea of what your payments might look like, try using our motorbike finance calculator.

Should I pay off my motorcycle loan early?

Fully paying off your motorcycle finance early is called an early settlement, which can save you money in the long run by reducing the interest you pay.

If you want to pay your bike finance off early, you should discuss this with your lender because there may be extra fees to pay.

Depending on the lender and type of finance you have, it may be possible to make larger payments to repay part or all of your loan. Read more in our guide that explains how you can make additional payments on finance.

Can I get a motorbike on finance with no deposit?

It is possible to be approved for motorbike finance without making a deposit, but this depends on your credit history and affordability.

While not putting a deposit down can make it more affordable at the beginning, it can end up costing more in the long run. This is because borrowing more money means paying more interest over a longer period of time.

Can I finance a motorbike for my partner?

No, it isn’t possible to finance a motorbike for a partner or family member. This is known as ‘fronting’ which is illegal. You can read more about why you can’t apply for finance for someone else in our guide.

Each application for motorbike finance is unique, as everyone’s circumstances are different. If you were to apply for someone else, your application would be misleading, as the lender would not be able to verify whether the finance is affordable for that person.

If you’re looking to apply with someone else, have you considered a joint finance application? This is where you apply with someone who lives with you.

125cc motorbike finance

There are lots of 125cc bikes on the market, but the amount of choice can be overwhelming. Find out how we could help you finance a 125cc motorbike today.

Find your local motorbike club

Looking to join a motorbike club? We have mapped out all the motorbike clubs across the UK. Click the button below to find your local motorbike club.

For a better road ahead

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.

Moneybarn is the trading style of Moneybarn No. 1 Limited, a company registered in England and Wales with company number 04496573. The registered address is Athena House, Bedford Road, Petersfield, Hampshire, GU32 3LJ.

Moneybarn’s VAT registration number is 180 5559 52.

Moneybarn No. 1 Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702780)

Representative example: Total amount of credit £6,088. Repayable over 53 months, 52 monthly payments of £216.84. Representative 36.8% APR (fixed). Deposit of £356.99. Total charge for credit £5,187.64. Total amount payable £11,632.63. Subject to status and affordability. You could risk losing your vehicle if you do not keep up payments.