- Car finance Car finance

- Motorbike finance Motorbike finance

- Van finance Van finance

- How it works How it works

- FAQs and guides FAQs and guides

- About us About us

Home > How it works > What is CS finance?

Home > How it works > What is CS finance?

What is CS finance?

CS stands for Conditional Sale agreement. It is a type of car finance where you automatically own the car at the end of the agreement, with no option to purchase fee or balloon payment.

What is CS finance?

CS stands for Conditional Sale agreement. It is a type of car finance where you automatically own the car at the end of the agreement, with no option to purchase fee or balloon payment.

What is a Conditional Sale agreement?

Conditional Sale (CS) is a type of car finance that means you legally own the car once you make your final payment. During the agreement, you’ll be the car’s registered keeper. This means you’ll be responsible for maintaining and servicing the car, but with full use of the car with no mileage restrictions.

How does Conditional Sale (CS) finance work?

In a Conditional Sale car finance agreement, the lender buys the vehicle on your behalf. They pay the dealership for you, and you make fixed monthly payments until you repay the amount you borrowed plus interest.

You can use our online car finance calculator to see what your Conditional Sale agreement might look like. Simply enter how much you want to borrow, for how long, and your credit score, and it’ll show you what your monthly CS payments could look like.

What is a Conditional Sale agreement?

Conditional Sale (CS) is a type of car finance that means you legally own the car once you make your final payment. During the agreement, you’ll be the car’s registered keeper. This means you’ll be responsible for maintaining and servicing the car, but with full use of the car with no mileage restrictions.

How does Conditional Sale (CS) finance work?

In a Conditional Sale car finance agreement, the lender buys the vehicle on your behalf. They pay the dealership for you, and you make fixed monthly payments until you repay the amount you borrowed plus interest.

You can use our online car finance calculator to see what your Conditional Sale agreement might look like. Simply enter how much you want to borrow, for how long, and your credit score, and it’ll show you what your monthly CS payments could look like.

How long is a Conditional Sale car finance agreement?

CS agreements usually last between 12 and 60 months (1 to 5 years). This varies depending on the lender you choose, and is subject to status and affordability checks.

Our Conditional Sale agreements range from 36 to 60 months (3 to 5 years). During this time, you’ll make fixed monthly payments. Once your final payment is made, you will legally own the car.

Do you need to pay a deposit?

It is possible to get Conditional Sale car finance with no deposit. Getting approved for this type of agreement depends on several factors, including credit history and affordability.

Not putting down a deposit can help make car finance more affordable at the beginning, however it can cause your agreement to cost more in the long run. This is because you’d be borrowing more and therefore paying more in interest, compared to someone who puts down a deposit.

We’ve created a guide on everything you need to know about car finance deposits, which can help you to decide how much of a deposit to put down on your next car.

Is a Conditional Sale agreement secured or unsecured?

Conditional Sale is a secured loan. This means that the agreement is secured against the car. If for whatever reason you don’t pay your car finance, the lender may terminate the agreement and repossess the vehicle.

Because CS is secured, if your circumstances change and you can no longer afford the agreement, you could hand back the car and use that to help pay off your agreement.

The exact process varies by lender, but there are several options available if you want to end your agreement or your circumstances have changed.

Can I change my car during a CS agreement?

While you can’t transfer finance from one car to another, you can settle your agreement early if you’d like to upgrade to a new car.

You can part exchange your vehicle during your agreement, but because you don’t legally own it, there are usually only two ways to do this. For more information, see our guide that explains how to part exchange a car on finance.

If you’re looking to have a new car every year or two, then other types of finance such as car leasing may be more suitable than CS. However, if you want to own the car at the end of the agreement, CS may be for you.

Am I eligible for Conditional Sale?

Whether or not you are eligible for CS car finance depends on several factors. These include your personal circumstances, credit history, and affordability.

We’re one of the UK’s leading specialist lenders who can help even if you’ve been refused by mainstream companies.

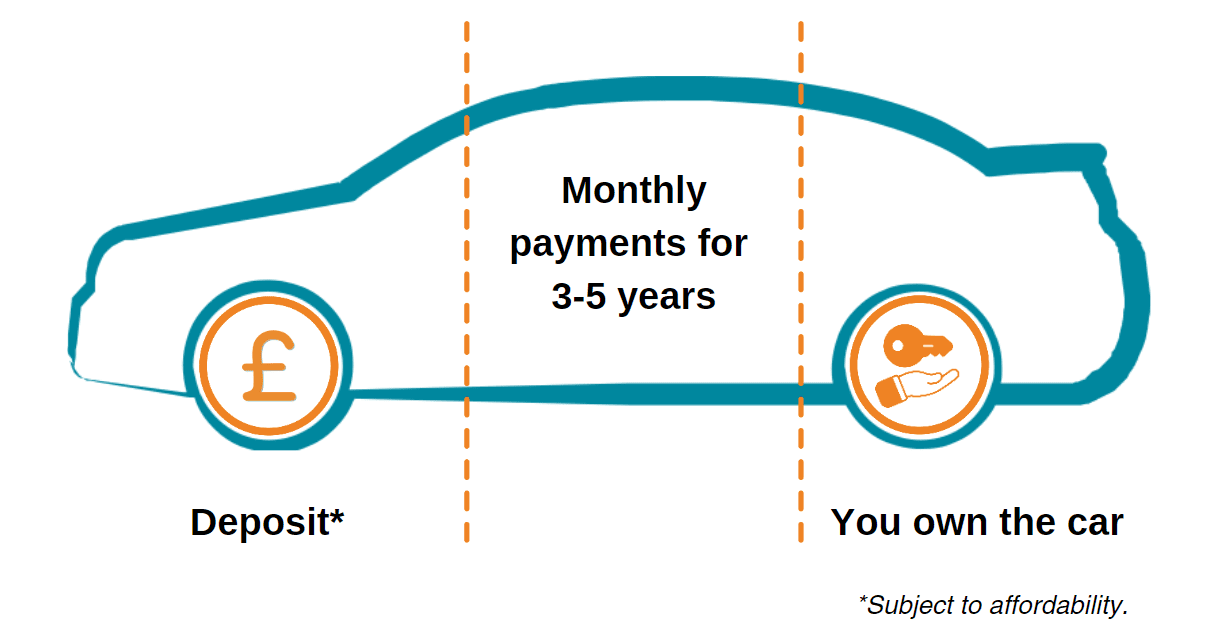

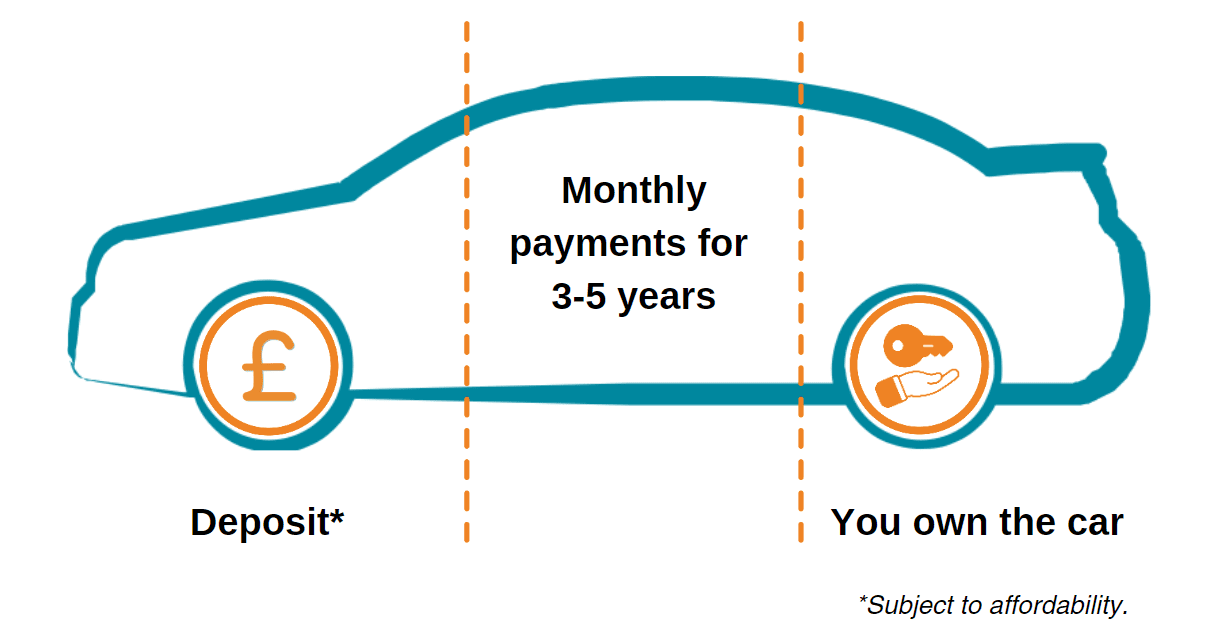

Conditional Sale agreement illustration

The key difference between CS and other types of car finance (like HP and PCP) is that you’ll legally own the car at the end of the agreement without an additional fee or payment required.

Conditional Sale agreement illustration

The key difference between CS and other types of car finance (like HP and PCP) is that you’ll legally own the car at the end of the agreement without an additional fee or payment required.

How long is a Conditional Sale car finance agreement?

CS agreements usually last between 12 and 60 months (1 to 5 years). This varies depending on the lender you choose, and is subject to status and affordability checks.

Our Conditional Sale agreements range from 36 to 60 months (3 to 5 years). During this time, you’ll make fixed monthly payments. Once your final payment is made, you will legally own the car.

Do you need to pay a deposit?

It is possible to get Conditional Sale car finance with no deposit. Getting approved for this type of agreement depends on several factors, including credit history and affordability.

Not putting down a deposit can help make car finance more affordable at the beginning, however it can cause your agreement to cost more in the long run. This is because you’d be borrowing more and therefore paying more in interest, compared to someone who puts down a deposit.

We’ve created a guide on everything you need to know about car finance deposits, which can help you to decide how much of a deposit to put down on your next car.

Is a Conditional Sale agreement secured or unsecured?

Conditional Sale is a secured loan. This means that the agreement is secured against the car. If for whatever reason you don’t pay your car finance, the lender may terminate the agreement and repossess the vehicle.

Because CS is secured, if your circumstances change and you can no longer afford the agreement, you could hand back the car and use that to help pay off your agreement.

The exact process varies by lender, but there are several options available if you want to end your agreement or your circumstances have changed.

Can I change my car during a CS agreement?

While you can’t transfer finance from one car to another, you can settle your agreement early if you’d like to upgrade to a new car.

You can part exchange your vehicle during your agreement, but because you don’t legally own it, there are usually only two ways to do this. For more information, see our guide that explains how to part exchange a car on finance.

If you’re looking to have a new car every year or two, then other types of finance such as car leasing may be more suitable than CS. However, if you want to own the car at the end of the agreement, CS may be for you.

Am I eligible for Conditional Sale?

Whether or not you are eligible for CS car finance depends on several factors. These include your personal circumstances, credit history, and affordability.

We’re one of the UK’s leading specialist lenders who can help even if you’ve been refused by mainstream companies.

Is CS finance good?

CS finance helps you to spread the cost of a new or used car over several years. There is no option to purchase fee (like with HP) or balloon payment (like with PCP). You will have a fixed interest rate and monthly payments, and will own the car at the end of the agreement.

If you’re looking to have a new car every couple of years, a PCP or PCH (leasing) agreement may be more suitable. If you’d prefer to own the car when your agreement ends, HP or CS could be more suitable.

Is CS finance good?

CS finance helps you to spread the cost of a new or used car over several years. There is no option to purchase fee (like with HP) or balloon payment (like with PCP). You will have a fixed interest rate and monthly payments, and will own the car at the end of the agreement.

If you’re looking to have a new car every couple of years, a PCP or PCH (leasing) agreement may be more suitable. If you’d prefer to own the car when your agreement ends, HP or CS could be more suitable.

Advantages and disadvantages of Conditional Sale

Advantages and disadvantages of Conditional Sale

The interest rate is fixed so your payments will be the same each month.

Finance is subject to status and affordability checks.

There are no mileage restrictions like other finance types such as PCP.

Monthly payments may be higher than other car finance types like PCP.

You’ll own the car at the end of the agreement with no additional fee.

You won’t legally own the car until the final payment is made.

Some CS agreements let you put down a low deposit or none at all.

There’s less flexibility at the end of the agreement compared to PCP.

If you can’t make the payments, you can return the car to help pay it off.

You may be offered a high APR if you have bad credit or no credit history.

There are no late payment charges or hidden fees during your agreement.

The car may be repossessed if you can’t make payments.

There are no mileage restrictions like other finance types such as PCP.

You’ll own the car at the end of the agreement with no additional fee.

Some CS agreements let you put down a low deposit or none at all.

If you can’t make the payments, you can return the car to help pay it off.

There are no late payment charges or hidden fees during your agreement.

Finance is subject to status and affordability checks.

Monthly payments may be higher than other car finance types like PCP.

You won’t legally own the car until the final payment is made.

There’s less flexibility at the end of the agreement compared to PCP.

You may be offered a high APR if you have bad credit or no credit history.

The car may be repossessed if you can’t make payments.

How is CS different to HP and PCP?

CS finance is designed to help people who want to legally own the car when the agreement ends. The main difference between CS and other finance agreements is what happens at the end of the agreement.

With CS, you legally own the car once you make the final payment. Unlike HP and PCP, there is no option to purchase fee or balloon payment to make to do this. When a CS agreement ends, the finance company will automatically transfer legal ownership of the car to you.

Comparing CS to other car finance types

We offer a Conditional Sale agreement, but understanding the different types of car finance can help you make an informed decision before you get a quote.

The most popular types of car finance in the UK are:

- Conditional Sale (CS)

- Hire Purchase (HP)

- Personal Contract Purchase (PCP)

- Personal Contract Hire (PCH, or car leasing)

How is CS different to HP and PCP?

CS finance is designed to help people who want to legally own the car when the agreement ends. The main difference between CS and other finance agreements is what happens at the end of the agreement.

With CS, you legally own the car once you make the final payment. Unlike HP and PCP, there is no option to purchase fee or balloon payment to make to do this. When a CS agreement ends, the finance company will automatically transfer legal ownership of the car to you.

Comparing CS to other car finance types

We offer a Conditional Sale agreement, but understanding the different types of car finance can help you make an informed decision before you get a quote.

The most popular types of car finance in the UK are:

- Conditional Sale (CS)

- Hire Purchase (HP)

- Personal Contract Purchase (PCP)

- Personal Contract Hire (PCH, or car leasing)

| CS | HP | PCP | PCH | Buy a new car | ✔ | ✔ | ✔ | ✔ |

|---|---|---|---|---|

| Buy a used car | ✔ | ✔ | ✔ | ✖ |

| Can you get a no deposit deal? | ✔ | ✔ | ✔ | No, you usually need to pay an initial rental |

| Damage charges | ✖* | ✖* | Yes, if the car has damage beyond fair wear and tear | Yes, if the car has damage beyond fair wear and tear |

| Excess mileage charges | ✖ | ✖ | ✔ | ✔ |

| Vehicle ownership | Automatically once you make the final payment | Once you make the option to purchase fee at the end | If you decide to make the balloon payment at the end | ✖ |

*with CS and HP, if you return the vehicle via voluntary termination or if it is repossessed, any repairs required to address damage exceeding normal wear and tear would incur charges.

| CS | HP | PCP | PCH | Buy a new car | ✔ | ✔ | ✔ | ✔ |

|---|---|---|---|---|

| Buy a used car | ✔ | ✔ | ✔ | ✖ |

| Can you get a no deposit deal? | ✔ | ✔ | ✔ | No, you usually need to pay an initial rental |

| Damage charges | ✖* | ✖* | Yes, if the car has damage beyond fair wear and tear | Yes, if the car has damage beyond fair wear and tear |

| Excess mileage charges | ✖ | ✖ | ✔ | ✔ |

| Vehicle ownership | Automatically once you make the final payment | Once you make the option to purchase fee at the end | If you decide to make the balloon payment at the end | ✖ |

*with CS and HP, if you return the vehicle via voluntary termination or if it is repossessed, any repairs required to address damage exceeding normal wear and tear would incur charges.

Is Conditional Sale the same as Hire Purchase?

A common misconception is that CS and HP are the same. They both have fixed monthly payments and no mileage restrictions. However, with CS, there is no option to purchase fee to legally own the car like there is with HP.

Both HP and CS are designed to help people who want to legally own the car at the end of the agreement. With our CS finance, there are no extra costs or fees during the lifetime of your agreement. Once you’ve made your final payment, we’ll notify you when legal ownership is transferred to you.

If you decide to apply for a Hire Purchase agreement, the lender will tell you what the option to purchase fee is before you sign the agreement.

CS vs PCP

The key difference between CS and PCP is the level of flexibility at the end of the agreement.

With Conditional Sale, you will automatically own the car once you make your final payment. However, with PCP, you will have 3 options. You can make the balloon payment to legally own the car, return it and end your agreement, or part exchange it and start a new PCP deal.

If you think your circumstances may change, or you don’t want to own the car at the end of the agreement, then PCP may be more suitable. However, if you know you want to own the car without having to make a large payment at the end, then CS may be more suitable.

Is Conditional Sale the same as car leasing?

No, leasing and Conditional Sale are quite different.

Leasing, also known as Personal Contract Hire (PCH) allows you to drive a new car every few years. However, you will never legally own the car, and will have to return it at the end of the agreement. With Conditional Sale, you will automatically own the car once you make your final payment.

If you want to own a new car and upgrade often, then PCH might be better for you. On the other hand, if you want to own the car once the agreement ends, you won’t be able to do that with PCH. This is because you will have to return the car at the end of the lease.

For more information about the differences, check out our guide that compares leasing and buying a car on finance.

Is Conditional Sale the same as Hire Purchase?

A common misconception is that CS and HP are the same. They both have fixed monthly payments and no mileage restrictions. However, with CS, there is no option to purchase fee to legally own the car like there is with HP.

Both HP and CS are designed to help people who want to legally own the car at the end of the agreement. With our CS finance, there are no extra costs or fees during the lifetime of your agreement. Once you’ve made your final payment, we’ll notify you when legal ownership is transferred to you.

If you decide to apply for a Hire Purchase agreement, the lender will tell you what the option to purchase fee is before you sign the agreement.

CS vs PCP

The key difference between CS and PCP is the level of flexibility at the end of the agreement.

With Conditional Sale, you will automatically own the car once you make your final payment. However, with PCP, you will have 3 options. You can make the balloon payment to legally own the car, return it and end your agreement, or part exchange it and start a new PCP deal.

If you think your circumstances may change, or you don’t want to own the car at the end of the agreement, then PCP may be more suitable. However, if you know you want to own the car without having to make a large payment at the end, then CS may be more suitable.

Is Conditional Sale the same as car leasing?

No, leasing and Conditional Sale are quite different.

Leasing, also known as Personal Contract Hire (PCH) allows you to drive a new car every few years. However, you will never legally own the car, and will have to return it at the end of the agreement. With Conditional Sale, you will automatically own the car once you make your final payment.

If you want to own a new car and upgrade often, then PCH might be better for you. On the other hand, if you want to own the car once the agreement ends, you won’t be able to do that with PCH. This is because you will have to return the car at the end of the lease.

For more information about the differences, check out our guide that compares leasing and buying a car on finance.

Handy guides to the other types of car finance

Handy guides to the other types of car finance

Personal Contract Purchase

Personal Contract Purchase (PCP) gives you some flexibility at the end of the agreement. Unlike CS, you have to make a balloon payment to legally own the car.

Hire Purchase

Hire Purchase (HP) is very similar to CS, and the two are often confused as being the same. With HP, there is an option to purchase fee needed to legally own the car.

Personal Contract Hire

Personal Contract Hire (PCH) is also called car leasing. This is where you rent a new car for an agreed amount of time, with no option of legally owning it.

Personal Contract Purchase

Personal Contract Purchase (PCP) gives you some flexibility at the end of the agreement. Unlike CS, you have to make a balloon payment to legally own the car.

Hire Purchase

Hire Purchase (HP) is very similar to CS, and the two are often confused as being the same. With HP, there is an option to purchase fee needed to legally own the car.

Personal Contract Hire

Personal Contract Hire (PCH) is also called car leasing. This is where you rent a new car for an agreed amount of time, with no option of legally owning it.

Can you get CS finance with bad credit?

Yes, just because you have bad credit, it doesn’t mean you can’t get a Conditional Sale agreement. It just means you might have to use a specialist lender such as Moneybarn.

As specialists in bad credit car finance, we consider people with poor credit scores or no credit history, including people looking for car finance with a CCJ or IVA.

Can you get CS finance with bad credit?

Yes, just because you have bad credit, it doesn’t mean you can’t get a Conditional Sale agreement. It just means you might have to use a specialist lender such as Moneybarn.

As specialists in bad credit car finance, we consider people with poor credit scores or no credit history, including people looking for car finance with a CCJ or IVA.

Showing our 4 & 5 star reviews

Showing our 4 & 5 star reviews

We’re proud to help thousands of people across the UK every month with car finance. We accept applications where other lenders might not, including:

We’re proud to help thousands of people across the UK every month with car finance. We accept applications where other lenders might not, including:

- Have a bad credit score or no credit history

- Currently or previously had an IVA

- Are self-employed

- Have had a CCJ in the past

- Have been rejected by mainstream lenders

- Are receiving benefits

- Have been discharged from bankruptcy

- Are looking to make a joint application

- Have missed payments on bills in the past

- Have had a DRO or DMP

- Have a bad credit score or no credit history

- Currently or previously had an IVA

- Are self-employed

- Have had a CCJ in the past

- Have been rejected by mainstream lenders

- Are receiving benefits

- Have been discharged from bankruptcy

- Are looking to make a joint application

- Have missed payments on bills in the past

- Have had a DRO or DMP

How do I apply for Conditional Sale finance?

How do I apply for Conditional Sale finance?

To get car finance, you’ll need:

- Monthly earnings over £1,000 (after tax)

- To be aged between 20 and 75

- A full valid UK driving licence

- 2 consecutive months of payslips

We can finance cars that meet our lending criteria:

- Priced between £4,000 and £35,000

- Up to 120,000 miles on the clock

- No older than 15 years by the end of the agreement

To get car finance, you’ll need:

- Monthly earnings over £1,000 (after tax)

- To be aged between 20 and 75

- A full valid UK driving licence

- 2 consecutive months of payslips

We can finance cars that meet our lending criteria:

- Priced between £4,000 and £35,000

- Up to 120,000 miles on the clock

- No older than 15 years by the end of the agreement

How to access our finance

If you need vehicle finance, we’ve got you covered. Thanks to our wide network of trusted credit brokers you can sit back and focus on what truly matters.

When you apply with our credit brokers, they will have a range of lenders that could offer you finance including ourselves. To make it simple, they will handle the paperwork, vehicle searching, and everything in between. Credit brokers may charge an administration fee.

How to access our finance

If you need vehicle finance, we’ve got you covered. Thanks to our wide network of trusted credit brokers you can sit back and focus on what truly matters.

When you apply with our credit brokers, they will have a range of lenders that could offer you finance including ourselves. To make it simple, they will handle the paperwork, vehicle searching, and everything in between. Credit brokers may charge an administration fee.

Other ways we could help

Other ways we could help

If you’re looking to buy a new van, we could help. Check out our guide to van finance and see how we could help.

A new motorbike can help you commute to work, get around, or ride socially. Find out about motorbike finance today.

We could help you make the switch to a hybrid or electric car. Check out our guide to getting electric car finance.

If you’re looking to buy a new van, we could help. Check out our guide to van finance and see how we could help.

A new motorbike can help you commute to work, get around, or ride socially. Find out about motorbike finance today.

We could help you make the switch to a hybrid or electric car. Check out our guide to getting electric car finance.

More FAQs about Conditional Sale

Can I modify a car on CS finance?

No, you can’t modify a car bought on CS finance. This is because you don’t legally own the car until the end of the agreement.

Once you have made your final payment and the lender has notified you that you are now the legal owner, you are able to make legal modifications to the car.

Can you pay off CS finance early?

Yes, you can pay off Conditional Sale finance early if you want to. You might do this if you circumstances have changed, you want to upgrade the car, or you simply want to pay the finance off and end the agreement.

With CS, you the flexibility of paying some or all of the amount early if your circumstances change. This is called an early settlement, and the process for doing this varies depending on the lender.

If you want to get CS car finance and think your circumstances might change in the near future, it’s best to discuss this with your potential lender. Our friendly experts would be happy to discuss your options to find an agreement length that is suitable for you.

Who owns the car at the end of a CS agreement?

At the end of a Conditional Sale agreement, you will own the car. Once you’ve made the final payment, the lender will notify you once legal ownership of the car has been transferred to you.

Up until that point, you’ll be the registered keeper of the car. This means you’ll have full access to it, and be responsible for its maintenance and servicing.

Can you cancel a Conditional Sale agreement?

You have a legal right to end your CS agreement early, provided you meet the necessary criteria.

You can voluntarily terminate your CS agreement and return the vehicle at any time.

If you end your CS agreement by voluntary termination, you are liable for half (50%) of the total amount payable, plus any arrears or charges where applicable. As part of voluntary termination, you are required to return the vehicle in good condition.

More FAQs about Conditional Sale

Can I modify a car on CS finance?

No, you can’t modify a car bought on CS finance. This is because you don’t legally own the car until the end of the agreement.

Once you have made your final payment and the lender has notified you that you are now the legal owner, you are able to make legal modifications to the car.

Can you pay off CS finance early?

Yes, you can pay off Conditional Sale finance early if you want to. You might do this if you circumstances have changed, you want to upgrade the car, or you simply want to pay the finance off and end the agreement.

With CS, you the flexibility of paying some or all of the amount early if your circumstances change. This is called an early settlement, and the process for doing this varies depending on the lender.

If you want to get CS car finance and think your circumstances might change in the near future, it’s best to discuss this with your potential lender. Our friendly experts would be happy to discuss your options to find an agreement length that is suitable for you.

Who owns the car at the end of a CS agreement?

At the end of a Conditional Sale agreement, you will own the car. Once you’ve made the final payment, the lender will notify you once legal ownership of the car has been transferred to you.

Up until that point, you’ll be the registered keeper of the car. This means you’ll have full access to it, and be responsible for its maintenance and servicing.

Can you cancel a Conditional Sale agreement?

You have a legal right to end your CS agreement early, provided you meet the necessary criteria.

You can voluntarily terminate your CS agreement and return the vehicle at any time.

If you end your CS agreement by voluntary termination, you are liable for half (50%) of the total amount payable, plus any arrears or charges where applicable. As part of voluntary termination, you are required to return the vehicle in good condition.

What do you need to apply?

You may be asked to provide certain documents to get car finance. See our guide to learn what you need when applying.

Car finance when self-employed

Our CS agreement lets us consider applications from self-employed people. Click the button below to find out how we could help you.

For a better road ahead

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.

Moneybarn is the trading style of Moneybarn No. 1 Limited, a company registered in England and Wales with company number 04496573. The registered address is Athena House, Bedford Road, Petersfield, Hampshire, GU32 3LJ.

Moneybarn’s VAT registration number is 180 5559 52.

Moneybarn No. 1 Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702780)

Representative example: Total amount of credit £9,268. Repayable over 56 months, 55 monthly payments of £295.82. Representative 30.7% APR (fixed). Deposit of £731.53. Total charge for credit £7,002.09. Total amount payable £17,001.62. Subject to status and affordability. You could risk losing your vehicle if you do not keep up payments.