- Car finance Car finance

- Motorbike finance Motorbike finance

- Van finance Van finance

- How it works How it works

- FAQs and guides FAQs and guides

- About us About us

Home > Car finance > Calculator

Home > Car finance > Calculator

Car finance calculator

Use our car financing calculator to see what your car finance agreement with Moneybarn could look like.

To get started, you’ll need:

Monthly earnings over £1,000 (after tax)

To be aged between 20 and 75

A full valid UK driving licence

2 consecutive months of payslips

Car finance calculator

- Monthly earnings over £1,000 (after tax)

- To be aged between 20 and 75

- A full valid UK driving licence

- 2 consecutive months of payslips

Showing our 4 & 5 star reviews

Showing our 4 & 5 star reviews

How to use our car finance calculator

Before you begin, it’s important to note that our calculator shows you what Conditional Sale (CS) finance with Moneybarn could look like. It won’t help with costs for other types of car finance, such as Personal Contract Purchase (PCP) or Hire Purchase (HP). Its purpose is to provide illustrative examples of what car finance could look like.

If you’re still unsure about which type of finance to choose, our car finance calculator will show you what our CS finance might look like so that you can decide if it’s right for you.

How to use our car finance calculator

Before you begin, it’s important to note that our calculator shows you what Conditional Sale (CS) finance with Moneybarn could look like. It won’t help with costs for other types of car finance, such as Personal Contract Purchase (PCP) or Hire Purchase (HP). Its purpose is to provide illustrative examples of what car finance could look like.

If you’re still unsure about which type of finance to choose, our car finance calculator will show you what our CS finance might look like so that you can decide if it’s right for you.

Press one box at a time. Use the slider for quick changes and the + and – buttons for fine tuning in our car finance calculator.

Enter the amount you wish to borrow into the ‘Car price’ box. This can either be the cost of a car you have already found or an estimate of how much you want to pay for a car.

Choose the duration of your agreement by selecting the ‘Payment term’, which is the number of months your car finance will last for.

Adjust the ‘Credit score’ box to reflect your current credit score. If you are unsure about your credit score, please refer to our guide on checking your credit score.

View your result. You’ll be able to see an estimate of your monthly payments and the calculated APR.

Explore how changing the finance amount and payment term affects your monthly payments with our car finance calculator.

Enter the amount you wish to borrow into the ‘Car price’ box. This can either be the cost of a car you have already found or an estimate of how much you want to pay for a car.

Choose the duration of your agreement by selecting the ‘Payment term’, which is the number of months your car finance will last for.

Adjust the ‘Credit score’ box to reflect your current credit score. If you are unsure about your credit score, please refer to our guide on checking your credit score.

View your result. You’ll be able to see an estimate of your monthly payments and the calculated APR.

Explore how changing the finance amount and payment term affects your monthly payments with our car finance calculator.

Who is eligible for a car loan?

If you’re worried about financing a car due to having less-than-perfect credit, our bad credit car finance calculator can help. You can use it to estimate the cost of car finance and get an idea of what your agreement could look like.

We can also help people in the following situations:

- You’ve been refused car finance by other lenders

- You’re self-employed and looking to finance a car

- You want to finance a car with bad credit and no guarantor

Who is eligible for a car loan?

If you’re worried about financing a car due to having less-than-perfect credit, our bad credit car finance calculator can help. You can use it to estimate the cost of car finance and get an idea of what your agreement could look like.

We can also help people in the following situations:

- You’ve been refused car finance by other lenders

- You’re self-employed and looking to finance a car

- You want to finance a car with bad credit and no guarantor

To get car finance with us, you’ll need:

- Monthly earnings over £1,000 (after tax)

- To be aged between 20 and 75

- A full valid UK driving licence

- 2 consecutive months of payslips

We can finance cars that meet our lending criteria:

- Priced between £4,000 and £35,000

- Up to 120,000 miles on the clock

- No older than 15 years by the end of the agreement

To get car finance with us, you’ll need:

- Monthly earnings over £1,000 (after tax)

- To be aged between 20 and 75

- A full valid UK driving licence

- 2 consecutive months of payslips

We can finance cars that meet our lending criteria:

- Priced between £4,000 and £35,000

- Up to 120,000 miles on the clock

- No older than 15 years by the end of the agreement

How to access our finance

If you need vehicle finance, we’ve got you covered. Thanks to our wide network of trusted credit brokers you can sit back and focus on what truly matters.

When you apply with our credit brokers, they will have a range of lenders that could offer you finance including ourselves. To make it simple, they will handle the paperwork, vehicle searching, and everything in between. Credit brokers may charge an administration fee.

How to access our finance

If you need vehicle finance, we’ve got you covered. Thanks to our wide network of trusted credit brokers you can sit back and focus on what truly matters.

When you apply with our credit brokers, they will have a range of lenders that could offer you finance including ourselves. To make it simple, they will handle the paperwork, vehicle searching, and everything in between. Credit brokers may charge an administration fee.

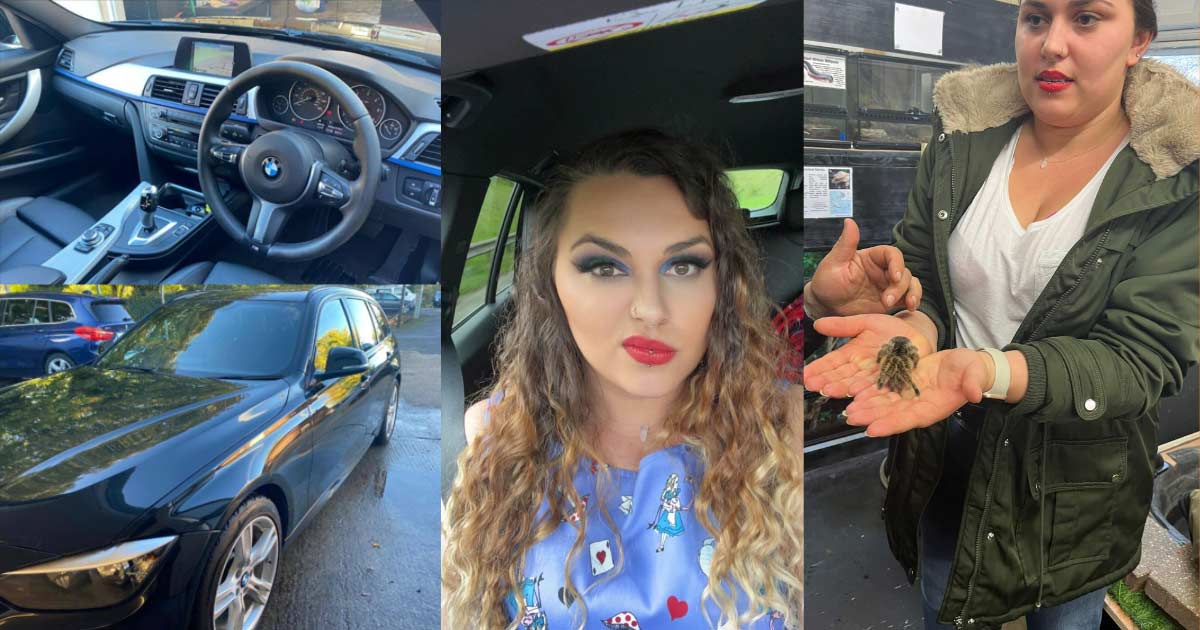

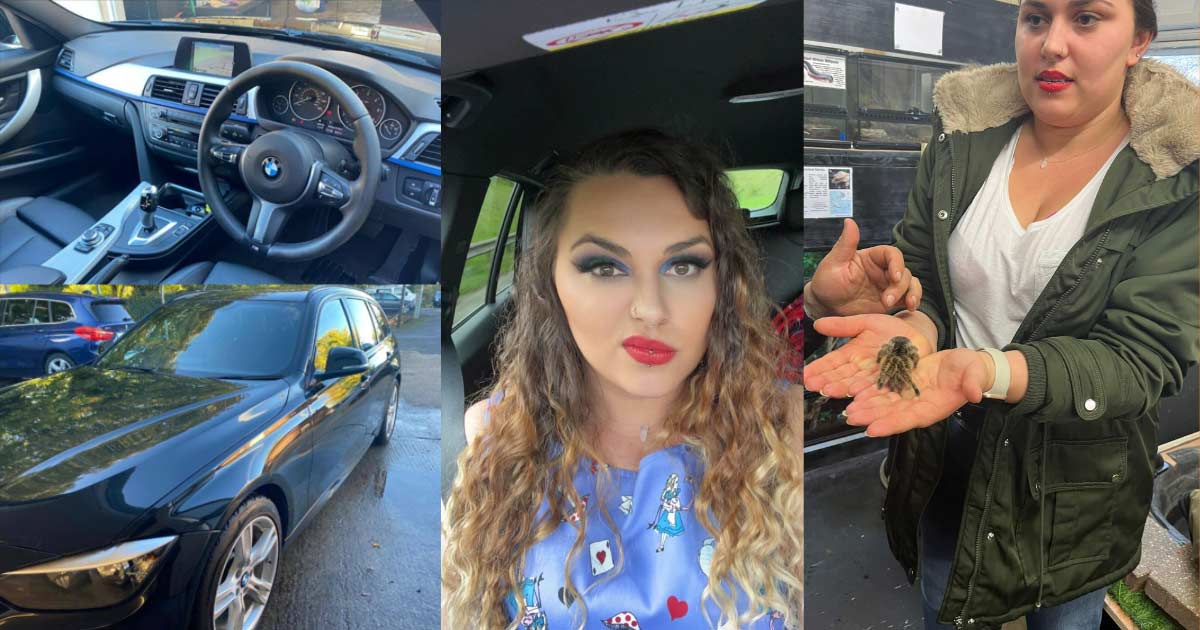

Join thousands of monthly customers like Jazz

My experience with Moneybarn was wonderful. It was professional, smooth, and easy. Within 6 hours of the initial phone call, we secured a vehicle, and within a week, everything was sorted. I can’t express enough how easy it was! – Jazz.

Join thousands of monthly customers like Jazz

My experience with Moneybarn was wonderful. It was professional, smooth, and easy. Within 6 hours of the initial phone call, we secured a vehicle, and within a week, everything was sorted. I can’t express enough how easy it was! – Jazz.

How do car finance monthly payments work?

How do car finance monthly payments work?

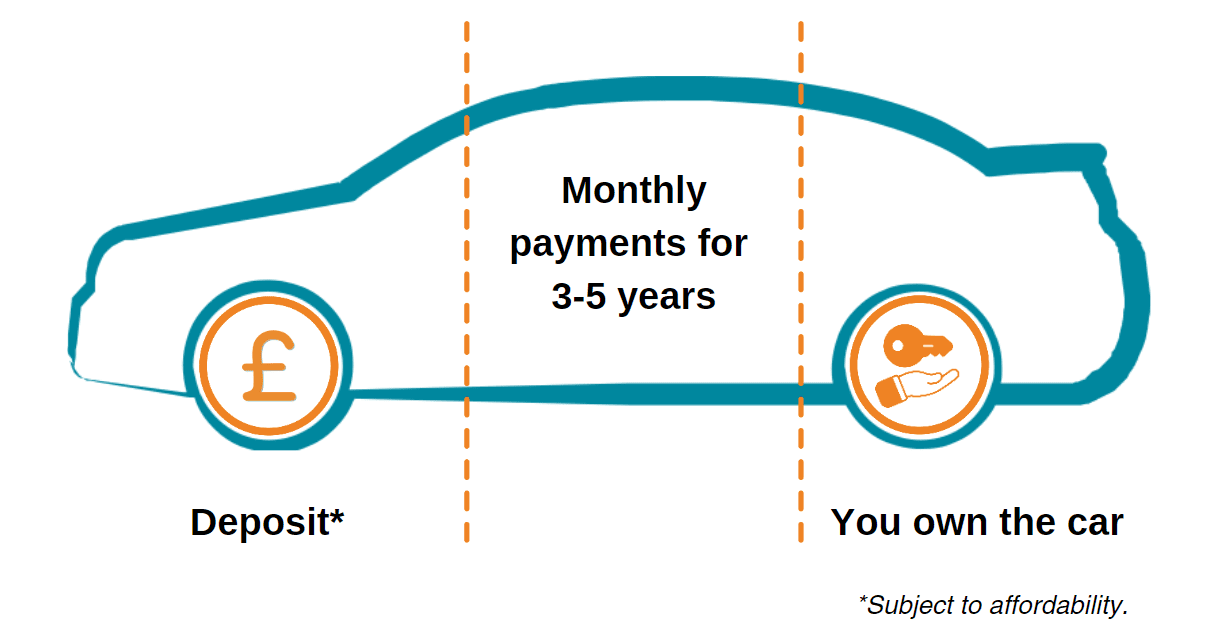

We offer a type of car finance called Conditional Sale (CS). The main difference between CS and other car finance types, like PCP and HP, is that with CS, you will legally own the car once you make your final payment.

With HP, you have to pay an additional ‘option to purchase’ fee, and PCP agreements require a ‘balloon payment’ before you legally own the car.

However, the monthly payments on CS are often higher than with PCP. With PCP, you’re deferring a large part of the finance until the end of the agreement term. This means you can then decide if you want to hand back the car to the lender, trade it in to start another finance agreement, or pay the balloon payment and become the legal owner.

Like other finance types, a Conditional Sale agreement is secured against the car. This means that the car could be repossessed if you can’t make your monthly payments.

If you’d like to read more about the different finance then check out our guide on the types of car finance.

How our car finance works

We offer a type of car finance called Conditional Sale (CS). The main difference between CS and other car finance types, like PCP and HP, is that with CS, you will legally own the car once you make your final payment.

With HP, you have to pay an additional ‘option to purchase’ fee, and PCP agreements require a ‘balloon payment’ before you legally own the car.

However, the monthly payments on CS are often higher than with PCP. With PCP, you’re deferring a large part of the finance until the end of the agreement term. This means you can then decide if you want to hand back the car to the lender, trade it in to start another finance agreement, or pay the balloon payment and become the legal owner.

Like other finance types, a Conditional Sale agreement is secured against the car. This means that the car could be repossessed if you can’t make your monthly payments.

How our car finance works

Like other finance types, the agreement is secured against the car. This means that the car could be repossessed if you can’t make your monthly payments.

If you’d like to read more about the different finance then check out our guide on the types of car finance.

Do you offer bad credit car finance?

As specialists in car finance for people with bad credit, we understand that having a low credit score doesn’t mean you don’t need a reliable car.

Our car finance calculator lets you adjust the calculations according to your credit score. If you have fair or poor credit, you can customise the calculator to see how this affects your monthly payments. The calculator is completely free to use, and it gives you an idea of what your agreement might look like.

Our goal is to help people get onto a better road ahead. If you have bad credit, no credit history, a CCJ, or an IVA, you could join the thousands of customers we help every month.

Do you offer bad credit car finance?

As specialists in car finance for people with bad credit, we understand that having a low credit score doesn’t mean you don’t need a reliable car.

Our car finance calculator lets you adjust the calculations according to your credit score. If you have fair or poor credit, you can customise the calculator to see how this affects your monthly payments. The calculator is completely free to use, and it gives you an idea of what your agreement might look like.

Our goal is to help people get onto a better road ahead. If you have bad credit, no credit history, a CCJ, or an IVA, you could join the thousands of customers we help every month.

Why choose Moneybarn?

Great customer service

We support thousands of people up and down the country each month, even if they’ve been refused elsewhere. Our customers rate us as Excellent on Trustpilot.

Award-winning finance

We continue to win industry awards for our approach to responsible lending, including ‘Vehicle Finance Provider of the Year’ and ‘Sub-Prime Lender of the Year’ for 2023.

Leading specialist lender

As one of the UK's leading lenders for bad credit, we accept people let down by mainstream lenders, with over 30 years of experience helping people onto a better road ahead.

Why choose Moneybarn?

Great customer service

We support thousands of people up and down the country each month, even if they’ve been refused elsewhere. Our customers rate us as Excellent on Trustpilot.

Award-winning finance

We continue to win industry awards for our approach to responsible lending, including ‘Vehicle Finance Provider of the Year’ and ‘Sub-Prime Lender of the Year’ for 2023.

Leading specialist lender

As one of the UK’s leading lenders for bad credit, we accept people let down by mainstream lenders, with over 30 years of experience helping people onto a better road ahead.

Helpful car finance guides

Helpful car finance guides

Car finance explained

Understanding the different types of car financing can help you make an informed decision.

What do you need to apply?

It’s important to know what information and documents are required to avoid delays when getting car finance.

Car finance explained

Understanding the different types of car financing can help you make an informed decision.

What do you need to apply?

It’s important to know what information and documents are required to avoid delays when getting car finance.

Car finance calculator FAQs

What does APR mean?

APR stands for ‘annual percentage rate’. This represents the total cost of borrowing money for a year.

Our car financing calculator gives examples of what an agreement with us might look like, but it’s important to note that your personal APR will depend on various factors, including your credit history and score.

For more information, check out our guides that explain what APR means and how car finance interest is calculated.

Is a car loan the same as car finance?

Car finance and a car loan might seem similar but they are not the same thing.

Car finance is where a lender pays the dealership for you, and you make monthly payments until you have repaid the borrowed amount plus interest.

On the other hand, a personal loan is a lump sum of money that you can use as you please. You can use it to buy a car, and if there’s any money left, you can use it to cover maintenance and running costs as well.

Read more in our guide that compares car finance and personal loans so you can decide which is best for you.

What is a deposit and do I need to pay one?

A deposit is the amount of money you pay up front when starting a car finance agreement. Whether or not you are eligible for a no deposit car finance deal depends on your individual circumstances.

It’s important to note that some of our car finance agreements may require a deposit based on your credit history and affordability.

What paperwork will I need?

To get car finance, you’ll need to provide proof of your identity and income to the lender. This is to verify your identity and to ensure that car finance is affordable for your circumstances.

When you apply for finance, you’ll be asked for the following information:

- Personal information: this includes your name, date of birth, and marital status.

- Employment: your employment status, employer, and job title. Please note that we will never contact your employer.

- Income: your net monthly income (what you make each month after tax)

- Address history: your current address and 3 years of UK address history.

- Contact details: your mobile number and email address so we can get in touch with you if you’re approved.

How much can I get to finance a car?

Most lenders provide car finance for 100% of the value of the car. However, it’s important to remember that there are other costs to owning and running a car, such as fuel, tax, insurance, and servicing and maintenance. Make sure you factor in these costs before applying for car finance.

The amount of car finance that a company will lend you depends on various factors, such as your credit history and affordability. Eligibility varies from person to person, so some people may be eligible for more car finance than others.

We can provide car finance from £4,000 to £35,000.

What is the average monthly car payment?

It’s important to understand that car finance varies from person to person, which means that your monthly payments may differ based on your financial status and affordability.

On average, our customers pay between £300 to £400 per month for their Conditional Sale car finance.

There are several factors that affect how much your monthly payments are. These include:

- How much you want to borrow

- The length of your agreement

- Your personal APR

You can use our free car finance calculator to get an idea of what your monthly payments might look like.

Will my credit rating be affected if I take out car finance?

When you make an application, lenders will typically carry out a soft search which won’t affect your credit score or leave a mark on your credit file.

Once you’ve found the right car and contracts are drawn up for you to sign, a hard search is carried out. A hard search verifies your identity and financial circumstances and ensures the lender can provide finance to you. However, it may cause a slight drop in your credit score.

It’s important to note that when you get car finance, your credit score may drop because you’ve taken on a new line of credit and agreed to borrow a large amount of money.

Over time, car finance can help build your credit score. Making payments on time shows that you can manage credit responsibly, which can increase your chances of being approved for credit in the future. However, this isn’t guaranteed, and you’ll need to make sure that you’re also repaying your other debts on time.

What vehicles do Moneybarn provide car finance for?

If you already have a vehicle in mind, great! Check out our lending criteria to make sure it’s something we can finance.

There are some vehicles we can’t finance, however, so make sure to check our vehicle exclusion list.

Car finance calculator FAQs

What does APR mean?

APR stands for ‘annual percentage rate’. This represents the total cost of borrowing money for a year.

Our car financing calculator gives examples of what an agreement with us might look like, but it’s important to note that your personal APR will depend on various factors, including your credit history and score.

For more information, check out our guides that explain what APR means and how car finance interest is calculated.

Is a car loan the same as car finance?

Car finance and a car loan might seem similar but they are not the same thing.

Car finance is where a lender pays the dealership for you, and you make monthly payments until you have repaid the borrowed amount plus interest.

On the other hand, a personal loan is a lump sum of money that you can use as you please. You can use it to buy a car, and if there’s any money left, you can use it to cover maintenance and running costs as well.

Read more in our guide that compares car finance and personal loans so you can decide which is best for you.

What is a deposit and do I need to pay one?

A deposit is the amount of money you pay up front when starting a car finance agreement. Whether or not you are eligible for a no deposit car finance deal depends on your individual circumstances.

It’s important to note that some of our car finance agreements may require a deposit based on your credit history and affordability.

What paperwork will I need?

To get car finance, you’ll need to provide proof of your identity and income to the lender. This is to verify your identity and to ensure that car finance is affordable for your circumstances.

When you apply for finance, you’ll be asked for the following information:

- Personal information: this includes your name, date of birth, and marital status.

- Employment: your employment status, employer, and job title. Please note that we will never contact your employer.

- Income: your net monthly income (what you make each month after tax)

- Address history: your current address and 3 years of UK address history.

- Contact details: your mobile number and email address so we can get in touch with you if you’re approved.

How much can I get to finance a car?

Most lenders provide car finance for 100% of the value of the car. However, it’s important to remember that there are other costs to owning and running a car, such as fuel, tax, insurance, and servicing and maintenance. Make sure you factor in these costs before applying for car finance.

The amount of car finance that a company will lend you depends on various factors, such as your credit history and affordability. Eligibility varies from person to person, so some people may be eligible for more car finance than others.

We can provide car finance from £4,000 to £35,000.

What is the average monthly car payment?

It’s important to understand that car finance varies from person to person, which means that your monthly payments may differ based on your financial status and affordability.

On average, our customers pay between £300 to £400 per month for their Conditional Sale car finance.

There are several factors that affect how much your monthly payments are. These include:

- How much you want to borrow

- The length of your agreement

- Your personal APR

You can use our free car finance calculator to get an idea of what your monthly payments might look like.

Will my credit rating be affected if I take out car finance?

When you make an application, lenders will typically carry out a soft search which won’t affect your credit score or leave a mark on your credit file.

Once you’ve found the right car and contracts are drawn up for you to sign, a hard search is carried out. A hard search verifies your identity and financial circumstances and ensures the lender can provide finance to you. However, it may cause a slight drop in your credit score.

It’s important to note that when you get car finance, your credit score may drop because you’ve taken on a new line of credit and agreed to borrow a large amount of money.

Over time, car finance can help build your credit score. Making payments on time shows that you can manage credit responsibly, which can increase your chances of being approved for credit in the future. However, this isn’t guaranteed, and you’ll need to make sure that you’re also repaying your other debts on time.

What vehicles do Moneybarn provide car finance for?

If you already have a vehicle in mind, great! Check out our lending criteria to make sure it’s something we can finance.

There are some vehicles we can’t finance, however, so make sure to check our vehicle exclusion list.

Car finance

Car finance can be a great option for many, as it gives you access to a car without having to pay any lump sums up front. Find out how we could help you.

Bad credit car finance

If you have a poor credit score or no credit history, you might think this makes it impossible to get approved. Click the button below to find out how we could help.

Self-employed car finance

People who are self-employed can find it difficult to get approved by mainstream lenders. Click the button below to see how we could help you.

For a better road ahead

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.

Moneybarn is the trading style of Moneybarn No. 1 Limited, a company registered in England and Wales with company number 04496573, and Moneybarn Limited, a company registered in England and Wales with company number 02766324. The registered address for these companies is: Athena House, Bedford Road, Petersfield, Hampshire, GU32 3LJ.

Moneybarn’s VAT registration number is 180 5559 52.

Moneybarn Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702781)

Moneybarn No. 1 Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702780)

Representative example: Total amount of credit £9144. Repayable over 56 months, 55 monthly payments of £291.86. Representative 30.7% APR (fixed). Deposit of £754.93. Total charge for credit £6908.30. Total amount payable £16,807.23. Subject to status and affordability. You could risk losing your vehicle if you do not keep up payments.