- Car finance Car finance

- Motorbike finance Motorbike finance

- Van finance Van finance

- How it works How it works

- FAQs and guides FAQs and guides

- About us About us

- Home

- Blog

- Your Money

- What is a balloon payment in car finance?

What is a balloon payment in car finance?

Updated: Tuesday, 17 October 2023

If you have or are considering getting a car finance agreement, it’s important you understand the ins and outs of how it works so you know what your monthly payments are, and whether you will need to pay any additional costs.

With some types of finance, like Conditional Sale agreements, you will automatically own the car once you make your final monthly payment.

However, on some finance agreements, like Personal Contract Purchase (PCP), you can make a balloon payment and buy the car outright.

Here, we explore if you need to make a balloon payment, how the amount is calculated, and the pros and cons of paying a larger sum at the end of your finance agreement.

What is a balloon payment?

Sometimes called the ‘optional final payment’, a ‘balloon payment’ is the amount you can pay at the end of a PCP agreement to legally own the car.

One key benefit of the balloon payment is that it reduces the monthly instalments of your loan, making car finance more affordable and accessible.

Do all car finance types end with a balloon payment?

No, you will only have the option of making a final balloon payment on Personal Contract Purchase (PCP) agreement and some Hire Purchase (HP) deals.

Personal Contract Hire agreements and Leasing are both essentially long-term rental agreements. As such, they do not include the option of making a final payment, as you will return the car at the end of the agreement.

Similarly, Conditional Sale agreements do not include balloon payment options. Each monthly payment reduces the total amount payable until you automatically become the vehicle’s legal owner at the end.

How is a balloon payment calculated?

Finance providers calculate what your balloon payment will be by considering the following factors:

- The current mileage of the vehicle

- The estimated mileage at the end of the finance deal

- The make and model of the vehicle

- The length of the agreement

- The impact of fair wear and tear on the vehicle’s condition.

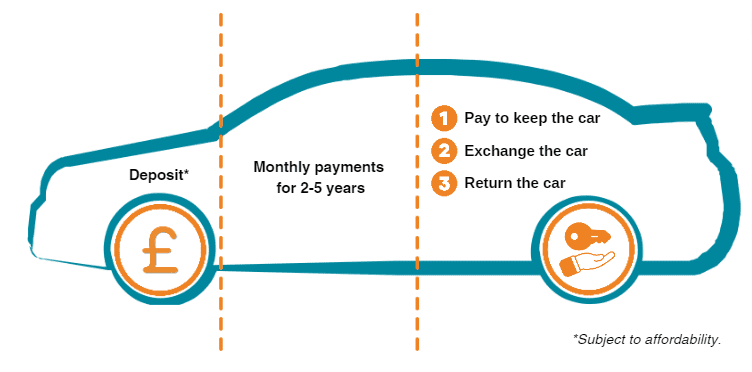

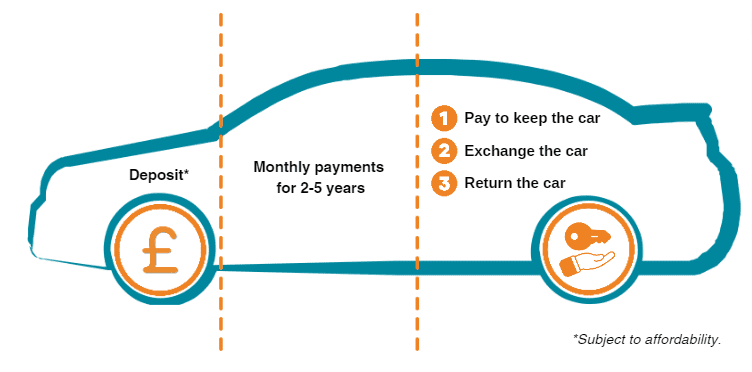

What happens at the end of a PCP agreement?

When your PCP finance agreement comes to an end, you have several options, including making the balloon payment to own the vehicle.

It helps to understand each so you can make an informed decision when the time comes.

If you have or are considering getting a car finance agreement, it’s important you understand the ins and outs of how it works so you know what your monthly payments are, and whether you will need to pay any additional costs.

With some types of finance, like Conditional Sale agreements, you will automatically own the car once you make your final monthly payment.

However, on some finance agreements, like Personal Contract Purchase (PCP), you can make a balloon payment and buy the car outright.

Here, we explore if you need to make a balloon payment, how the amount is calculated, and the pros and cons of paying a larger sum at the end of your finance agreement.

What is a balloon payment?

Sometimes called the ‘optional final payment’, a ‘balloon payment’ is the amount you can pay at the end of a PCP agreement to legally own the car.

One key benefit of the balloon payment is that it reduces the monthly instalments of your loan, making car finance more affordable and accessible.

Do all car finance types end with a balloon payment?

No, you will only have the option of making a final balloon payment on Personal Contract Purchase (PCP) agreement and some Hire Purchase (HP) deals.

Personal Contract Hire agreements and Leasing are both essentially long-term rental agreements. As such, they do not include the option of making a final payment, as you will return the car at the end of the agreement.

Similarly, Conditional Sale agreements do not include balloon payment options. Each monthly payment reduces the total amount payable until you automatically become the vehicle’s legal owner at the end.

How is a balloon payment calculated?

Finance providers calculate what your balloon payment will be by considering the following factors:

- The current mileage of the vehicle

- The estimated mileage at the end of the finance deal

- The make and model of the vehicle

- The length of the agreement

- The impact of fair wear and tear on the vehicle’s condition.

What happens at the end of a PCP agreement?

When your PCP finance agreement comes to an end, you have several options, including making the balloon payment to own the vehicle.

It helps to understand each so you can make an informed decision when the time comes.

Option 1: making the balloon payment

Paying the final balloon payment will mean you own the car outright and become the legal owner. If you pay the balloon payment, the finance company will transfer ownership of the car to you, meaning you are free to modify, sell, or trade it in as you please.

Option 2: using positive equity to take out a new finance agreement

If you don’t want to pay the balloon payment, you can return the car and start a new finance agreement. If you’ve built up positive equity in your car, you can put this amount towards a deposit.

Option 1: making the balloon payment

Paying the final balloon payment will mean you own the car outright and become the legal owner. If you pay the balloon payment, the finance company will transfer ownership of the car to you, meaning you are free to modify, sell, or trade it in as you please.

Option 2: using positive equity to take out a new finance agreement

If you don’t want to pay the balloon payment, you can return the car and start a new finance agreement. If you’ve built up positive equity in your car, you can put this amount towards a deposit.

What is positive equity?

Equity is the difference between how much your vehicle is worth and the finance you owe to your lender.

So, if your vehicle is worth £6,000 and you owe £4,000 on the finance, you have £2,000 in positive equity.

On the other hand, you will have negative equity if your vehicle is worth less than the amount of finance you owe. For example, if your vehicle is worth £4,000 and you owe £5,000, you are £1,000 in negative equity.

Option 3: handing the vehicle back to the finance company

If you don’t want to keep the car or get a new car with your existing lender, you can return the car. If you do this, you will sacrifice any equity you have built up in your current vehicle.

What happens if the financed car has gone up or down in value?

The balloon payment is set at the start of your agreement, so it cannot change. It is important to note that the predicted value of your car is based on its expected depreciation, including the mileage at the end of the agreement.

If you exceed this mileage limit, you may have to pay a fee. Excess mileage costs should be set out in your contract.

Sometimes, the car may depreciate to lower than its forecasted value. If this happens, the car will fall into negative equity, but you won’t be charged additional fees because the balloon payment balance is decided at the beginning of your agreement.

When the balloon payment is due, you should research the car’s value to see whether the vehicle could be worth more than the agreed optional payment. You might find that you are in positive equity, in which case, you could decide to trade the car in at the end of the agreement and use the positive equity as a deposit for your next car.

What are the advantages and disadvantages of balloon payments?

As with all types of car finance, there are pros and cons, and whether you should seek a car finance agreement that includes a final balloon payment will depend on your specific circumstances. Here are the pros and cons of balloon payments to help you understand whether it’s right for you.

Pros of balloon payments

What is positive equity?

Equity is the difference between how much your vehicle is worth and the finance you owe to your lender.

So, if your vehicle is worth £6,000 and you owe £4,000 on the finance, you have £2,000 in positive equity.

On the other hand, you will have negative equity if your vehicle is worth less than the amount of finance you owe. For example, if your vehicle is worth £4,000 and you owe £5,000, you are £1,000 in negative equity.

Option 3: handing the vehicle back to the finance company

If you don’t want to keep the car or get a new car with your existing lender, you can return the car. If you do this, you will sacrifice any equity you have built up in your current vehicle.

What happens if the financed car has gone up or down in value?

The balloon payment is set at the start of your agreement, so it cannot change. It is important to note that the predicted value of your car is based on its expected depreciation, including the mileage at the end of the agreement.

If you exceed this mileage limit, you may have to pay a fee. Excess mileage costs should be set out in your contract.

Sometimes, the car may depreciate to lower than its forecasted value. If this happens, the car will fall into negative equity, but you won’t be charged additional fees because the balloon payment balance is decided at the beginning of your agreement.

When the balloon payment is due, you should research the car’s value to see whether the vehicle could be worth more than the agreed optional payment. You might find that you are in positive equity, in which case, you could decide to trade the car in at the end of the agreement and use the positive equity as a deposit for your next car.

What are the advantages and disadvantages of balloon payments?

As with all types of car finance, there are pros and cons, and whether you should seek a car finance agreement that includes a final balloon payment will depend on your specific circumstances. Here are the pros and cons of balloon payments to help you understand whether it’s right for you.

Pros of balloon payments

Reduced monthly payments

One of the primary benefits is that balloon payments allow you to pay lower monthly instalments compared to other types of car finance. This can help you get into a newer car that you wouldn’t have been able to buy otherwise.

You have added flexibility

Having a car finance deal with a balloon payment doesn’t mean you have to use it. You still have other options, like returning the car or starting a new finance agreement.

Reduced monthly payments

One of the primary benefits is that balloon payments allow you to pay lower monthly instalments compared to other types of car finance. This can help you get into a newer car that you wouldn’t have been able to buy otherwise.

You have added flexibility

Having a car finance deal with a balloon payment doesn’t mean you have to use it. You still have other options, like returning the car or starting a new finance agreement.

Cons of balloon payments

Cons of balloon payments

Higher total cost

If you make your final balloon payment, you may pay more than the car is worth when you factor in the monthly fees and any deposits. Throughout the finance agreement, you will be paying a fixed interest rate as part of your monthly payments, which will further increase the overall amount you pay.

The risk of depreciation

If the car’s value depreciates more rapidly than anticipated, you might owe more on the balloon payment than the car is worth. This can leave you in negative equity.

Higher total cost

If you make your final balloon payment, you may pay more than the car is worth when you factor in the monthly fees and any deposits. Throughout the finance agreement, you will be paying a fixed interest rate as part of your monthly payments, which will further increase the overall amount you pay.

The risk of depreciation

If the car’s value depreciates more rapidly than anticipated, you might owe more on the balloon payment than the car is worth. This can leave you in negative equity.

Can I get car finance without a balloon payment?

Some types of car finance agreements don’t require you to make a final balloon payment at the end of the repayment period. Depending on your personal circumstances, one of these options may be more suitable.

1. Conditional Sale (CS)

With a Conditional Sale agreement, you make monthly payments over a set amount of time and you’ll legally own the car once you’ve made your final payment. Until then, you’ll be the registered keeper, so you must ensure the vehicle is well maintained and serviced.

At Moneybarn, we offer Conditional Sale agreements between 3-5 years, whether you’re looking to buy a car, finance a van, or get motorbike finance. This lets you spread the cost of a new or used vehicle without paying a large deposit upfront.

Use our car finance calculator to see what your monthly payments could look like depending on how much you want to borrow, the length of the agreement, and your credit score.

2. Personal Contract Hire (PCH)

A PCH agreement is a long-term lease. This means you’ll have full access to the car by making monthly payments, but you will never legally own it.

At the end of the agreement, you’ll give the car back to the dealership or finance company. There’s no balloon payment or commitment to buy.

This can be a better option for people who want to change their car regularly, as you’ll be free to choose a new vehicle to lease when your current agreement ends.

3. Personal Loans

With an unsecured loan, you borrow money to buy a new car outright and pay the loan balance off monthly over a set amount of time. If you do this, you’ll be the vehicle’s legal owner from the moment you take out a loan and use it to purchase the car since the money you borrow remains separate from the car itself.

Get your next car with Moneybarn

At Moneybarn, we help drivers up and down the country get the vehicles they need by providing specialist car finance. Our flexible Conditional Sale agreement means you won’t have to pay a balloon payment at the end – simply make your final payment, and you’ll own the vehicle.

Even if mainstream lenders have rejected you in the past, you have bad credit, or you are looking for car finance with an IVA, we may be able to help.

Our online form takes less than 5 minutes to fill in and will give you an instant decision. If you’re ready, get a quote today, and join the thousands of people we help each month.

Representative 30.7% APR.

FAQs about balloon payments

Can you negotiate a balloon payment?

No, you can’t negotiate a balloon payment. The balloon payment is decided at the start of a car finance deal and cannot be negotiated. Your finance company will tell you before signing an agreement what your balloon payment will be.

The balloon payment amount is calculated by considering the following factors:

- The current mileage of the vehicle

- The estimated mileage at the end of the finance deal

- The make and model of the vehicle

- The length of the agreement

Does Conditional Sale car finance end with a balloon payment?

No, once you’ve made the final payment of a Conditional Sale agreement, you’ll become the legal owner of your car. While you’re paying the balance amount, you’ll be the vehicle’s registered keeper, which means you’ll be responsible for ensuring the car is well-maintained and serviced.

Can you refinance a balloon payment?

Some lenders might allow you to refinance a balloon payment. This means taking out another loan to spread the cost of the final balloon payment. Read our guide about refinancing a car on finance to help you decide if taking out another finance agreement is the best option for you.

Can I get car finance without a balloon payment?

Some types of car finance agreements don’t require you to make a final balloon payment at the end of the repayment period. Depending on your personal circumstances, one of these options may be more suitable.

1. Conditional Sale (CS)

With a Conditional Sale agreement, you make monthly payments over a set amount of time and you’ll legally own the car once you’ve made your final payment. Until then, you’ll be the registered keeper, so you must ensure the vehicle is well maintained and serviced.

At Moneybarn, we offer Conditional Sale agreements between 3-5 years, whether you’re looking to buy a car, finance a van, or get motorbike finance. This lets you spread the cost of a new or used vehicle without paying a large deposit upfront.

Use our car finance calculator to see what your monthly payments could look like depending on how much you want to borrow, the length of the agreement, and your credit score.

2. Personal Contract Hire (PCH)

A PCH agreement is a long-term lease. This means you’ll have full access to the car by making monthly payments, but you will never legally own it.

At the end of the agreement, you’ll give the car back to the dealership or finance company. There’s no balloon payment or commitment to buy.

This can be a better option for people who want to change their car regularly, as you’ll be free to choose a new vehicle to lease when your current agreement ends.

3. Personal Loans

With an unsecured loan, you borrow money to buy a new car outright and pay the loan balance off monthly over a set amount of time. If you do this, you’ll be the vehicle’s legal owner from the moment you take out a loan and use it to purchase the car since the money you borrow remains separate from the car itself.

Get your next car with Moneybarn

At Moneybarn, we help drivers up and down the country get the vehicles they need by providing specialist car finance. Our flexible Conditional Sale agreement means you won’t have to pay a balloon payment at the end – simply make your final payment, and you’ll own the vehicle.

Even if mainstream lenders have rejected you in the past, you have bad credit, or you are looking for car finance with an IVA, we may be able to help.

Our online form takes less than 5 minutes to fill in and will give you an instant decision. If you’re ready, get a quote today, and join the thousands of people we help each month.

Representative 30.7% APR.

FAQs about balloon payments

Can you negotiate a balloon payment?

No, you can’t negotiate a balloon payment. The balloon payment is decided at the start of a car finance deal and cannot be negotiated. Your finance company will tell you before signing an agreement what your balloon payment will be.

The balloon payment amount is calculated by considering the following factors:

- The current mileage of the vehicle

- The estimated mileage at the end of the finance deal

- The make and model of the vehicle

- The length of the agreement

Does Conditional Sale car finance end with a balloon payment?

No, once you’ve made the final payment of a Conditional Sale agreement, you’ll become the legal owner of your car. While you’re paying the balance amount, you’ll be the vehicle’s registered keeper, which means you’ll be responsible for ensuring the car is well-maintained and serviced.

Can you refinance a balloon payment?

Some lenders might allow you to refinance a balloon payment. This means taking out another loan to spread the cost of the final balloon payment. Read our guide about refinancing a car on finance to help you decide if taking out another finance agreement is the best option for you.

Bringing you guides that compare different finance products available in the market today.

More from Moneybarn...

For a better road ahead

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.

Moneybarn is the trading style of Moneybarn No. 1 Limited, a company registered in England and Wales with company number 04496573, and Moneybarn Limited, a company registered in England and Wales with company number 02766324. The registered address for these companies is: Athena House, Bedford Road, Petersfield, Hampshire, GU32 3LJ.

Moneybarn’s VAT registration number is 180 5559 52.

Moneybarn Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702781)

Moneybarn No. 1 Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702780)