- Car finance Car finance

- Motorbike finance Motorbike finance

- Van finance Van finance

- How it works How it works

- FAQs and guides FAQs and guides

- About us About us

- Home

- Blog

- Your Money

- How hard is it to get approved to finance a car?

How hard is it to get approved to finance a car?

Updated: Friday, 5 April 2024

Any applications for car finance involve credit and affordability checks before the lender makes a decision. The thought of these checks may leave you worried about your chances of getting approved, especially if you’ve been refused car finance in the past or have a poor credit history.

In this guide, we explore circumstances that can make it difficult to get accepted and how financing a car works.

Any applications for car finance involve credit and affordability checks before the lender makes a decision. The thought of these checks may leave you worried about your chances of getting approved, especially if you’ve been refused car finance in the past or have a poor credit history.

In this guide, we explore circumstances that can make it difficult to get accepted and how financing a car works.

Summary

Being approved for car finance depends on several factors. These include the lender’s criteria, your credit score and history, and affordability. Having a stable source of income and address history and paying your bills on time shows you can manage credit responsibly. This may make it easier to get approved for car finance.

Being approved for car finance depends on several factors. These include the lender’s criteria, your credit score and history, and affordability. Having a stable source of income and address history and paying your bills on time shows you can manage credit responsibly. This may make it easier to get approved for car finance.

In this guide

Do you need good credit to finance a car?

No, you don’t need good credit to get approved for car finance. Each lender has their own criteria and processes. If you meet their application criteria, they will use a credit check to decide whether you can afford any finance they could offer.

Having a higher credit score suggests that you have a history of responsible borrowing. This means finance providers may be more willing to approve your application and offer you a lower interest rate.

It’s not impossible to finance a car if you have a poor credit score or limited credit history, but you may find it tricky to get approved by mainstream lenders. You might need to use a specialist lender such as Moneybarn.

We’re experts in providing bad credit car finance for people who have been refused car finance by other lenders in the past, even if they have a CCJ or IVA.

What credit score do I need to finance a car?

There is no specific credit score you need to get car finance. There are 3 main Credit Reference Agencies (CRAs) in the UK, each with their own credit score ranges and calculations. Different car finance companies use different CRAs to view your credit file, so there is no minimum score required and lenders take other factors into consideration.

If you have a higher credit rating, you may find it easier to get approved for credit at lower interest rates. However, even if you have a poor credit history, you can find finance companies that will approve your application, but they might offer higher interest rates or require a deposit.

Before applying for car finance, you could check to see what you can do to improve your credit score. A good credit history and score could increase your chances of getting approved and could even reduce the interest rate you are offered.

You could also use a specialist lender like Moneybarn, who can help you get bad credit car finance with no deposit.

Can I get car finance with a bad credit score?

As one of the UK’s largest providers of car finance for people with bad credit, we may be able to help, even if you:

- Are in an Individual Voluntary Arrangement (IVA)

- Have a County Court Judgment (CCJ)

- Are looking for car finance when self-employed

- Have experienced bankruptcy in the past

- Are looking for car finance on benefits

- Are looking to get car finance while having an overdraft

To better understand what bad credit means, check out our guide that explains bad credit and common myths.

What other factors can make it difficult to get car finance?

When lenders check your eligibility for finance, they consider factors beyond your credit score and history. They also look at your personal and financial circumstances to understand whether you can afford to buy a car on finance.

In this guide

Do you need good credit to finance a car?

No, you don’t need good credit to get approved for car finance. Each lender has their own criteria and processes. If you meet their application criteria, they will use a credit check to decide whether you can afford any finance they could offer.

Having a higher credit score suggests that you have a history of responsible borrowing. This means finance providers may be more willing to approve your application and offer you a lower interest rate.

It’s not impossible to finance a car if you have a poor credit score or limited credit history, but you may find it tricky to get approved by mainstream lenders. You might need to use a specialist lender such as Moneybarn.

We’re experts in providing bad credit car finance for people who have been refused car finance by other lenders in the past, even if they have a CCJ or IVA.

What credit score do I need to finance a car?

There is no specific credit score you need to get car finance. There are 3 main Credit Reference Agencies (CRAs) in the UK, each with their own credit score ranges and calculations. Different car finance companies use different CRAs to view your credit file, so there is no minimum score required and lenders take other factors into consideration.

If you have a higher credit rating, you may find it easier to get approved for credit at lower interest rates. However, even if you have a poor credit history, you can find finance companies that will approve your application, but they might offer higher interest rates or require a deposit.

Before applying for car finance, you could check to see what you can do to improve your credit score. A good credit history and score could increase your chances of getting approved and could even reduce the interest rate you are offered.

You could also use a specialist lender like Moneybarn, who can help you get bad credit car finance with no deposit.

Can I get car finance with a bad credit score?

As one of the UK’s largest providers of car finance for people with bad credit, we may be able to help, even if you:

- Are in an Individual Voluntary Arrangement (IVA)

- Have a County Court Judgment (CCJ)

- Are looking for car finance when self-employed

- Have experienced bankruptcy in the past

- Are looking for car finance on benefits

- Are looking to get car finance while having an overdraft

To better understand what bad credit means, check out our guide that explains bad credit and common myths.

What other factors can make it difficult to get car finance?

When lenders check your eligibility for finance, they consider factors beyond your credit score and history. They also look at your personal and financial circumstances to understand whether you can afford to buy a car on finance.

Your income

Lenders make an affordability check to ensure any finance offered is suitable for you.

Every lender has its own criteria, and some may accept different sources of income than others.

You can check the sources of income that we accept to see if we can help you.

Your employment

People who are self-employed or currently unemployed may be seen as a higher lending risk. This is because there isn’t a stable income, unlike people in salaried employment.

Getting car finance when self-employed is still possible, but you may need to provide additional documents to verify your income.

Your expenses

Lenders also review your expenses to ensure that car finance is affordable and sustainable for you.

If your expenses are high in proportion to your income, your account shows bounced direct debits for bills, or you spend a large portion of your income on gambling, you may find it hard to get approved.

Address history

If you’re an expat or have recently moved to the UK, you may find it difficult to get approved.

This is because many lenders, including Moneybarn, require at least 3 years of UK address history. For more information on why that is, check out our guide to getting car finance as an expat.

Your income

Lenders make an affordability check to ensure any finance offered is suitable for you.

Every lender has its own criteria, and some may accept different sources of income than others.

You can check the sources of income that we accept to see if we can help you.

Your employment

People who are self-employed or currently unemployed may be seen as a higher lending risk. This is because there isn’t a stable income, unlike people in salaried employment.

Getting car finance when self-employed is still possible, but you may need to provide additional documents to verify your income.

Your expenses

Lenders also review your expenses to ensure that car finance is affordable and sustainable for you.

If your expenses are high in proportion to your income, your account shows bounced direct debits for bills, or you spend a large portion of your income on gambling, you may find it hard to get approved.

Address history

If you’re an expat or have recently moved to the UK, you may find it difficult to get approved.

This is because many lenders, including Moneybarn, require at least 3 years of UK address history. For more information on why that is, check out our guide to getting car finance as an expat.

When applying for car finance, the lender is likely to ask for some supporting documents. Discover what documents you might need to apply for car finance with our guide.

Do credit checks for car finance affect your credit score?

There are two types of credit checks: hard credit checks and soft credit checks. Make sure you understand which check the lender conducts before you make an application.

When applying for car finance, the lender is likely to ask for some supporting documents. Discover what documents you might need to apply for car finance with our guide.

Do credit checks for car finance affect your credit score?

There are two types of credit checks: hard credit checks and soft credit checks. Make sure you understand which check the lender conducts before you make an application.

Soft credit checks don't affect your score

Soft checks (sometimes called soft searches) don’t affect your credit score. Only you can see them when you check your credit report. Lenders use a soft check to have an initial look at certain information on your credit file.

Soft credit checks don't affect your score

Soft checks (sometimes called soft searches) don’t affect your credit score. Only you can see them when you check your credit report. Lenders use a soft check to have an initial look at certain information on your credit file.

Hard credit checks do affect your score

Hard checks (sometimes called hard searches) happen when a company looks at your credit file in more detail. They are visible to other companies, and can cause your credit score to drop even if you have good credit.

Hard credit checks do affect your score

Hard checks (sometimes called hard searches) happen when a company looks at your credit file in more detail. They are visible to other companies, and can cause your credit score to drop even if you have good credit.

When you get a quote with us, we use a soft credit check. This helps us understand your eligibility for car finance so we can provide an instant decision. We only use a hard check when you’ve found the right car and contracts are drawn up for you to sign. Some car finance companies use a hard check at the point of application, so find out which is made before applying.

You can read more about the differences between hard and soft credit checks in our dedicated guide.

Why might car finance make sense for you?

Car finance is one of the most popular ways to buy a new vehicle. It can allow you to buy a car that you might not otherwise be able to afford by spreading the cost over several years. There are several other reasons why car finance might make sense for you.

When you get a quote with us, we use a soft credit check. This helps us understand your eligibility for car finance so we can provide an instant decision. We only use a hard check when you’ve found the right car and contracts are drawn up for you to sign. Some car finance companies use a hard check at the point of application, so find out which is made before applying.

You can read more about the differences between hard and soft credit checks in our dedicated guide.

Why might car finance make sense for you?

Car finance is one of the most popular ways to buy a new vehicle. It can allow you to buy a car that you might not otherwise be able to afford by spreading the cost over several years. There are several other reasons why car finance might make sense for you.

Choosing from various types of car finance

As financing a car has become more popular, lenders have grown to offer a wider range of finance options. There are several types of car finance available:

- Conditional Sale (CS)

- Hire Purchase (HP)

- Personal Contract Purchase (PCP)

- Personal Contract Hire (PCH or leasing)

You can find more information about each type of car finance, including their pros and cons, in our guide on how financing a car works.

Being able to afford a newer, or bigger car

Many people choose to finance their car so that they can choose from a broader range of vehicles, including newer models and those with better specifications.

With a finance agreement, you can spread the cost of a vehicle over smaller monthly payments until the total amount has been paid.

Some financing options, such as CS, HP, and PCP, allow you to become the legal owner of the car at the end of the agreement.

Improving your credit score over time

If you make your monthly payments in full and on time, car finance can help to build your credit score. This can help make it easier to get credit in the future.

If you don’t know what your credit score is, providers like Experian and ClearScore allow you to view your credit score for free.

To find out more about credit, take a look at our guides:

Choosing from various types of car finance

As financing a car has become more popular, lenders have grown to offer a wider range of finance options. There are several types of car finance available:

- Conditional Sale (CS)

- Hire Purchase (HP)

- Personal Contract Purchase (PCP)

- Personal Contract Hire (PCH or leasing)

You can find more information about each type of car finance, including their pros and cons, in our guide on how financing a car works.

Being able to afford a newer, or bigger car

Many people choose to finance their car so that they can choose from a broader range of vehicles, including newer models and those with better specifications.

With a finance agreement, you can spread the cost of a vehicle over smaller monthly payments until the total amount has been paid.

Some financing options, such as CS, HP, and PCP, allow you to become the legal owner of the car at the end of the agreement.

Improving your credit score over time

If you make your monthly payments in full and on time, car finance can help to build your credit score. This can help make it easier to get credit in the future.

If you don’t know what your credit score is, providers like Experian and ClearScore allow you to view your credit score for free.

To find out more about credit, take a look at our guides:

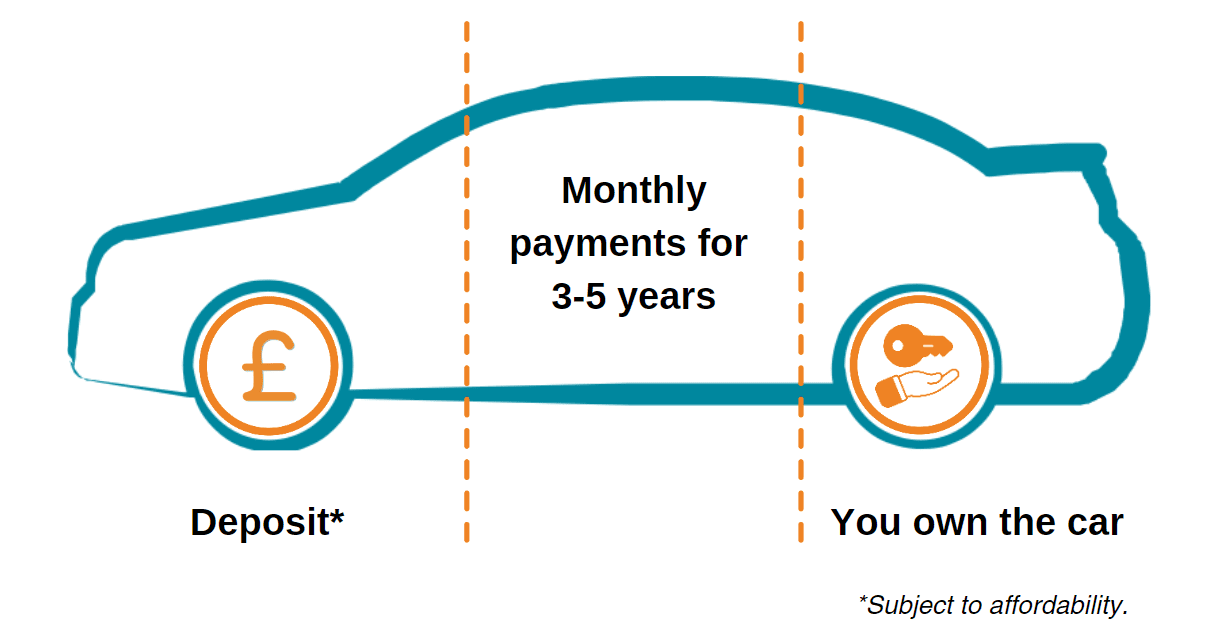

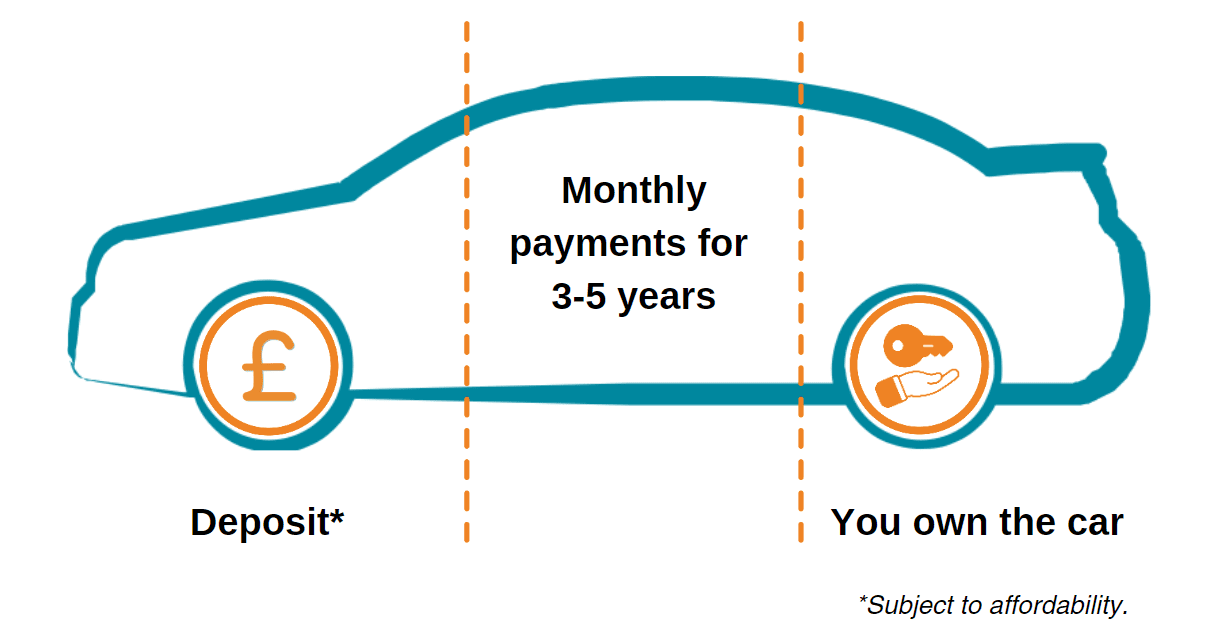

At Moneybarn, we offer Conditional Sale (CS) car finance. Under this type of agreement, you make fixed monthly payments over a pre-agreed period until the finance has been paid in full. Once you make the final payment, there are no additional fees; you automatically become the car’s legal owner.

What to keep in mind when applying for car finance

Before applying for car finance, there are several factors to be aware of to make an informed decision. While financing can help you buy a newer or larger car than what you could afford with cash, it’s important to understand what you’ll be signing up to.

At Moneybarn, we offer Conditional Sale (CS) car finance. Under this type of agreement, you make fixed monthly payments over a pre-agreed period until the finance has been paid in full. Once you make the final payment, there are no additional fees; you automatically become the car’s legal owner.

What to keep in mind when applying for car finance

Before applying for car finance, there are several factors to be aware of to make an informed decision. While financing can help you buy a newer or larger car than what you could afford with cash, it’s important to understand what you’ll be signing up to.

There is no such thing as guaranteed car finance. Finance is subject to status and affordability checks. Your eligibility depends on several factors including the lender’s criteria, your income, and credit history.

If you have a low credit score or no credit history, you may find it difficult to get approved. You could use a specialist lender, however, they may offer a higher APR to account for the fact you have bad credit.

If you get into financial difficulty, ending a finance agreement isn’t as simple as handing back the car and cancelling the contract. There are different processes for voluntary termination and early settlement of your car finance. If you aren’t able to make the payments, the car may be repossessed.

With car finance, you don’t legally own the car during the agreement. You’ll typically be the registered keeper and responsible for maintaining and servicing the car. With CS finance, you won’t legally own the car until the final payment is made.

There is no such thing as guaranteed car finance. Finance is subject to status and affordability checks. Your eligibility depends on several factors including the lender’s criteria, your income, and credit history.

If you have a low credit score or no credit history, you may find it difficult to get approved. You could use a specialist lender, however, they may offer a higher APR to account for the fact you have bad credit.

If you get into financial difficulty, ending a finance agreement isn’t as simple as handing back the car and cancelling the contract. There are different processes for voluntary termination and early settlement of your car finance. If you aren’t able to make the payments, the car may be repossessed.

With car finance, you don’t legally own the car during the agreement. You’ll typically be the registered keeper and responsible for maintaining and servicing the car. With CS finance, you won’t legally own the car until the final payment is made.

If you’re worrying about getting approved for car finance or have been refused car finance in the past, there are some things you could do that may improve your chances:

- Keep on top of bills: Any missed or late payments on bills can affect your credit score. Staying on top of bills can help build your credit history and prove that you are responsible with credit.

- Fix any incorrect information: You could check your credit report, and if there’s anything that’s wrong or out of date, you can make a Notice of Correction to get it updated.

- Register for the electoral roll: If you aren’t on the electoral roll, you may find it harder to get approved for credit as lenders may not be able to verify your identity and address history.

- Put down a bigger deposit: Much like getting a mortgage, a larger deposit means you will borrow less money from the lender and, in turn, have less to pay back.

If you’re worrying about getting approved for car finance or have been refused car finance in the past, there are some things you could do that may improve your chances:

- Keep on top of bills: Any missed or late payments on bills can affect your credit score. Staying on top of bills can help build your credit history and prove that you are responsible with credit.

- Fix any incorrect information: You could check your credit report, and if there’s anything that’s wrong or out of date, you can make a Notice of Correction to get it updated.

- Register for the electoral roll: If you aren’t on the electoral roll, you may find it harder to get approved for credit as lenders may not be able to verify your identity and address history.

- Put down a bigger deposit: Much like getting a mortgage, a larger deposit means you will borrow less money from the lender and, in turn, have less to pay back.

Get your next car on finance with Moneybarn

Get your next car on finance with Moneybarn

If you have bad credit or have been refused by other lenders, you might feel like it’s impossible to get car finance.

You could join the thousands of customers we help each month onto a better road ahead.

Even if you have a low credit score, are self-employed, or have had financial difficulties in the past, our expert team can help you buy the car you need.

To get started, try our car finance calculator. It’ll show you what your agreement could look like depending on how much you want to borrow.

When you’re ready, get a quote in less than 5 minutes. We’ll give you an instant decision, and we only use a soft check at the point of application which doesn’t affect your credit score.

How our car finance works

If you have bad credit or have been refused by other lenders, you might feel like it’s impossible to get car finance.

You could join the thousands of customers we help each month onto a better road ahead.

Even if you have a low credit score, are self-employed, or have had financial difficulties in the past, our expert team can help you buy the car you need.

How our car finance works

To get started, try our car finance calculator. It’ll show you what your agreement could look like depending on how much you want to borrow.

When you’re ready, get a quote in less than 5 minutes. We’ll give you an instant decision, and we only use a soft check at the point of application which doesn’t affect your credit score.

FAQs about getting accepted for car finance

Can you get rejected for car finance?

Yes, it is possible to be rejected for car finance. Lenders assess various factors such as credit history, income, and affordability to understand if you can afford car finance.

Check out our guide that explores the most common reasons for being refused car finance.

How likely are you to be accepted for car finance?

The likelihood of being accepted for car finance depends on several factors, including your credit history, income, and the lender’s criteria. Everyone’s eligibility is different, so no one can say for certain what your chances are of being approved.

While people with a good credit history and stable income are more likely to be approved, some lenders specialise in bad credit car finance and can help those that mainstream lenders can’t.

What's the difference between car finance and a personal loan?

Car finance is when the lender pays the dealership for you, and it often uses the car as security against the finance agreement. This means that, if you aren’t able to make payments, the car may be repossessed.

A personal loan is a lump sum of money given to you by a lender which can be used for a variety of purposes. You could use it to buy a car, and if you have any money left over, you could use this to contribute to fuel, maintenance, and servicing costs.

For more information, our guide to car finance vs personal loans explains the differences.

How long will I have to wait for car finance approval?

When you get a quote with us, you’ll get an immediate indication of whether we could offer you finance. We’ll also show you how much you could borrow, and what your agreement terms could be. One of our friendly experts will reach out and guide you to finding your dream car.

For more information about this, please see our guide which explains how long car finance approval takes with us. You can also find out more about our application process.

FAQs about getting accepted for car finance

Can you get rejected for car finance?

Yes, it is possible to be rejected for car finance. Lenders assess various factors such as credit history, income, and affordability to understand if you can afford car finance.

Check out our guide that explores the most common reasons for being refused car finance.

How likely are you to be accepted for car finance?

The likelihood of being accepted for car finance depends on several factors, including your credit history, income, and the lender’s criteria. Everyone’s eligibility is different, so no one can say for certain what your chances are of being approved.

While people with a good credit history and stable income are more likely to be approved, some lenders specialise in bad credit car finance and can help those that mainstream lenders can’t.

What's the difference between car finance and a personal loan?

Car finance is when the lender pays the dealership for you, and it often uses the car as security against the finance agreement. This means that, if you aren’t able to make payments, the car may be repossessed.

A personal loan is a lump sum of money given to you by a lender which can be used for a variety of purposes. You could use it to buy a car, and if you have any money left over, you could use this to contribute to fuel, maintenance, and servicing costs.

For more information, our guide to car finance vs personal loans explains the differences.

How long will I have to wait for car finance approval?

When you get a quote with us, you’ll get an immediate indication of whether we could offer you finance. We’ll also show you how much you could borrow, and what your agreement terms could be. One of our friendly experts will reach out and guide you to finding your dream car.

For more information about this, please see our guide which explains how long car finance approval takes with us. You can also find out more about our application process.

Bringing you guides that simplify the world of credit and answer common vehicle finance questions.

More from Moneybarn...

For a better road ahead

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.

Moneybarn is the trading style of Moneybarn No. 1 Limited, a company registered in England and Wales with company number 04496573, and Moneybarn Limited, a company registered in England and Wales with company number 02766324. The registered address for these companies is: Athena House, Bedford Road, Petersfield, Hampshire, GU32 3LJ.

Moneybarn’s VAT registration number is 180 5559 52.

Moneybarn Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702781)

Moneybarn No. 1 Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702780)

Representative example: Total amount of credit £9015. Repayable over 56 months, 55 monthly payments of £287.74. Representative 30.7% APR (fixed). Deposit of £755.54. Total charge for credit £6810.70. Total amount payable £16,581.24. Subject to status and affordability. You could risk losing your vehicle if you do not keep up payments.