- Car finance Car finance

- Motorbike finance Motorbike finance

- Van finance Van finance

- How it works How it works

- FAQs and guides FAQs and guides

- About us About us

- Home

- Blog

- Researching a Vehicle

- Should you lease or buy your next car?

Should you lease or buy your next car?

Updated: Tuesday, 18 June 2024

There are many different ways to buy a car. If you’re wondering whether to buy outright, lease, or get car finance, it’s important to understand the differences before you make a decision.

In this guide, we explain car leasing and explore how it differs from buying or financing a car to help make the process more straightforward.

Leasing vs buying outright vs financing: How do they compare?

The main difference between car leasing and car finance is ownership. Car finance deals like Personal Contract Purchase (PCP), Hire Purchase (HP), and Conditional Sale (CS) have various ways to own the car legally when the agreement ends, assuming all payments have been made.

With leasing, you never own the car and must return it at the end of the agreement.

Some finance deals require a deposit, which can be cash or from a part exchange of another vehicle you own. This depends on your circumstances, though some lenders offer no deposit car finance.

Here are some of the key differences between leasing, buying outright, and finance agreements.

| Leasing | Buying outright | Financing | Ownership | You will never own the car and must return it at the end of the lease. | You will become the car’s legal owner as soon as you pay for it (this also applies to purchases made with personal loans). | You will be the registered keeper of the vehicle throughout the agreement and may have the option of becoming the owner at the end. |

|---|---|---|---|

| Vehicle choice | Leasing allows you to own brand-new models and upgrade more often if you wish. | You will be limited by your budget, so you may need to choose a cheaper car. | You can choose from a range of new and used cars so long as they meet the lender’s criteria. |

| Additional charges | There may be a mileage limit with a charge for exceeding it. If there's damage beyond what's considered normal wear and tear, you could get charged for that too. | Once you purchase the car, you won’t need to make any additional payments. | Depending on the type of finance agreement you have, there may be additional fees (e.g. mileage limits, wear and tear, etc.). There may be late payment fees, depending on the lender you choose. |

| Services & maintenance | Some lease agreements include regular servicing and maintenance costs. | You will need to cover the cost of any services, MOTs, and maintenance needed. | Finance deals generally don’t include servicing and maintenance. |

| Payments | You will make an initial rental payment, followed by a pre-agreed amount each month for the period of the lease. | You will need to pay the full amount upfront unless you’re using a personal loan, in which case you’d make monthly payments to the lender. | You will make monthly repayments over an agreed term. Some agreements like PCP and HP also include a ‘balloon payment’ or ‘option to buy’ fee to legally own the car. |

| Upgrade options | You will have the option to upgrade to a newer vehicle at the end of your lease agreement. | If you want a new car, you will need to save up or sell your current one to help cover the cost. | Depending on your type of finance, you can choose to return your car to the dealership or lender and take out a new agreement on a different vehicle. |

| Modification options | You will not be able to modify the car, as you never legally own it. | Once you own the car, you can modify it as you wish (i.e. adding personalised number plates). | You will not be able to modify the car until you reach the end of your agreement and become its legal owner. |

| Payment protection | Lease providers are regulated by the FCA. | Buying from a private seller doesn’t come with the same protection as buying from a dealership or using a finance company. | Vehicle finance providers are regulated by the FCA. |

There are many different ways to buy a car. If you’re wondering whether to buy outright, lease, or get car finance, it’s important to understand the differences before you make a decision.

In this guide, we explain car leasing and explore how it differs from buying or financing a car to help make the process more straightforward.

Leasing vs buying outright vs financing: How do they compare?

The main difference between car leasing and car finance is ownership. Car finance deals like Personal Contract Purchase (PCP), Hire Purchase (HP), and Conditional Sale (CS) have various ways to own the car legally when the agreement ends, assuming all payments have been made.

With leasing, you never own the car and must return it at the end of the agreement.

Some finance deals require a deposit, which can be cash or from a part exchange of another vehicle you own. This depends on your circumstances, though some lenders offer no deposit car finance.

Here are some of the key differences between leasing, buying outright, and finance agreements.

| Leasing | Buying outright | Financing | Ownership | You will never own the car and must return it at the end of the lease. | You will become the car’s legal owner as soon as you pay for it (this also applies to purchases made with personal loans). | You will be the registered keeper of the vehicle throughout the agreement and may have the option of becoming the owner at the end. |

|---|---|---|---|

| Vehicle choice | Leasing allows you to own brand-new models and upgrade more often if you wish. | You will be limited by your budget, so you may need to choose a cheaper car. | You can choose from a range of new and used cars so long as they meet the lender’s criteria. |

| Additional charges | There may be a mileage limit with a charge for exceeding it. If there's damage beyond what's considered normal wear and tear, you could get charged for that too. | Once you purchase the car, you won’t need to make any additional payments. | Depending on the type of finance agreement you have, there may be additional fees (e.g. mileage limits, wear and tear, etc.). There may be late payment fees, depending on the lender you choose. |

| Services & maintenance | Some lease agreements include regular servicing and maintenance costs. | You will need to cover the cost of any services, MOTs, and maintenance needed. | Finance deals generally don’t include servicing and maintenance. |

| Payments | You will make an initial rental payment, followed by a pre-agreed amount each month for the period of the lease. | You will need to pay the full amount upfront unless you’re using a personal loan, in which case you’d make monthly payments to the lender. | You will make monthly repayments over an agreed term. Some agreements like PCP and HP also include a ‘balloon payment’ or ‘option to buy’ fee to legally own the car. |

| Upgrade options | You will have the option to upgrade to a newer vehicle at the end of your lease agreement. | If you want a new car, you will need to save up or sell your current one to help cover the cost. | Depending on your type of finance, you can choose to return your car to the dealership or lender and take out a new agreement on a different vehicle. |

| Modification options | You will not be able to modify the car, as you never legally own it. | Once you own the car, you can modify it as you wish (i.e. adding personalised number plates). | You will not be able to modify the car until you reach the end of your agreement and become its legal owner. |

| Payment protection | Lease providers are regulated by the FCA. | Buying from a private seller doesn’t come with the same protection as buying from a dealership or using a finance company. | Vehicle finance providers are regulated by the FCA. |

What happens when you buy a car?

The experience of buying a car will likely differ depending on whether you’re getting a brand-new or used vehicle.

With a new car, you won’t need to worry about previous owners, service histories, or upcoming MOTs, and you might be able to configure it to your tastes. If you’re buying a used car, there are more things you need to check to make sure you’re getting a fair deal.

Look at our guide for a full list of what to check when buying a used car.

What happens when you buy a car?

The experience of buying a car will likely differ depending on whether you’re getting a brand-new or used vehicle.

With a new car, you won’t need to worry about previous owners, service histories, or upcoming MOTs, and you might be able to configure it to your tastes. If you’re buying a used car, there are more things you need to check to make sure you’re getting a fair deal.

Look at our guide for a full list of what to check when buying a used car.

Before viewing the car

When you find a car you like that’s within your budget, you can check its history using the DVLA website. To do this, you need to know the car’s number plate.

This helps to ensure its details match the seller’s advert, so you can avoid any surprises about the car’s history or condition. You can also check the full MOT history to see if there are any underlying issues with the car.

Once you’re happy and ready to view the car, organise a time to see it and go for a test drive.

When you find a car you like that’s within your budget, you can check its history using the DVLA website. To do this, you need to know the car’s number plate.

This helps to ensure its details match the seller’s advert, so you can avoid any surprises about the car’s history or condition. You can also check the full MOT history to see if there are any underlying issues with the car.

Once you’re happy and ready to view the car, organise a time to see it and go for a test drive.

Viewing and test-driving the car

Viewing and test-driving the car

It’s best to inspect a car during the day, ideally when it’s dry, as it’ll be easier to spot damage. If you’re buying from a private seller (a person, not a dealership), meeting them at their house means you’ll have a record of their address if something goes wrong with the car.

When you take the car for a test drive, try to spend at least 15 minutes driving on different road types, such as minor and major roads. This will help you check that everything is working as it should.

For a full list of what to inspect, read our guide on how to test-drive a car.

It’s best to inspect a car during the day, ideally when it’s dry, as it’ll be easier to spot damage. If you’re buying from a private seller (a person, not a dealership), meeting them at their house means you’ll have a record of their address if something goes wrong with the car.

When you take the car for a test drive, try to spend at least 15 minutes driving on different road types, such as minor and major roads. This will help you check that everything is working as it should.

For a full list of what to inspect, read our guide on how to test-drive a car.

Buying the car

Buying the car

If you’re happy with the car, your next step is to agree a deal to buy it. If you’ve found any damage, things that need replacing, or advisories on its MOT history, you could use this to negotiate a lower price.

Once you’ve made a deal, make sure you get original copies of these documents:

- The logbook (V5C registration)

- The most recent MOT test document

- If possible, any MOT, maintenance, and service receipts

You should never purchase a car without its logbook. You’ll need this to transfer ownership and organise road tax once you complete the purchase. The seller will also help you fill in the green ‘new keeper slip’ so that the DVLA can update the vehicle so it is registered to you.

If you’re happy with the car, your next step is to agree a deal to buy it. If you’ve found any damage, things that need replacing, or advisories on its MOT history, you could use this to negotiate a lower price.

Once you’ve made a deal, make sure you get original copies of these documents:

- The logbook (V5C registration)

- The most recent MOT test document

- If possible, any MOT, maintenance, and service receipts

You should never purchase a car without its logbook. You’ll need this to transfer ownership and organise road tax once you complete the purchase. The seller will also help you fill in the green ‘new keeper slip’ so that the DVLA can update the vehicle so it is registered to you.

Paying for the car

Paying for the car

If you want to buy a car outright, there are a few ways to pay for it:

Cash

Most private sellers will prefer you to pay with cash. While you can sometimes save money if you pay with cash, there isn’t as much protection buying from a private seller with cash as there is with using a debit or credit card with a reputable dealership.

Credit card

You may have to pay interest if you pay for a car on a credit card, but you will benefit from payment protection on purchases from £100 up to £30,000. However, private sellers and most dealerships will not accept credit cards and will require either cash or a debit card.

Debit card or bank transfer

Make sure you have your debit card handy or know how to log in to your online banking. As the money comes from your bank account, you won’t pay interest on these transactions.

A personal loan

You can get a loan from a bank or building society to help cover the cost of your new car. This is when you borrow a sum of money, and agree to pay it back in monthly instalments, plus interest. If you’re thinking about whether you should take out car finance or a personal loan, take a look at our guide.

You could also get a car loan. This is different from a personal loan because it is secured against the vehicle. This means that if you fail to keep up with your repayments, the lender could repossess your car.

Read more about secured and unsecured car loans in our guide.

If you want to buy a car outright, there are a few ways to pay for it:

Cash

Most private sellers will prefer you to pay with cash. While you can sometimes save money if you pay with cash, there isn’t as much protection buying from a private seller with cash as there is with using a debit or credit card with a reputable dealership.

Credit card

You may have to pay interest if you pay for a car on a credit card, but you will benefit from payment protection on purchases from £100 up to £30,000. However, private sellers and most dealerships will not accept credit cards and will require either cash or a debit card.

Debit card or bank transfer

Make sure you have your debit card handy or know how to log in to your online banking. As the money comes from your bank account, you won’t pay interest on these transactions.

A personal loan

You can get a loan from a bank or building society to help cover the cost of your new car. This is when you borrow a sum of money, and agree to pay it back in monthly instalments, plus interest. If you’re thinking about whether you should take out car finance or a personal loan, take a look at our guide.

You could also get a car loan. This is different from a personal loan because it is secured against the vehicle. This means that if you fail to keep up with your repayments, the lender could repossess your car.

Read more about secured and unsecured car loans in our guide.

What is car leasing and how does it work?

Also known as a Personal Contract Hire agreement, leasing a car is just renting one over a long period, typically between 24 and 48 months. You will make an initial rental payment (similar to a car finance deposit), then make monthly payments for the length of the lease.

What is car leasing and how does it work?

Also known as a Personal Contract Hire agreement, leasing a car is just renting one over a long period, typically between 24 and 48 months. You will make an initial rental payment (similar to a car finance deposit), then make monthly payments for the length of the lease.

By choosing a lease agreement, you’ll be able to enjoy a new car with the latest technology. Some car leasing agreements also include servicing, maintenance, and breakdown cover as a package deal (depending on the leasing company).

Car leasing has its limitations. For instance, you might have a mileage limit which is agreed at the start of the contract, and if you go over it, you’ll need to pay a fee. Also, you must return the car to the lease company or dealership at the end of the contract. There is no option to legally own the car at the end of its lease.

By choosing a lease agreement, you’ll be able to enjoy a new car with the latest technology. Some car leasing agreements also include servicing, maintenance, and breakdown cover as a package deal (depending on the leasing company).

Car leasing has its limitations. For instance, you might have a mileage limit which is agreed at the start of the contract, and if you go over it, you’ll need to pay a fee. Also, you must return the car to the lease company or dealership at the end of the contract. There is no option to legally own the car at the end of its lease.

Is it better to lease or buy a car?

When considering the best way to buy a car, it’s important to think about your circumstances and whether they’re likely to change soon. If they are, buying a second-hand car may be more suitable than signing up for a leasing agreement.

Let’s explore some examples so you can make an informed decision.

When could it be best to lease a car?

Is it better to lease or buy a car?

When considering the best way to buy a car, it’s important to think about your circumstances and whether they’re likely to change soon. If they are, buying a second-hand car may be more suitable than signing up for a leasing agreement.

Let’s explore some examples so you can make an informed decision.

When could it be best to lease a car?

If you want to change cars on a more regular basis or drive a newer car.

If you would prefer to pay lower monthly payments as opposed to one lump sum.

If you want to avoid paying ownership costs, i.e. road tax or MOTs.

If you don’t want to worry about the car depreciating in value.

If you want to change cars on a more regular basis or drive a newer car.

If you would prefer to pay lower monthly payments as opposed to one lump sum.

If you want to avoid paying ownership costs, i.e. road tax or MOTs.

If you don’t want to worry about the car depreciating in value.

When could it be best to buy a car?

When could it be best to buy a car?

If you want to own the car outright.

If you don’t intend to swap the car in the near future.

If you need the flexibility of driving without mileage restrictions.

If you want the freedom to modify, sell, or trade in your car.

If you want to own the car outright.

If you don’t intend to swap the car in the near future.

If you need the flexibility of driving without mileage restrictions.

If you want the freedom to modify, sell, or trade in your car.

What's the difference between leasing and financing a car?

The main difference between leasing and financing a car is that, with leasing, you won’t legally own the vehicle when the lease agreement ends.

On the other hand, when financing a car, you will have the option to own the car once you’ve paid off the agreement. Whether this happens at the end of the contract or there is a fee involved depends on the type of finance you get.

What is car financing?

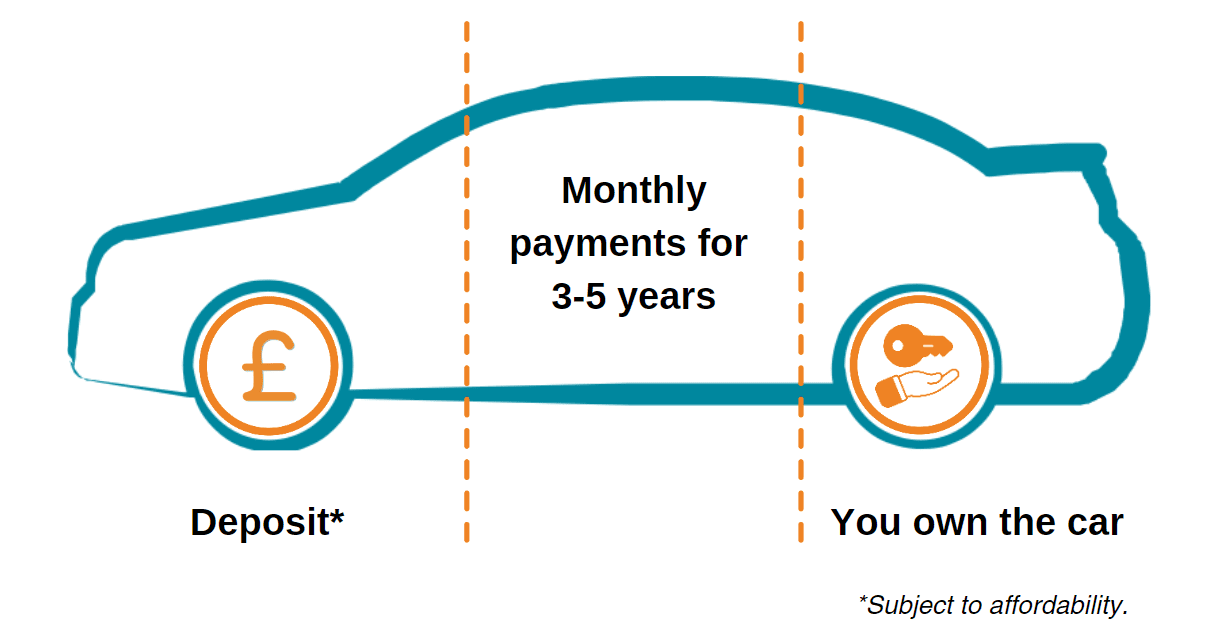

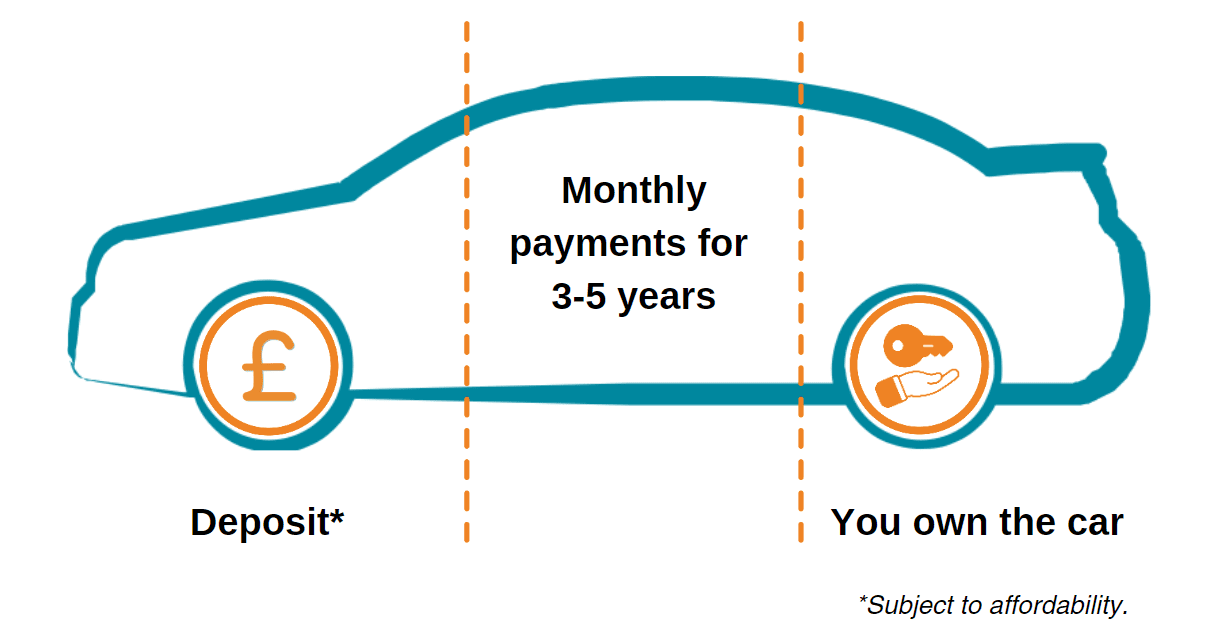

When you finance a car, the lender pays the dealership for you, and you make monthly payments over an agreed period. Car finance helps you to spread the cost of a car over time, so you don’t have to pay for it all upfront.

The most popular types of car finance include:

What's the difference between leasing and financing a car?

The main difference between leasing and financing a car is that, with leasing, you won’t legally own the vehicle when the lease agreement ends.

On the other hand, when financing a car, you will have the option to own the car once you’ve paid off the agreement. Whether this happens at the end of the contract or there is a fee involved depends on the type of finance you get.

What is car financing?

When you finance a car, the lender pays the dealership for you, and you make monthly payments over an agreed period. Car finance helps you to spread the cost of a car over time, so you don’t have to pay for it all upfront.

The most popular types of car finance include:

Conditional Sale (CS)

A Conditional Sale (CS) agreement is where you make fixed monthly payments over an agreed term. Once you make the final payment, you’ll become the car’s legal owner, with no extra fee or payment needed.

This is what we offer at Moneybarn. We’re specialists in providing bad credit car finance. We can help if you’ve been refused by other lenders or have an IVA or CCJ.

Representative 30.7% APR.

Hire Purchase (HP)

With a Hire Purchase (HP) plan, you usually put down a deposit at the start of the agreement. Then, you make fixed monthly payments over an agreed term.

At the end of the agreement, you can become the car’s legal owner by paying the ‘option to purchase fee’.

The size of this fee depends on several factors, and your lender will tell you how much this will be before you sign your agreement.

Personal Contract Purchase (PCP)

With a Personal Contract Purchase (PCP) plan, you will put down a deposit and make monthly payments for the duration of the agreement. According to MoneyHelper, down payments are usually around 10% of the car’s value, but it can vary depending on your circumstances.

Once the agreement ends, you can buy the car outright by paying the ‘balloon payment’, give it back to the lender and end the deal, or trade it in and start a new PCP deal.

Conditional Sale (CS)

A Conditional Sale (CS) agreement is where you make fixed monthly payments over an agreed term. Once you make the final payment, you’ll become the car’s legal owner, with no extra fee or payment needed.

This is what we offer at Moneybarn. We’re specialists in providing bad credit car finance. We can help if you’ve been refused by other lenders or have an IVA or CCJ.

Representative 30.7% APR.

Hire Purchase (HP)

With a Hire Purchase (HP) plan, you usually put down a deposit at the start of the agreement. Then, you make fixed monthly payments over an agreed term.

At the end of the agreement, you can become the car’s legal owner by paying the ‘option to purchase fee’.

The size of this fee depends on several factors, and your lender will tell you how much this will be before you sign your agreement.

Personal Contract Purchase (PCP)

With a Personal Contract Purchase (PCP) plan, you will put down a deposit and make monthly payments for the duration of the agreement. According to MoneyHelper, down payments are usually around 10% of the car’s value, but it can vary depending on your circumstances.

Once the agreement ends, you can buy the car outright by paying the ‘balloon payment’, give it back to the lender and end the deal, or trade it in and start a new PCP deal.

Are you looking to finance your next car?

Are you looking to finance your next car?

Financing and leasing a car might seem alike, but they’re quite different. Leasing is handy if you fancy a newer car or like to upgrade every year or so.

On the other hand, financing lets you spread the cost over time, with the ability to legally own the car at the end.

If you’re interested in financing your next car, we could help. Our team of experts would be happy to guide you onto a better road ahead. Find out how we could help you with car finance today.

How our car finance works

When you’re ready, get a quote in less than 5 minutes and see how much you could borrow. We do a soft search when you apply, and if you’re approved, we’ll guide you through the process.

Representative 30.7% APR.

We only use a hard search once you’ve found your dream car and contracts are drawn up for you to sign.

Financing and leasing a car might seem alike, but they’re quite different. Leasing is handy if you fancy a newer car or like to upgrade every year or so.

On the other hand, financing lets you spread the cost over time, with the ability to legally own the car at the end.

If you’re interested in financing your next car, we could help. Our team of experts would be happy to guide you onto a better road ahead. Find out how we could help you with car finance today.

When you’re ready, get a quote in less than 5 minutes and see how much you could borrow. We do a soft search when you apply, and if you’re approved, we’ll guide you through the process.

Representative 30.7% APR.

We only use a hard search once you’ve found your dream car and contracts are drawn up for you to sign.

How our car finance works

FAQs about leasing or buying a car

Is leasing a car a waste of money?

A lease deal can be a flexible alternative to buying your car outright, particularly if you want to drive a brand-new car and upgrade every few years. However, there is no way to legally own the car, and you’ll have to return it at the end of the lease.

With a lease car, it’s important to understand the conditions of your agreement, as you can incur additional fees if you exceed your mileage limits or if the car is returned with excess wear and tear or damage.

Is car finance worth it?

Car finance can be a convenient and flexible car-buying solution for many people. Unlike leasing, it gives you a way to legally own the car at the end of the agreement. However, no one can tell you what’s best for you because everyone’s situation is different. That’s why it’s important to understand the ins and outs of your agreement before you sign anything.

To get started, why not try out our car finance calculator? It will show you what your monthly payments might look like, depending on how much you’re looking to borrow and for how long.

Or, for more information, check out our guide where we explore the question ‘Is car finance worth it?’ in more detail.

What is the average monthly cost of leasing a car?

The monthly costs of leasing a car will vary depending on factors like the type of car, the agreed annual mileage, and the lease term. For example, the car leasing company Leasoo offer cars starting from £260 per month.

However, some monthly payments could be more, especially if you want to lease a rare or classic car.

What happens if you can't keep up with leased car payments?

If you can’t keep up with your lease payments, the leasing company may terminate your contract and repossess the car. If you are experiencing financial difficulty, contact your lender, and they can discuss what support is available.

FAQs about leasing or buying a car

Is leasing a car a waste of money?

A lease deal can be a flexible alternative to buying your car outright, particularly if you want to drive a brand-new car and upgrade every few years. However, there is no way to legally own the car, and you’ll have to return it at the end of the lease.

With a lease car, it’s important to understand the conditions of your agreement, as you can incur additional fees if you exceed your mileage limits or if the car is returned with excess wear and tear or damage.

Is car finance worth it?

Car finance can be a convenient and flexible car-buying solution for many people. Unlike leasing, it gives you a way to legally own the car at the end of the agreement. However, no one can tell you what’s best for you because everyone’s situation is different. That’s why it’s important to understand the ins and outs of your agreement before you sign anything.

To get started, why not try out our car finance calculator? It will show you what your monthly payments might look like, depending on how much you’re looking to borrow and for how long.

Or, for more information, check out our guide where we explore the question ‘Is car finance worth it?’ in more detail.

What is the average monthly cost of leasing a car?

The monthly costs of leasing a car will vary depending on factors like the type of car, the agreed annual mileage, and the lease term. For example, the car leasing company Leasoo offer cars starting from £260 per month.

However, some monthly payments could be more, especially if you want to lease a rare or classic car.

What happens if you can't keep up with leased car payments?

If you can’t keep up with your lease payments, the leasing company may terminate your contract and repossess the car. If you are experiencing financial difficulty, contact your lender, and they can discuss what support is available.

Bringing you guides that compare different finance products available in the market today.

More from Moneybarn...

For a better road ahead

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.

Moneybarn is the trading style of Moneybarn No. 1 Limited, a company registered in England and Wales with company number 04496573. The registered address is Athena House, Bedford Road, Petersfield, Hampshire, GU32 3LJ.

Moneybarn’s VAT registration number is 180 5559 52.

Moneybarn No. 1 Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702780)