- Car finance Car finance

- Motorbike finance Motorbike finance

- Van finance Van finance

- How it works How it works

- FAQs and guides FAQs and guides

- About us About us

- Home

- Blog

- Latest Motor News

- The cost of car ownership

The cost of car ownership

Updated: Thursday, 5 September 2024

The cost of owning a car goes well beyond the purchase price. After buying a new or used car, drivers need to budget for a range of ongoing expenses. Various things affect car ownership costs, such as the car’s make and model, personal circumstances, and market prices.

But with living costs rising and other global events impacting fuel availability, how has the cost of owning a car changed in the last year?

We’ve examined all the costs associated with car ownership to give an overview of how much you might need to pay to keep your car on the road.

The cost of owning a car goes well beyond the purchase price. After buying a new or used car, drivers need to budget for a range of ongoing expenses. Various things affect car ownership costs, such as the car’s make and model, personal circumstances, and market prices.

But with living costs rising and other global events impacting fuel availability, how has the cost of owning a car changed in the last year?

We’ve examined all the costs associated with car ownership to give an overview of how much you might need to pay to keep your car on the road.

In this guide

In this guide

What are the average car running costs around the UK?

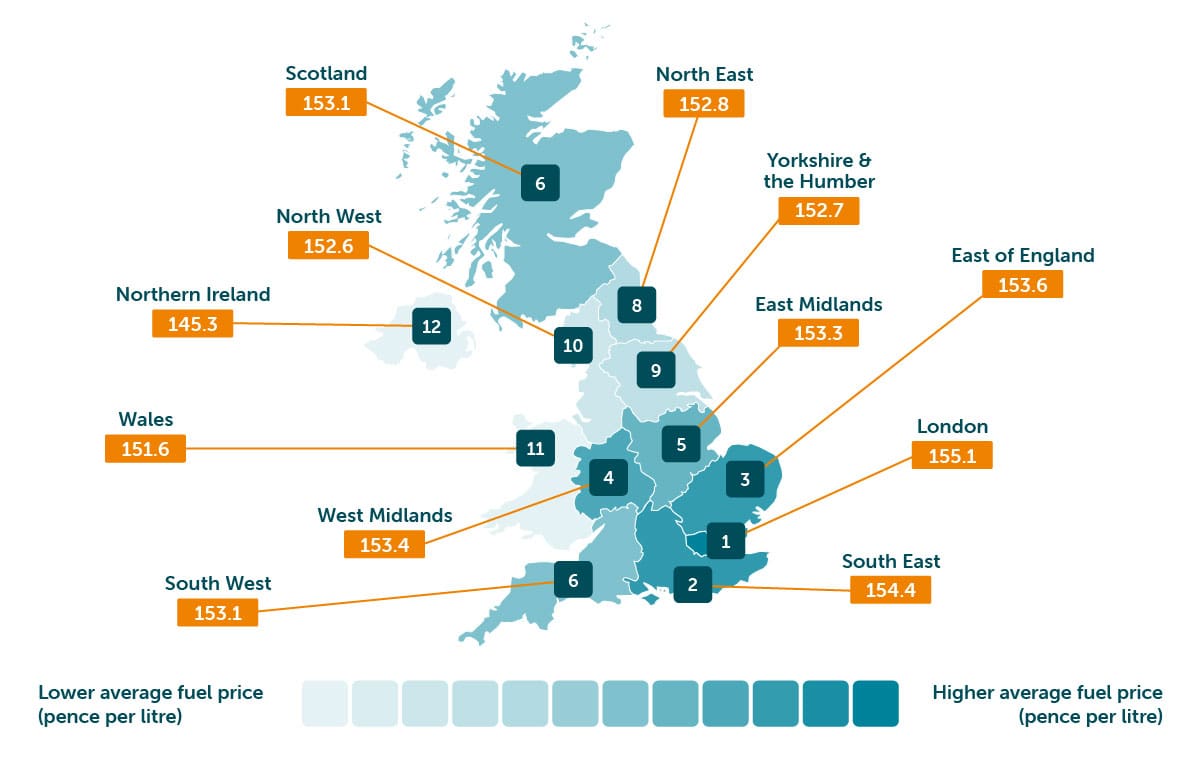

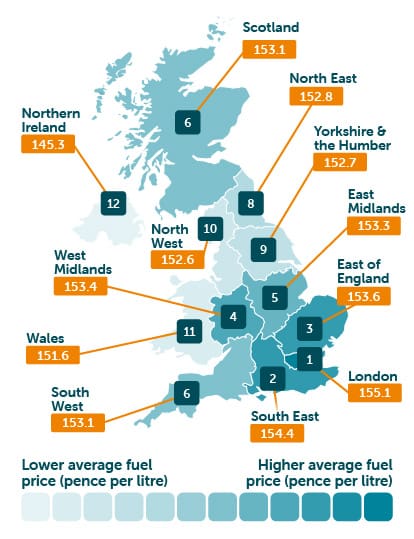

Average fuel cost by region

The cost of petrol or diesel is one of the most regular costs drivers face, and it varies depending on local and country-wide factors. However, fuel-efficient cars can offset these costs, and the increasing availability of electric vehicles offers potential long-term savings on fuel.

We’ve examined the average price of 3 different fuel types and revealed the average fuel cost around the UK.

1. London: 155.1 pence per litre

London is the most expensive region for fuel, with an average price of 155.1 pence per litre. The cost of unleaded averaged 146.7 pence per litre, diesel at 154.8 pence per litre, and super unleaded is the highest at 163.9 pence per litre.

2. South East: 154.4 pence per litre

The South East follows closely, ranking second with average fuel costs of 154.4 pence per litre. Here, the average prices are slightly lower than in London, unleaded at 146.1 pence per litre, diesel at 154.6 pence per litre, and super unleaded at 162.6 pence per litre.

3. East of England: 153.6 pence per litre

The East of England ranks third, with the average fuel price at 153.6 pence per litre. In this region, unleaded costs an average of 145.9 pence per litre, diesel costs 153.7 pence per litre, and super unleaded costs 161.3 pence per litre.

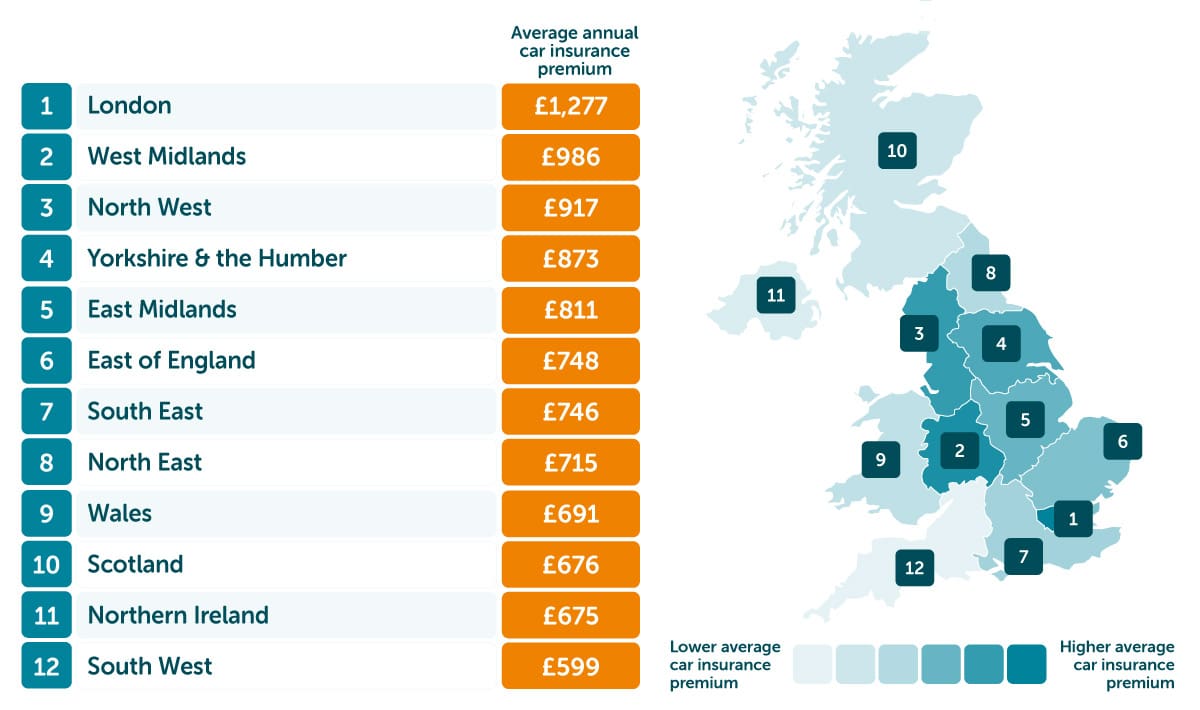

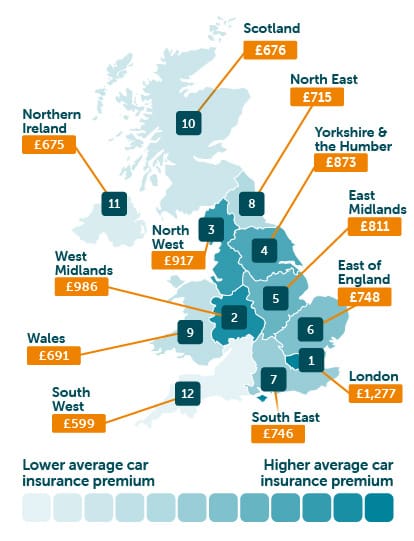

Average car insurance cost by region

Insurance premiums are influenced by the car type and driver’s history and are significantly affected by the driver’s age and location. Younger drivers often face higher rates due to their perceived risk, and premiums can vary widely between regions due to local risk factors and accident rates.

1. London: £1,227

London has the highest average car insurance premium, at £1,277 per year. This figure is due to the capital’s dense traffic, higher accident rates, and higher vehicle crime rates.

2. West Midlands: £986

The West Midlands has an average annual premium of £986. This region includes major cities such as Birmingham, which will influence the higher premium rates due to urban risks like higher traffic levels, theft, and vandalism.

3. North West: £917

The North West includes cities like Manchester and Liverpool, with an average premium of £917 per year. These cities also face urban risk factors that increase insurance costs.

Average maintenance and repair costs by region

Regular maintenance, such as oil changes, checking tyre pressure and tread depth, and monitoring fluid levels, is needed to keep a car in good working condition and prevent more costly repairs later.

Unexpected maintenance can also be expensive. Here, we’ve averaged the cost of 4 standard repairs in the UK’s largest towns and cities, including MOT, full service, aircon regas, and full service and MOT.

Luton has the highest average cost across all 4 services (£153.40), mainly due to the high full service and MOT (£265.02). This is followed by Southend-on-Sea, with an average of £152.50.

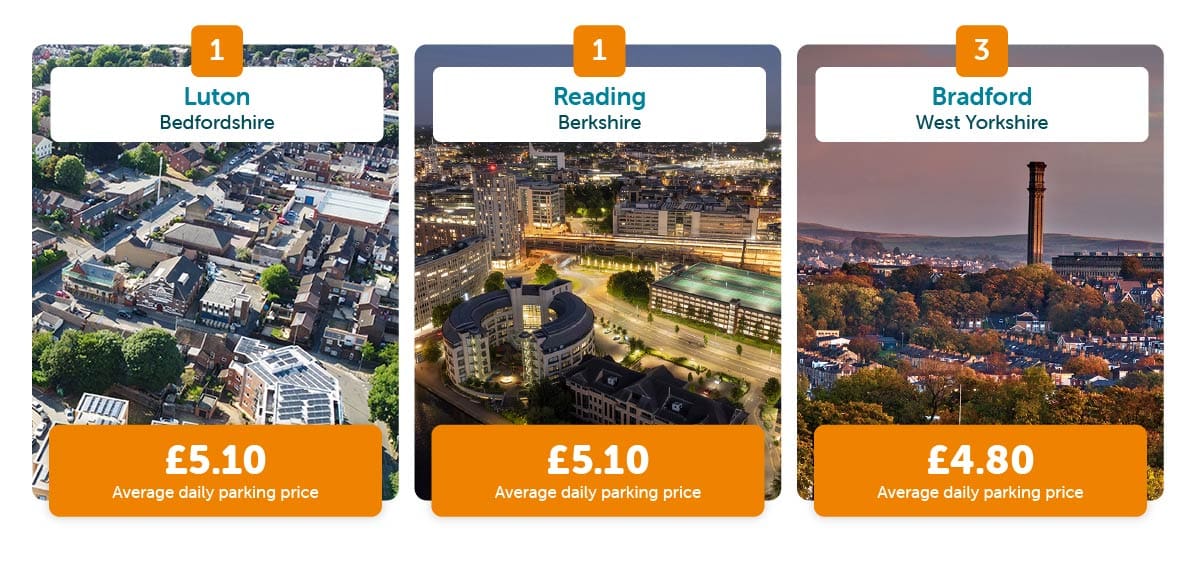

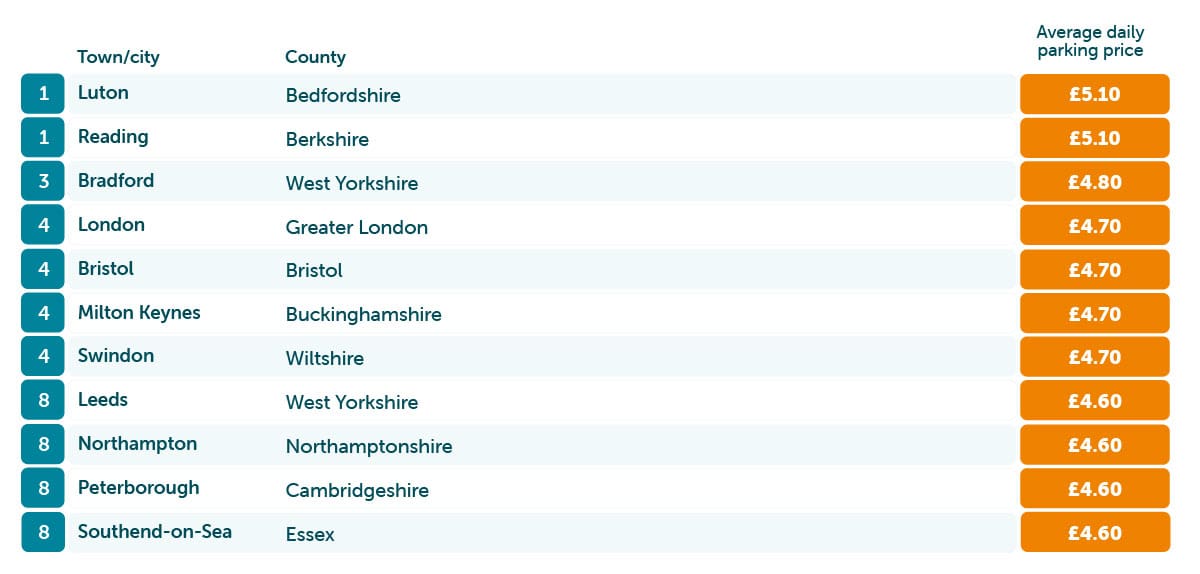

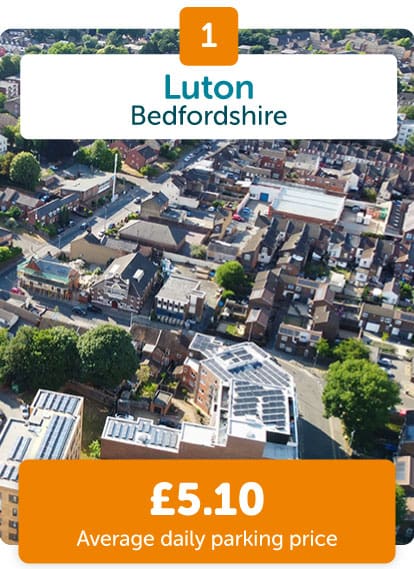

Average parking costs by city

Parking prices often vary depending on location. Cities often charge high fees for parking spaces in residential and commercial zones.

Luton and Reading have the highest average daily parking price at £5.10. This could be due to a high demand or a limited supply of parking spaces in these areas.

Bradford in West Yorkshire follows with an average daily parking price of £4.80. Behind this are 4 cities with an average price of £4.70: London, Bristol, Milton Keynes and Swindon.

How much does it cost to own a car in the UK?

The cost of owning a car in the UK can vary based on various factors such as the type of car, its age, your driving habits, and where you live.

Here’s a breakdown of the everyday expenses associated with car ownership:

Purchase cost

The price of a brand-new car depends on the make, model, and specifications. For example, for a VW Polo, the average new price is between £20,975 – £27,475[1], increasing to £29,670 – £40,455 for a Ford Focus estate[2]. For an SUV, this would be slightly more, with the Ford Kuga averaging £32,095 – £42,455[3].

The average cost of a used car is just over £16,000, but this figure varies depending on the vehicle’s age, mileage, manufacturer, and condition[4]. For more information, read our ‘What car can I afford?’ guide.

Depreciation

Cars typically lose between 10% and 15% of their value yearly[5]. The rate of depreciation depends on the vehicle’s make and model.

Insurance

Annual insurance premiums depend on your age, driving history, location, and the car’s make and model.

Between January and March 2024, the average premium cost was £627, up 12% from the previous quarter[6].

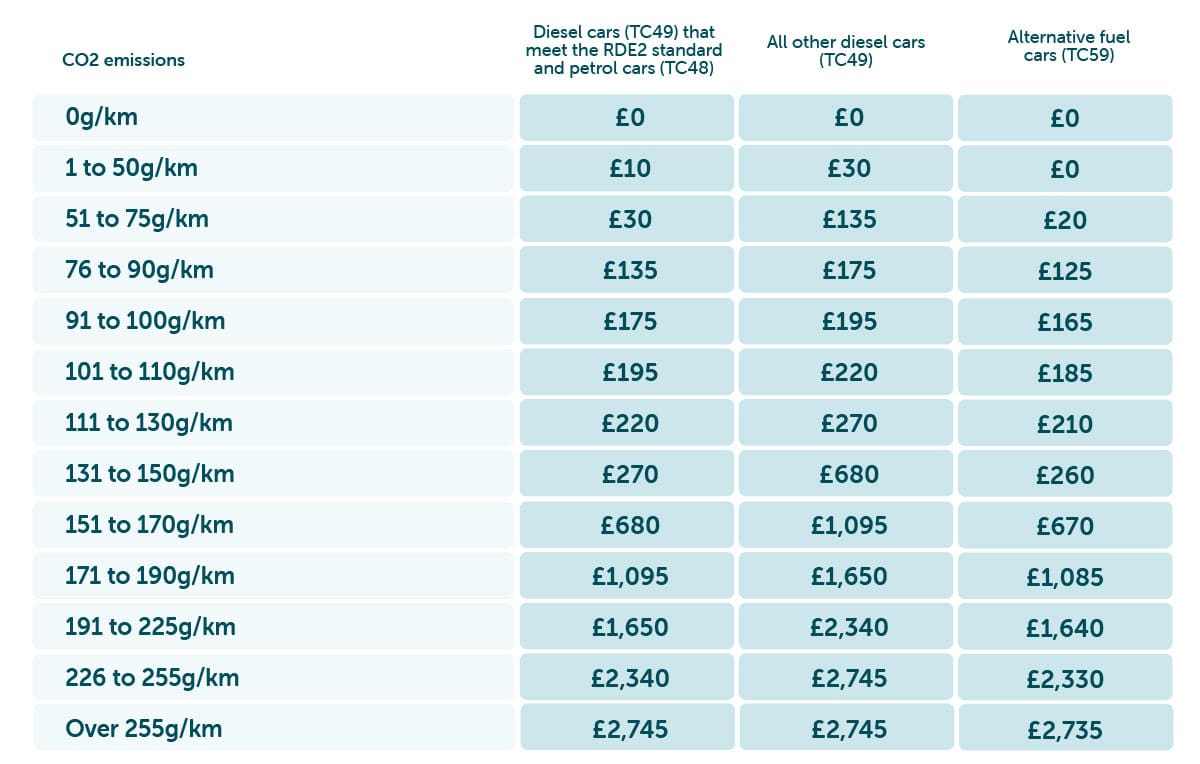

Road tax

The rate of road tax that you pay depends on your vehicle’s CO2 emissions. You can see the rates for the initial tax payment below, as of 1 April 2024, and check GOV.UK for the most up-to-date rates[7]. These rates apply to cars registered on or after 1 April 2017. For cars registered before this, you can see the rates for cars registered before this date here.

For the second year’s tax payment onwards, you can expect to pay:

MOT test

The cost of an MOT test can vary, but the maximum amount that can be charged is £54.85 for a car and £29.65 for a standard motorcycle[8]. The UK government controls this, with the maximum fees set by the Driver and Vehicle Standards Agency (DVSA), a part of the Department for Transport. While some garages may offer MOT tests at lower prices, they cannot legally charge more than the DVSA-set maximum.

Servicing and maintenance

The average cost of a full car service is between £170 and £395, with an interim service costing around £110. Of course, if the service finds more problems that need to be fixed, this will add to the cost[9].

Fuel

The average cost of a litre of unleaded fuel is 145.3 pence per litre and 153.9 per litre for diesel fuel. Over a year, this depends on mileage and fuel efficiency but averages around £1,095 for unleaded and £1,284 for diesel, based on average fuel economy[10].

Breakdown cover

The cost of breakdown cover varies depending on the provider, the level of cover you choose, and your vehicle’s make and model. Basic cover can start at around £60 a year, but more comprehensive policies may cost as much as £200 per year[11].

With many different suppliers and cover levels available, it’s important to compare options to find the best fit for your needs and vehicle.

Financing costs

If you take out a loan or car finance on your car, you will have to pay interest on the amount you borrow. The monthly cost of financing a car can vary significantly based on your circumstances.

For example, the UK’s most popular car, the Ford Fiesta, has an average used price of £3,960 – £22,035[12]. Taking the middle of this range (around £13,000) and assuming a repayment term of 5 years and APR of 30.7%, with a fair credit score, an average car finance agreement would have monthly payments of £400.75[13].

What is the average car service cost in the UK?

The cost of car servicing in the UK can vary based on the type of service, the vehicle’s size, and the garage’s location.

An interim service, typically recommended every 6 months or 6,000 miles, costs around £110[6]. This service includes basic checks and replacements, such as engine oil and oil filters, and topping up various fluids, such as brake, steering, and coolant fluids.

A full service, recommended every 12 months or 12,000 miles, costs between £170 and £395[6]. This complete service includes all the checks from an interim service plus extra checks and replacements, potentially covering up to 80 different car parts and systems.

A major service, typically carried out every 24 months or 24,000 miles, can cost around £210[6]. This includes everything in a full service plus extra inspections and replacements like brake fluid, spark plugs, and more thorough checks of the car’s major systems.

What is the average cost of an MOT in the UK?

The average cost of an MOT test in the UK varies depending on the type of vehicle and the location. The maximum fee for a standard car (Class 4 vehicle) is £54.85, but the actual cost often ranges between £40 and £55. Many garages offer discounted prices, and it is not uncommon to find MOT tests for as low as £35 to £45[14].

The maximum fee for motorcycles is £29.65. Larger vehicles, such as vans up to 3,500 kg, can have an MOT fee of up to £58.60[14]. The cost can be higher in urban areas than in rural locations, so it’s worth checking multiple local garages for the best rates.

If your vehicle fails the MOT and needs a re-test, some garages may offer this service for free or at a reduced cost if the repairs are done at the same centre within a given timeframe (usually 10 working days).

What is the average cost of car insurance in the UK?

The average cost of car insurance in the UK has significantly increased recently. As of 2024, the typical annual cost for comprehensive car insurance is about £627[3]. This marks a large rise from previous years, reflecting the overall trend of escalating insurance premiums.

The exact cost can vary widely based on several factors, including the driver’s age, location, driving history and the type of car insurance chosen. For example, younger drivers face the highest premiums, averaging £1,037 for comprehensive cover due to their higher risk profiles. Older drivers generally benefit from lower premiums, dropping to £383 for those aged 50-plus[15].

Regional differences also play a role. Drivers in London experience the highest average costs at around £1,277 annually, whereas those in other parts of the UK, such as the South West, pay significantly less, averaging about £599 per year[12].

What is the average cost of car repairs and maintenance?

The average cost of car repairs and maintenance in the UK varies significantly depending on the car model, age, and specific services needed.

The average annual cost for maintenance and repairs is about £150[16]. However, specific maintenance costs vary by brand.

Cars over 40 years old are free from vehicle tax each year starting on 1 January, offering further financial relief to owners of classic cars.

What extra costs are associated with owning a car?

Cleaning

The money it costs to clean your car can vary depending on the type of service, the provider, and your location.

- A basic exterior hand wash costs between £5 and £20, or between £5 and £8 for a drive-through car wash

- A full valet car wash, which includes interior vacuum cleaning and dusting and the interior wash, costs between £40 and £150

- At the top end, a full-detail car wash includes washing, waxing, vacuuming, upholstery cleaning, and detailing and costs between £100 and £250[17]

Prices can also vary based on the size of the car, with larger vehicles like SUVs and vans often costing more than standard saloons or hatchbacks. Some premium services may be more expensive depending on the products used and the cleaner’s expertise.

Car park fees/parking tickets

The cost of car park fees and parking tickets in the UK can vary widely depending on the location, time, and type of parking facility.

In city centres like London, Manchester, or Birmingham, hourly rates range from £1 to £6 or more. Daily rates vary from £15 to £50 depending on the location and demand[16].

At airports, short-term parking (e.g., for pick-ups and drop-offs) can cost between £3 to £7 for the first 15-30 minutes. Long-term parking can be upward of £10 per day, with discounts for pre-booking[17].

In our Airport Parking Report, we found the cost of weekly parking to be £180 at London Gatwick and £255.30 at Heathrow.

Parking fees at train stations typically range from £5 to £25 per day, with some differences based on the station’s size and location. You can read more about train station parking prices around the UK in our Train Station Parking Report.

Vehicle tax

Vehicle tax (car tax, road tax, or Vehicle Excise Duty – VED) in the UK varies depending on several factors, including the type of vehicle, its CO2 emissions, and its registration date. Here is a general overview of car tax bands:

First-year rate

Standard rate (after the first year)

The above applies to vehicles registered after 1 April 2017. Different bands apply for those registered between 1 March 2001 and 31 March 2017, which you can view on GOV.UK.

For those registered before 1 March 2001, rates depend on engine size, with those up to 1549cc paying £210 and those over 1549cc paying £345.

Fully electric vehicles are generally free from VED, while tax rates for motorcycles, vans, and other vehicles vary. For example, motorcycle tax rates depend on engine size and range from £25 to £117 per year[4].

Depreciation

Car depreciation is the reduction in a vehicle’s value over time due to age, mileage, wear and tear, and market conditions. It can significantly impact the amount you get if you sell or trade in your vehicle.

On average, a brand-new car loses 15 – 35% of its value in the first year. Over the next 3 years, it can lose 50% or more of its initial value[2].

Factors affecting depreciation include:

- Make and model: Some brands and models hold their value better than others

- Mileage: Higher mileage cuts a car’s value more quickly

- Condition: Well-maintained cars depreciate slower

- Market demand: Popular models retain value better

- Economic factors: General economic conditions can affect car values

Online depreciation calculators and car valuation tools can give more specific estimates based on make, model, age, mileage, and condition.

How have car ownership costs changed over the years?

Fuel prices

Fuel prices have fluctuated due to various factors, such as crude oil prices, geopolitical events, and changes in demand and supply. There has been a notable increase in fuel prices in recent years due to the global energy crisis and supply chain disruptions.

Petrol and diesel prices peaked on 4 July 2022, reaching 191.6 and 199.2 pence per litre, respectively. Since then, they’ve fluctuated in price but had fallen to 144.3 and 150.1 pence per litre by July 2024[20].

Insurance premiums

Insurance premiums have generally risen over the past few years. According to the Association of British Insurers, car insurance was 25% more expensive on average in 2023 than the previous year[3].

Factors contributing to this include increased accident rates and higher repair costs due to advanced vehicle technologies.

Maintenance costs

Maintenance costs have increased by 40% between 2018 and 2022[21]. This rise is partly due to the higher complexity of modern vehicles, which often need specialised services and parts.

Inflation and supply chain issues have also increased spare parts and labour prices.

Vehicle prices

The prices of new and used cars have significantly risen. Supply chain disruptions caused by the COVID pandemic, semiconductor shortages, and increased demand have driven up the costs of new vehicles. Used car prices have also surged due to the high demand and limited supply[22].

New cars vs used cars: How do the ownership costs compare?

The cost of owning a new car versus a used car can vary significantly based on various factors, including depreciation, maintenance, insurance, financing, and fuel efficiency.

Depreciation

- New cars: Depreciation is the most significant cost factor for new vehicles. A new car can lose 20 – 30% of its value within the first year and about 50% or more over 3 years[2]

- Used cars: Used cars depreciate slower since the biggest depreciation hit has already happened. The rate of depreciation decreases with the car’s age

Insurance

- New cars: Insurance premiums for new cars are typically higher. This is due to the higher replacement cost and the addition of comprehensive and collision coverage.

- Used cars: Insurance costs are generally lower for used cars since their value is lower, and they might not need comprehensive cover. However, this isn’t always the case. For example, an older luxury car will likely be a lot more expensive to insure than a brand-new version of a model like a VW Golf or Ford Focus[23]

Maintenance & repairs

- New cars: Maintenance costs are lower since new cars are under warranty. However, repair costs can be higher after the warranty period

- Used cars: Used cars may need frequent maintenance and repairs, but the overall cost can vary depending on the car’s condition and history[24]

When considering the total cost of ownership over a typical 5-year period, used cars generally offer lower ownership costs due to reduced depreciation, lower insurance premiums, and lower purchase prices.

New vehicles offer a warranty, lower initial maintenance costs, and the latest technology and safety features.

Petrol cars vs diesel cars: How do the ownership costs compare?

The ownership costs of petrol and diesel cars can be compared by looking at several key factors: purchase price, fuel costs, maintenance and servicing, insurance, and resale value.

Purchase price

- Petrol cars: Petrol cars are generally cheaper to buy than diesel cars. This is due to the lower production costs of petrol engines

- Diesel cars: Diesel cars usually have a higher upfront cost because diesel engines are more complex and expensive to make[25]

Fuel costs

- Petrol cars: While petrol is initially cheaper per litre than diesel – 145.3 pence per litre versus 153.9 pence per litre – petrol is less fuel-efficient for longer journeys[7]. Although it costs less at the pump, it may not be as cheap for long-distance driving as diesel, particularly on motorways

- Diesel cars: Diesel engines are more fuel-efficient and provide better mileage, especially for long-distance driving, potentially lowering fuel costs[7]. However, the type of driving you do can also influence costs; for example, petrol might be more cost-effective for mainly urban or residential street driving

Maintenance & servicing

- Petrol cars: Petrol engines generally have fewer parts and are cheaper to maintain. Service intervals can be longer, and parts are usually less expensive

- Diesel cars: Due to their complexity, diesel engines can be more expensive to maintain. Parts like turbochargers, particulate filters, and high-pressure fuel pumps can increase servicing costs[26]

Insurance

- Petrol cars: Insurance premiums for petrol cars tend to be lower, reflecting their lower price and simpler engine design

- Diesel cars: Diesel cars might have higher insurance costs due to their higher cost and more complex mechanical parts[26]

Resale value

- Petrol cars: The resale value of petrol cars can be lower, especially for larger vehicles with more desirable diesel variants

- Diesel cars: Diesel cars often retain their value better due to their fuel efficiency and durability, particularly for high-mileage drivers[27]

Taxes & emissions

- Petrol cars: Petrol cars emit more carbon dioxide (CO2) than diesel cars, but they usually produce less nitrogen oxide (NOx) emissions. This can affect vehicle tax rates

- Diesel cars: Diesel cars often have lower CO2 emissions, which can lead to lower vehicle taxes. However, higher NOx emissions can result in extra charges in low-emission zones, especially in urban areas[28]

Summary

The total cost of ownership for petrol versus diesel cars varies based on your driving habits and personal situation. Diesel cars can be cheaper for high-mileage drivers because of their fuel efficiency and better resale value.

Due to its lower price, maintenance costs, and fewer emissions restrictions, a petrol car might be cheaper for lower-mileage drivers or those primarily driving in urban areas.

When deciding between petrol and diesel cars, it’s essential to think about your specific driving needs and future trends in the automotive market.

What are the ownership costs of electric vehicles?

The ownership costs of electric vehicles (EVs) can vary widely based on factors such as the type of vehicle, local electricity prices, and government incentives.

Purchase price

- Initial cost: EVs often have a higher upfront cost than internal combustion engine (ICE) vehicles. For example, the average price of an EV in the UK is £48,000, but this can vary from £14,995 up to more than £300,000 depending on the make and model[29]

- Government incentives: Before June 2022, the UK government offered a plug-in car grant for most EVs. However, this now only applies to certain eligible vehicles, like motorcycles, vans, and taxis

Charging costs

- Home charging: Electricity rates in the UK average around £0.22 per kWh, and home charging can cost around £15 per charge[30]

- Public charging: Costs vary; slow/fast chargers (those below 50 kW) cost around 57p/kWh and 80p/kWh for rapid chargers (those 50kW and above)[31]. Some networks offer subscription models, reducing per kWh costs

- Supercharging: Tesla’s Supercharger network typically costs around 77p/kWh for non-Tesla drivers or around 53p/kWh for Tesla subscribers[32]

Maintenance costs

- Lower maintenance costs: EVs generally have fewer moving parts, leading to lower maintenance costs. Regular maintenance might include tyre changes, brake fluid changes, and cabin air filter replacements[33]

- Battery maintenance: EV batteries have warranties (typically 8 years or 100,000 miles). Battery degradation is a concern, but significant capacity loss is rare within the warranty period, according to Chargemap Blog

Insurance

- Insurance rates: Insurance for EVs can be slightly higher due to the vehicle’s higher value and specialised repair costs. On average, EV insurance costs £654[34]

Depreciation

- Resale value: EVs tend to depreciate faster than ICE vehicles, though this is improving. Depreciation can be around 48% of the purchase price over 3 years[35]

Taxes & fees

Extra costs

- Charging infrastructure: Installing a home charging point can cost between £500 and £1,000[37]. However, an electric vehicle chargepoint grant can cover up to 75% of the cost (up to £350) if you rent your home or own a flat

- Battery replacement: Although battery replacement is rare and usually covered under warranty, it can cost several thousand pounds if needed[38]

While EVs have a higher initial cost, their lower running costs, government incentives, and exemptions from certain taxes and charges can make them cheaper.

Potential owners should carefully consider their driving habits, charging options, and local incentives to make a well-informed decision.

How can you cut the monthly cost of car ownership?

Paul Green, Moneybarn’s motoring expert, has almost 30 years of experience in the automotive industry. He uses this knowledge to share ways motorists could cut the monthly cost of car ownership.

Explore car finance options

- Make a larger deposit upfront: If you’re planning to take out car finance or bad credit car finance, a large deposit can reduce your monthly repayments. This is because it lowers the amount you need to borrow.

- Choose the right finance term: Having a longer agreement term can help to make the monthly payments smaller. However, this may also increase the amount of interest you’re paying, meaning the total cost of your new car could be higher.

Reduce insurance costs

- Compare insurance quotes: Money Saving Expert found that the cheapest time to get quotes for car insurance is 20 to 27 days ahead of your renewal date.

- Increase your excess: Choosing a higher excess on your insurance could lower your premium. Make sure this is affordable for you in the event of a claim, and if you’re financing your car, check your contract as your lender may specify the excess.

- Take advantage of discounts: Look out for discounts such as those for safe drivers, multi-car policies, or bundled insurance products if they’re applicable to you.

Maintain your vehicle

- Regular maintenance: Keep up with regular maintenance to avoid costly repairs. This includes oil changes, tyre changes, and brake inspections.

- DIY minor repairs: Learn to do minor repairs yourself, such as changing air filters, wiper blades, or headlight bulbs.

Improve fuel efficiency

- Drive efficiently: Avoid rapid acceleration and hard braking, which can lower fuel efficiency.

- Reduce weight: Remove unnecessary items from your car to make it lighter and improve fuel economy.

- Keep tyres inflated: Properly inflated tyres can improve fuel efficiency and extend tyre life.

Lower depreciation costs

- Buy a reliable used car: New cars depreciate quickly. Buying a used car that’s a few years old could save you money and reduce depreciation costs.

- Choose cars with strong resale value: Some cars are known to retain their value better than others. When choosing a car, look for popular models with a reputation for reliability. Factors like brand reputation, low ownership costs, and high demand in the used car market can suggest a stronger resale value.

- Avoid odd colour combinations: Colours can affect a car’s resale value because some buyers are put off by divisive shades, so stick to popular colours like silver or grey… and avoid pink!

- Road Tax costs: Keep an eye on the CO2 emissions when purchasing as this directly affects the road tax costs, some increase by as much as 1000% if you buy the ‘less clean’ version of the same make and model! Not only does this drive-up cost of ownership, but also increases the depreciation and makes it harder to sell on.

Change driving habits

- Avoid idling: Turn off your engine if you’ll be stopped in traffic for a long time.

- Combine trips: Plan your errands to combine multiple trips into one, reducing the distance you drive.

- Carpool or use public transport: You could share rides with colleagues or friends, or use public transport if possible, to reduce the amount of driving you do.

Sell or trade-in

- Downsize your vehicle: If you have a large or expensive car, consider selling it and buying a smaller, cheaper car.

- Evaluate necessity: If you have multiple cars, think about whether you need all of them and consider selling one to cut costs.

Methodology

The data in this study is accurate as of 22 July 2024.

How much does it cost to run a car around the UK?

- Fuel: sourced from the AA’s March 2024 fuel prices

- Insurance: sourced from Quotezone.co.uk. All data shown uses a random sample of over 100,000 UK car insurance policies across all age groups from January 2023 to January 2024

- Repairs: sourced from FixMyCar (taking an average of MOT, full service, aircon regas, full service, and MOT prices)

- Parking: sourced from JustPark

Additional data was taken from the following sources:

- [1] Average VW Polo price – Parkers

- [2] Average Ford Focus estate price – Parkers

- [3] Average Ford Kuga price – Parkers

- [4] Average new and used purchase costs – NimbleFins Average Cost of Cars UK 2024

- [5] Average depreciation rate – Motorway Car Depreciation UK Market Guide (2024 Update)

- [6] Average insurance prices – ABI

- [7] Vehicle tax rates – GOV.UK Vehicle Tax Rate Tables

- [8] MOT costs – GOV.UK MOT costs

- [9] Average servicing costs – Checkatrade car service cost guide

- [10] Average fuel costs – NimbleFins Average Cost of Petrol for a Car 2024

- [11] Average breakdown cover cost – Carwow How much is breakdown cover?

- [12] Average Ford Fiesta cost – Parkers

- [13] Estimated car finance cost – Moneybarn car finance calculator

- [14] Average MOT costs – Checkatrade

- [15] Average insurance by age and region – GoCompare

- [16] Average maintenance cost – RAC

- [17] Average car wash costs – NimbleFins Average Cost of a Car Wash UK 2024

- [18] Average car parking costs – JustPark

- [19] Average airport parking costs – The Mirror

- [20] Historic fuel prices – House of Commons Library

- [21] Historic maintenance prices – Fleet News

- [22] Inflation and the auto industry: When will car prices drop? – J.P. Morgan

- [23] New or old car – which is cheaper to insure? – Insurance Business

- [24] Should I Buy a New or Used Car? – Evans Halshaw

- [25] Petrol vs diesel cars – Compare the Market

- [26] Should I get a petrol or a diesel car? – MoneySuperMarket

- [27] Does fuel type impact the value of your car? – Motorway

- [28] Is diesel actually better for the environment? – RAC

- [29] Average EV purchase price – NimbleFins Average Cost of an Electric Car UK 2024

- [30] Average electricity price – EDF Energy

- [31] Average public charging prices – Zap Map

- [32] Average Tesla charging prices – Vanarama

- [33] EV maintenance, service, and repairs guide – RAC

- [34] Average EV insurance price – NimbleFins – Average Cost of Electric Car Insurance UK 2024

- [35] Average EV depreciation rate – Motorway Electric Car Depreciation – The Ultimate Guide (2024 Update)

- [36] Ultra Low Emission Zone – Transport for London

- [37] Carwow Electric car charger installation cost 2024

- [38] How long do electric car batteries last? Replacement, warranties and battery life explained – Auto Express

What are the average car running costs around the UK?

Average fuel cost by region

The cost of petrol or diesel is one of the most regular costs drivers face, and it varies depending on local and country-wide factors. However, fuel-efficient cars can offset these costs, and the increasing availability of electric vehicles offers potential long-term savings on fuel.

We’ve examined the average price of 3 different fuel types and revealed the average fuel cost around the UK.

1. London: 155.1 pence per litre

London is the most expensive region for fuel, with an average price of 155.1 pence per litre. The cost of unleaded averaged 146.7 pence per litre, diesel at 154.8 pence per litre, and super unleaded is the highest at 163.9 pence per litre.

2. South East: 154.4 pence per litre

The South East follows closely, ranking second with average fuel costs of 154.4 pence per litre. Here, the average prices are slightly lower than in London, unleaded at 146.1 pence per litre, diesel at 154.6 pence per litre, and super unleaded at 162.6 pence per litre.

3. East of England: 153.6 pence per litre

The East of England ranks third, with the average fuel price at 153.6 pence per litre. In this region, unleaded costs an average of 145.9 pence per litre, diesel costs 153.7 pence per litre, and super unleaded costs 161.3 pence per litre.

Average car insurance cost by region

Insurance premiums are influenced by the car type and driver’s history and are significantly affected by the driver’s age and location. Younger drivers often face higher rates due to their perceived risk, and premiums can vary widely between regions due to local risk factors and accident rates.

1. London: £1,227

London has the highest average car insurance premium, at £1,277 per year. This figure is due to the capital’s dense traffic, higher accident rates, and higher vehicle crime rates.

2. West Midlands: £986

The West Midlands has an average annual premium of £986. This region includes major cities such as Birmingham, which will influence the higher premium rates due to urban risks like higher traffic levels, theft, and vandalism.

3. North West: £917

The North West includes cities like Manchester and Liverpool, with an average premium of £917 per year. These cities also face urban risk factors that increase insurance costs.

Average maintenance and repair costs by region

Regular maintenance, such as oil changes, checking tyre pressure and tread depth, and monitoring fluid levels, is needed to keep a car in good working condition and prevent more costly repairs later.

Unexpected maintenance can also be expensive. Here, we’ve averaged the cost of 4 standard repairs in the UK’s largest towns and cities, including MOT, full service, aircon regas, and full service and MOT.

Luton has the highest average cost across all 4 services (£153.40), mainly due to the high full service and MOT (£265.02). This is followed by Southend-on-Sea, with an average of £152.50.

Average parking costs by city

Parking prices often vary depending on location. Cities often charge high fees for parking spaces in residential and commercial zones.

Luton and Reading have the highest average daily parking price at £5.10. This could be due to a high demand or a limited supply of parking spaces in these areas.

Bradford in West Yorkshire follows with an average daily parking price of £4.80. Behind this are 4 cities with an average price of £4.70: London, Bristol, Milton Keynes and Swindon.

How much does it cost to own a car in the UK?

The cost of owning a car in the UK can vary based on various factors such as the type of car, its age, your driving habits, and where you live.

Here’s a breakdown of the everyday expenses associated with car ownership:

Purchase cost

The price of a brand-new car depends on the make, model, and specifications. For example, for a VW Polo, the average new price is between £20,975 – £27,475[1], increasing to £29,670 – £40,455 for a Ford Focus estate[2]. For an SUV, this would be slightly more, with the Ford Kuga averaging £32,095 – £42,455[3].

The average cost of a used car is just over £16,000, but this figure varies depending on the vehicle’s age, mileage, manufacturer, and condition[4]. For more information, read our ‘What car can I afford?’ guide.

Depreciation

Cars typically lose between 10% and 15% of their value yearly[5]. The rate of depreciation depends on the vehicle’s make and model.

Insurance

Annual insurance premiums depend on your age, driving history, location, and the car’s make and model.

Between January and March 2024, the average premium cost was £627, up 12% from the previous quarter[6].

Road tax

The rate of road tax that you pay depends on your vehicle’s CO2 emissions. You can see the rates for the initial tax payment below, as of 1 April 2024, and check GOV.UK for the most up-to-date rates[7]. These rates apply to cars registered on or after 1 April 2017. For cars registered before this, you can see the rates for cars registered before this date here.

The car tax band prices listed in the following tables are for petrol, diesel, and alternative fuel cars. Diesel cars tested to Real Driving Emissions 2 (RDE2) standards* fall into the same category as petrol cars (TC48). All other diesel cars tested to RDE standards** sit in a higher tax class (TC49). Alternative fuels are hydrogen fuel cells, liquid petroleum gas (LPG) and condensed natural gas (CNG).

| CO2 emissions (g/km) | Petrol and diesel cars* | Diesel cars** | Alternative fuel cars | 0 | £0 | £0 | £0 |

|---|---|---|---|

| 1-50 | £10 | £30 | £0 |

| 51-75 | £30 | £135 | £20 |

| 76-90 | £135 | £175 | £125 |

| 91-100 | £175 | £195 | £165 |

| 101-110 | £195 | £220 | £185 |

| 111-130 | £220 | £270 | £210 |

| 131-150 | £270 | £680 | £260 |

| 151-170 | £680 | £1,095 | £670 |

| 171-190 | £1,095 | £1,650 | £1,085 |

| 191-225 | £1,650 | £2,340 | £1,640 |

| 226-255 | £2,340 | £2,745 | £2,330 |

| Over 255 | £2,745 | £2,745 | £2,735 |

For the second year’s tax payment onwards, you can expect to pay:

| Tax class | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly payments by Direct Debit | Single 6 month payment | Single 6 month payment by Direct Debit | Petrol and diesel car | £190 | £190 | £199.50 | £104.50 | £99.75 |

|---|---|---|---|---|---|

| Electric | £0 | N/A | N/A | £0 | N/A |

| Alternative fuel car | £180 | £180 | £189 | £99 | £94.50 |

MOT test

The cost of an MOT test can vary, but the maximum amount that can be charged is £54.85 for a car and £29.65 for a standard motorcycle[8]. The UK government controls this, with the maximum fees set by the Driver and Vehicle Standards Agency (DVSA), a part of the Department for Transport. While some garages may offer MOT tests at lower prices, they cannot legally charge more than the DVSA-set maximum.

Servicing and maintenance

The average cost of a full car service is between £170 and £395, with an interim service costing around £110. Of course, if the service finds more problems that need to be fixed, this will add to the cost[9].

Fuel

The average cost of a litre of unleaded fuel is 145.3 pence per litre and 153.9 per litre for diesel fuel. Over a year, this depends on mileage and fuel efficiency but averages around £1,095 for unleaded and £1,284 for diesel, based on average fuel economy[10].

Breakdown cover

The cost of breakdown cover varies depending on the provider, the level of cover you choose, and your vehicle’s make and model. Basic cover can start at around £60 a year, but more comprehensive policies may cost as much as £200 per year[11].

With many different suppliers and cover levels available, it’s important to compare options to find the best fit for your needs and vehicle.

Financing costs

If you take out a loan or car finance on your car, you will have to pay interest on the amount you borrow. The monthly cost of financing a car can vary significantly based on your circumstances.

For example, the UK’s most popular car, the Ford Fiesta, has an average used price of £3,960 – £22,035[12]. Taking the middle of this range (around £13,000) and assuming a repayment term of 5 years and APR of 30.7%, with a fair credit score, an average car finance agreement would have monthly payments of £400.75[13].

What is the average car service cost in the UK?

The cost of car servicing in the UK can vary based on the type of service, the vehicle’s size, and the garage’s location.

An interim service, typically recommended every 6 months or 6,000 miles, costs around £110[6]. This service includes basic checks and replacements, such as engine oil and oil filters, and topping up various fluids, such as brake, steering, and coolant fluids.

A full service, recommended every 12 months or 12,000 miles, costs between £170 and £395[6]. This complete service includes all the checks from an interim service plus extra checks and replacements, potentially covering up to 80 different car parts and systems.

A major service, typically carried out every 24 months or 24,000 miles, can cost around £210[6]. This includes everything in a full service plus extra inspections and replacements like brake fluid, spark plugs, and more thorough checks of the car’s major systems.

What is the average cost of an MOT in the UK?

The average cost of an MOT test in the UK varies depending on the type of vehicle and the location. The maximum fee for a standard car (Class 4 vehicle) is £54.85, but the actual cost often ranges between £40 and £55. Many garages offer discounted prices, and it is not uncommon to find MOT tests for as low as £35 to £45[14].

The maximum fee for motorcycles is £29.65. Larger vehicles, such as vans up to 3,500 kg, can have an MOT fee of up to £58.60[14]. The cost can be higher in urban areas than in rural locations, so it’s worth checking multiple local garages for the best rates.

If your vehicle fails the MOT and needs a re-test, some garages may offer this service for free or at a reduced cost if the repairs are done at the same centre within a given timeframe (usually 10 working days).

What is the average cost of car insurance in the UK?

The average cost of car insurance in the UK has significantly increased recently. As of 2024, the typical annual cost for comprehensive car insurance is about £627[3]. This marks a large rise from previous years, reflecting the overall trend of escalating insurance premiums.

The exact cost can vary widely based on several factors, including the driver’s age, location, driving history and the type of car insurance chosen. For example, younger drivers face the highest premiums, averaging £1,037 for comprehensive cover due to their higher risk profiles. Older drivers generally benefit from lower premiums, dropping to £383 for those aged 50-plus[15].

Regional differences also play a role. Drivers in London experience the highest average costs at around £1,277 annually, whereas those in other parts of the UK, such as the South West, pay significantly less, averaging about £599 per year[12].

What is the average cost of car repairs and maintenance?

The average cost of car repairs and maintenance in the UK varies significantly depending on the car model, age, and specific services needed.

The average annual cost for maintenance and repairs is about £150[16]. However, specific maintenance costs vary by brand.

Cars over 40 years old are free from vehicle tax each year starting on 1 January, offering further financial relief to owners of classic cars.

What extra costs are associated with owning a car?

Cleaning

The money it costs to clean your car can vary depending on the type of service, the provider, and your location.

- A basic exterior hand wash costs between £5 and £20, or between £5 and £8 for a drive-through car wash

- A full valet car wash, which includes interior vacuum cleaning and dusting and the interior wash, costs between £40 and £150

- At the top end, a full-detail car wash includes washing, waxing, vacuuming, upholstery cleaning, and detailing and costs between £100 and £250[17]

Prices can also vary based on the size of the car, with larger vehicles like SUVs and vans often costing more than standard saloons or hatchbacks. Some premium services may be more expensive depending on the products used and the cleaner’s expertise.

Car park fees/parking tickets

The cost of car park fees and parking tickets in the UK can vary widely depending on the location, time, and type of parking facility.

In city centres like London, Manchester, or Birmingham, hourly rates range from £1 to £6 or more. Daily rates vary from £15 to £50 depending on the location and demand[16].

At airports, short-term parking (e.g., for pick-ups and drop-offs) can cost between £3 to £7 for the first 15-30 minutes. Long-term parking can be upward of £10 per day, with discounts for pre-booking[17].

In our Airport Parking Report, we found the cost of weekly parking to be £180 at London Gatwick and £255.30 at Heathrow.

Parking fees at train stations typically range from £5 to £25 per day, with some differences based on the station’s size and location. You can read more about train station parking prices around the UK in our Train Station Parking Report.

Vehicle tax

Vehicle tax (car tax, road tax, or Vehicle Excise Duty – VED) in the UK varies depending on several factors, including the type of vehicle, its CO2 emissions, and its registration date.

The car tax band prices listed in the following tables are for petrol, diesel, and alternative fuel cars. Diesel cars tested to Real Driving Emissions 2 (RDE2) standards* fall into the same category as petrol cars (TC48). All other diesel cars tested to RDE standards** sit in a higher tax class (TC49). Alternative fuels are hydrogen fuel cells, liquid petroleum gas (LPG) and condensed natural gas (CNG).

Here is a general overview of car tax bands:

First-year rate

| CO2 emissions (g/km) | Petrol and diesel cars* | Diesel cars** | Alternative fuel cars | 0 | £0 | £0 | £0 |

|---|---|---|---|

| 1-50 | £10 | £30 | £0 |

| 51-75 | £30 | £135 | £20 |

| 76-90 | £135 | £175 | £125 |

| 91-100 | £175 | £195 | £165 |

| 101-110 | £195 | £220 | £185 |

| 111-130 | £220 | £270 | £210 |

| 131-150 | £270 | £680 | £260 |

| 151-170 | £680 | £1,095 | £670 |

| 171-190 | £1,095 | £1,650 | £1,085 |

| 191-225 | £1,650 | £2,340 | £1,640 |

| 226-255 | £2,340 | £2,745 | £2,330 |

| Over 255 | £2,745 | £2,745 | £2,735 |

Standard rate (after the first year)

| Tax class | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly payments by Direct Debit | Single 6 month payment | Single 6 month payment by Direct Debit | Petrol and diesel car | £190 | £190 | £199.50 | £104.50 | £99.75 |

|---|---|---|---|---|---|

| Electric | £0 | N/A | N/A | £0 | N/A |

| Alternative fuel car | £180 | £180 | £189 | £99 | £94.50 |

The above applies to vehicles registered after 1 April 2017. Different bands apply for those registered between 1 March 2001 and 31 March 2017, which you can view on GOV.UK.

For those registered before 1 March 2001, rates depend on engine size, with those up to 1549cc paying £210 and those over 1549cc paying £345.

Fully electric vehicles are generally free from VED, while tax rates for motorcycles, vans, and other vehicles vary. For example, motorcycle tax rates depend on engine size and range from £25 to £117 per year[4].

Depreciation

Car depreciation is the reduction in a vehicle’s value over time due to age, mileage, wear and tear, and market conditions. It can significantly impact the amount you get if you sell or trade in your vehicle.

On average, a brand-new car loses 15 – 35% of its value in the first year. Over the next 3 years, it can lose 50% or more of its initial value[2].

Factors affecting depreciation include:

- Make and model: Some brands and models hold their value better than others

- Mileage: Higher mileage cuts a car’s value more quickly

- Condition: Well-maintained cars depreciate slower

- Market demand: Popular models retain value better

- Economic factors: General economic conditions can affect car values

Online depreciation calculators and car valuation tools can give more specific estimates based on make, model, age, mileage, and condition.

How have car ownership costs changed over the years?

Fuel prices

Fuel prices have fluctuated due to various factors, such as crude oil prices, geopolitical events, and changes in demand and supply. There has been a notable increase in fuel prices in recent years due to the global energy crisis and supply chain disruptions.

Petrol and diesel prices peaked on 4 July 2022, reaching 191.6 and 199.2 pence per litre, respectively. Since then, they’ve fluctuated in price but had fallen to 144.3 and 150.1 pence per litre by July 2024[20].

Insurance premiums

Insurance premiums have generally risen over the past few years. According to the Association of British Insurers, car insurance was 25% more expensive on average in 2023 than the previous year[3].

Factors contributing to this include increased accident rates and higher repair costs due to advanced vehicle technologies.

Maintenance costs

Maintenance costs have increased by 40% between 2018 and 2022[21]. This rise is partly due to the higher complexity of modern vehicles, which often need specialised services and parts.

Inflation and supply chain issues have also increased spare parts and labour prices.

Vehicle prices

The prices of new and used cars have significantly risen. Supply chain disruptions caused by the COVID pandemic, semiconductor shortages, and increased demand have driven up the costs of new vehicles. Used car prices have also surged due to the high demand and limited supply[22].

New cars vs used cars: How do the ownership costs compare?

The cost of owning a new car versus a used car can vary significantly based on various factors, including depreciation, maintenance, insurance, financing, and fuel efficiency.

Depreciation

- New cars: Depreciation is the most significant cost factor for new vehicles. A new car can lose 20 – 30% of its value within the first year and about 50% or more over 3 years[2]

- Used cars: Used cars depreciate slower since the biggest depreciation hit has already happened. The rate of depreciation decreases with the car’s age

Insurance

- New cars: Insurance premiums for new cars are typically higher. This is due to the higher replacement cost and the addition of comprehensive and collision coverage.

- Used cars: Insurance costs are generally lower for used cars since their value is lower, and they might not need comprehensive cover. However, this isn’t always the case. For example, an older luxury car will likely be a lot more expensive to insure than a brand-new version of a model like a VW Golf or Ford Focus[23]

Maintenance & repairs

- New cars: Maintenance costs are lower since new cars are under warranty. However, repair costs can be higher after the warranty period

- Used cars: Used cars may need frequent maintenance and repairs, but the overall cost can vary depending on the car’s condition and history[24]

When considering the total cost of ownership over a typical 5-year period, used cars generally offer lower ownership costs due to reduced depreciation, lower insurance premiums, and lower purchase prices.

New vehicles offer a warranty, lower initial maintenance costs, and the latest technology and safety features.

Petrol cars vs diesel cars: How do the ownership costs compare?

The ownership costs of petrol and diesel cars can be compared by looking at several key factors: purchase price, fuel costs, maintenance and servicing, insurance, and resale value.

Purchase price

- Petrol cars: Petrol cars are generally cheaper to buy than diesel cars. This is due to the lower production costs of petrol engines

- Diesel cars: Diesel cars usually have a higher upfront cost because diesel engines are more complex and expensive to make[25]

Fuel costs

- Petrol cars: While petrol is initially cheaper per litre than diesel – 145.3 pence per litre versus 153.9 pence per litre – petrol is less fuel-efficient for longer journeys[7]. Although it costs less at the pump, it may not be as cheap for long-distance driving as diesel, particularly on motorways

- Diesel cars: Diesel engines are more fuel-efficient and provide better mileage, especially for long-distance driving, potentially lowering fuel costs[7]. However, the type of driving you do can also influence costs; for example, petrol might be more cost-effective for mainly urban or residential street driving

Maintenance & servicing

- Petrol cars: Petrol engines generally have fewer parts and are cheaper to maintain. Service intervals can be longer, and parts are usually less expensive

- Diesel cars: Due to their complexity, diesel engines can be more expensive to maintain. Parts like turbochargers, particulate filters, and high-pressure fuel pumps can increase servicing costs[26]

Insurance

- Petrol cars: Insurance premiums for petrol cars tend to be lower, reflecting their lower price and simpler engine design

- Diesel cars: Diesel cars might have higher insurance costs due to their higher cost and more complex mechanical parts[26]

Resale value

- Petrol cars: The resale value of petrol cars can be lower, especially for larger vehicles with more desirable diesel variants

- Diesel cars: Diesel cars often retain their value better due to their fuel efficiency and durability, particularly for high-mileage drivers[27]

Taxes & emissions

- Petrol cars: Petrol cars emit more carbon dioxide (CO2) than diesel cars, but they usually produce less nitrogen oxide (NOx) emissions. This can affect vehicle tax rates

- Diesel cars: Diesel cars often have lower CO2 emissions, which can lead to lower vehicle taxes. However, higher NOx emissions can result in extra charges in low-emission zones, especially in urban areas[28]

Summary

The total cost of ownership for petrol versus diesel cars varies based on your driving habits and personal situation. Diesel cars can be cheaper for high-mileage drivers because of their fuel efficiency and better resale value.

Due to its lower price, maintenance costs, and fewer emissions restrictions, a petrol car might be cheaper for lower-mileage drivers or those primarily driving in urban areas.

When deciding between petrol and diesel cars, it’s essential to think about your specific driving needs and future trends in the automotive market.

What are the ownership costs of electric vehicles?

The ownership costs of electric vehicles (EVs) can vary widely based on factors such as the type of vehicle, local electricity prices, and government incentives.

Purchase price

- Initial cost: EVs often have a higher upfront cost than internal combustion engine (ICE) vehicles. For example, the average price of an EV in the UK is £48,000, but this can vary from £14,995 up to more than £300,000 depending on the make and model[29]

- Government incentives: Before June 2022, the UK government offered a plug-in car grant for most EVs. However, this now only applies to certain eligible vehicles, like motorcycles, vans, and taxis

Charging costs

- Home charging: Electricity rates in the UK average around £0.22 per kWh, and home charging can cost around £15 per charge[30]

- Public charging: Costs vary; slow/fast chargers (those below 50 kW) cost around 57p/kWh and 80p/kWh for rapid chargers (those 50kW and above)[31]. Some networks offer subscription models, reducing per kWh costs

- Supercharging: Tesla’s Supercharger network typically costs around 77p/kWh for non-Tesla drivers or around 53p/kWh for Tesla subscribers[32]

Maintenance costs

- Lower maintenance costs: EVs generally have fewer moving parts, leading to lower maintenance costs. Regular maintenance might include tyre changes, brake fluid changes, and cabin air filter replacements[33]

- Battery maintenance: EV batteries have warranties (typically 8 years or 100,000 miles). Battery degradation is a concern, but significant capacity loss is rare within the warranty period, according to Chargemap Blog

Insurance

- Insurance rates: Insurance for EVs can be slightly higher due to the vehicle’s higher value and specialised repair costs. On average, EV insurance costs £654[34]

Depreciation

- Resale value: EVs tend to depreciate faster than ICE vehicles, though this is improving. Depreciation can be around 48% of the purchase price over 3 years[35]

Taxes & fees

Extra costs

- Charging infrastructure: Installing a home charging point can cost between £500 and £1,000[37]. However, an electric vehicle chargepoint grant can cover up to 75% of the cost (up to £350) if you rent your home or own a flat

- Battery replacement: Although battery replacement is rare and usually covered under warranty, it can cost several thousand pounds if needed[38]

While EVs have a higher initial cost, their lower running costs, government incentives, and exemptions from certain taxes and charges can make them cheaper.

Potential owners should carefully consider their driving habits, charging options, and local incentives to make a well-informed decision.

How can you cut the monthly cost of car ownership?

He uses this knowledge to share ways motorists could cut the monthly cost of car ownership.

Explore car finance options

- Make a larger deposit upfront: If you’re planning to take out car finance or bad credit car finance, a large deposit can reduce your monthly repayments. This is because it lowers the amount you need to borrow.

- Choose the right finance term: Having a longer agreement term can help to make the monthly payments smaller. However, this may also increase the amount of interest you’re paying, meaning the total cost of your new car could be higher.

Reduce insurance costs

- Compare insurance quotes: Money Saving Expert found that the cheapest time to get quotes for car insurance is 20 to 27 days ahead of your renewal date.

- Increase your excess: Choosing a higher excess on your insurance could lower your premium. Make sure this is affordable for you in the event of a claim, and if you’re financing your car, check your contract as your lender may specify the excess.

- Take advantage of discounts: Look out for discounts such as those for safe drivers, multi-car policies, or bundled insurance products if they’re applicable to you.

Maintain your vehicle

- Regular maintenance: Keep up with regular maintenance to avoid costly repairs. This includes oil changes, tyre changes, and brake inspections.

- DIY minor repairs: Learn to do minor repairs yourself, such as changing air filters, wiper blades, or headlight bulbs.

Improve fuel efficiency

- Drive efficiently: Avoid rapid acceleration and hard braking, which can lower fuel efficiency.

- Reduce weight: Remove unnecessary items from your car to make it lighter and improve fuel economy.

- Keep tyres inflated: Properly inflated tyres can improve fuel efficiency and extend tyre life.

Lower depreciation costs

- Buy a reliable used car: New cars depreciate quickly. Buying a used car that’s a few years old could save you money and reduce depreciation costs.

- Choose cars with strong resale value: Some cars are known to retain their value better than others. When choosing a car, look for popular models with a reputation for reliability. Factors like brand reputation, low ownership costs, and high demand in the used car market can suggest a stronger resale value.

- Avoid odd colour combinations: Colours can affect a car’s resale value because some buyers are put off by divisive shades, so stick to popular colours like silver or grey… and avoid pink!

- Road Tax costs: Keep an eye on the CO2 emissions when purchasing as this directly affects the road tax costs, some increase by as much as 1000% if you buy the ‘less clean’ version of the same make and model! Not only does this drive-up cost of ownership, but also increases the depreciation and makes it harder to sell on.

Change driving habits

- Avoid idling: Turn off your engine if you’ll be stopped in traffic for a long time.

- Combine trips: Plan your errands to combine multiple trips into one, reducing the distance you drive.

- Carpool or use public transport: You could share rides with colleagues or friends, or use public transport if possible, to reduce the amount of driving you do.

Sell or trade-in

- Downsize your vehicle: If you have a large or expensive car, consider selling it and buying a smaller, cheaper car.

- Evaluate necessity: If you have multiple cars, think about whether you need all of them and consider selling one to cut costs.

Methodology

The data in this study is accurate as of 22 July 2024.

How much does it cost to run a car around the UK?

- Fuel: sourced from the AA’s March 2024 fuel prices

- Insurance: sourced from Quotezone.co.uk. All data shown uses a random sample of over 100,000 UK car insurance policies across all age groups from January 2023 to January 2024

- Repairs: sourced from FixMyCar (taking an average of MOT, full service, aircon regas, full service, and MOT prices)

- Parking: sourced from JustPark

Additional data was taken from the following sources:

- [1] Average VW Polo price – Parkers

- [2] Average Ford Focus estate price – Parkers

- [3] Average Ford Kuga price – Parkers

- [4] Average new and used purchase costs – NimbleFins Average Cost of Cars UK 2024

- [5] Average depreciation rate – Motorway Car Depreciation UK Market Guide (2024 Update)

- [6] Average insurance prices – ABI

- [7] Vehicle tax rates – GOV.UK Vehicle Tax Rate Tables

- [8] MOT costs – GOV.UK MOT costs

- [9] Average servicing costs – Checkatrade car service cost guide

- [10] Average fuel costs – NimbleFins Average Cost of Petrol for a Car 2024

- [11] Average breakdown cover cost – Carwow How much is breakdown cover?

- [12] Average Ford Fiesta cost – Parkers

- [13] Estimated car finance cost – Moneybarn car finance calculator

- [14] Average MOT costs – Checkatrade

- [15] Average insurance by age and region – GoCompare

- [16] Average maintenance cost – RAC

- [17] Average car wash costs – NimbleFins Average Cost of a Car Wash UK 2024

- [18] Average car parking costs – JustPark

- [19] Average airport parking costs – The Mirror

- [20] Historic fuel prices – House of Commons Library

- [21] Historic maintenance prices – Fleet News

- [22] Inflation and the auto industry: When will car prices drop? – J.P. Morgan

- [23] New or old car – which is cheaper to insure? – Insurance Business

- [24] Should I Buy a New or Used Car? – Evans Halshaw

- [25] Petrol vs diesel cars – Compare the Market

- [26] Should I get a petrol or a diesel car? – MoneySuperMarket

- [27] Does fuel type impact the value of your car? – Motorway

- [28] Is diesel actually better for the environment? – RAC

- [29] Average EV purchase price – NimbleFins Average Cost of an Electric Car UK 2024

- [30] Average electricity price – EDF Energy

- [31] Average public charging prices – Zap Map

- [32] Average Tesla charging prices – Vanarama

- [33] EV maintenance, service, and repairs guide – RAC

- [34] Average EV insurance price – NimbleFins – Average Cost of Electric Car Insurance UK 2024

- [35] Average EV depreciation rate – Motorway Electric Car Depreciation – The Ultimate Guide (2024 Update)

- [36] Ultra Low Emission Zone – Transport for London

- [37] Carwow Electric car charger installation cost 2024

- [38] How long do electric car batteries last? Replacement, warranties and battery life explained – Auto Express

Bringing you the latest news and insights from Moneybarn.

More from Moneybarn...

For a better road ahead

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.

Moneybarn is the trading style of Moneybarn No. 1 Limited, a company registered in England and Wales with company number 04496573, and Moneybarn Limited, a company registered in England and Wales with company number 02766324. The registered address for these companies is: Athena House, Bedford Road, Petersfield, Hampshire, GU32 3LJ.

Moneybarn’s VAT registration number is 180 5559 52.

Moneybarn Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702781)

Moneybarn No. 1 Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702780)