- Car finance Car finance

- Motorbike finance Motorbike finance

- Van finance Van finance

- How it works How it works

- FAQs and guides FAQs and guides

- About us About us

- Home

- Blog

- Buying a Vehicle

- What deposit should I put down for car finance?

What deposit should I put down for car finance?

Updated: Wednesday, 24 April 2024

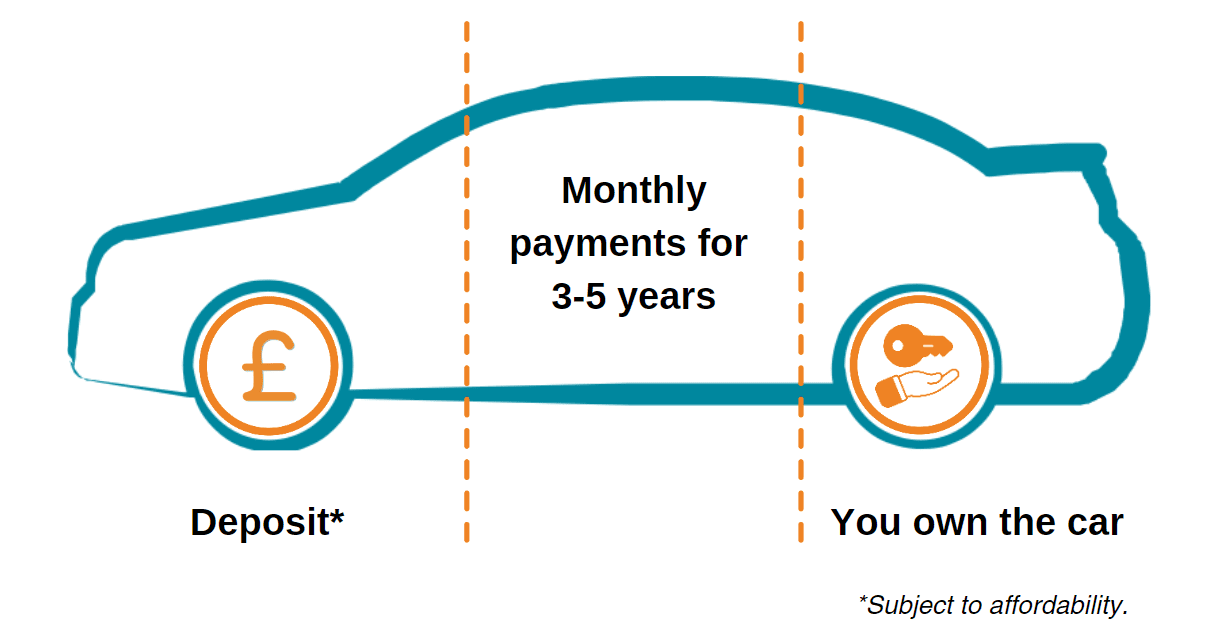

When you buy a car on finance, one of the things you can do to reduce your monthly payments is put down a deposit.

This guide explores the benefits of putting down a deposit and how putting down little or no deposit affects your agreement.

What is a car deposit?

A deposit is an amount of money paid upfront when buying a car. This could be a deposit paid to a dealership to reserve the car or a deposit paid to a lender if you’ve bought a car on finance.

In the context of car finance, your deposit amount is a percentage of the car’s price, which you may be able to negotiate with your finance provider.

When buying a car on finance, the lender may require you to make a deposit. This deposit can decrease the amount of money you borrow, or help you to buy a newer or bigger car.

What size deposit do I need for car finance?

There is no set deposit size to get car finance. Some lenders may offer no deposit car finance, while some may require a deposit of some kind.

Getting approved for car finance depends on several factors, including the lender’s eligibility criteria and your ability to make the monthly payments. In some cases, the lender may require you to put down a deposit in order to approve your application. This could be due to factors such as your credit history, affordability, or other personal circumstances.

According to MoneyHelper, the average deposit expected for HP, PCP, and CS car finance is around 10% of the value of the car.

Can I get my deposit back?

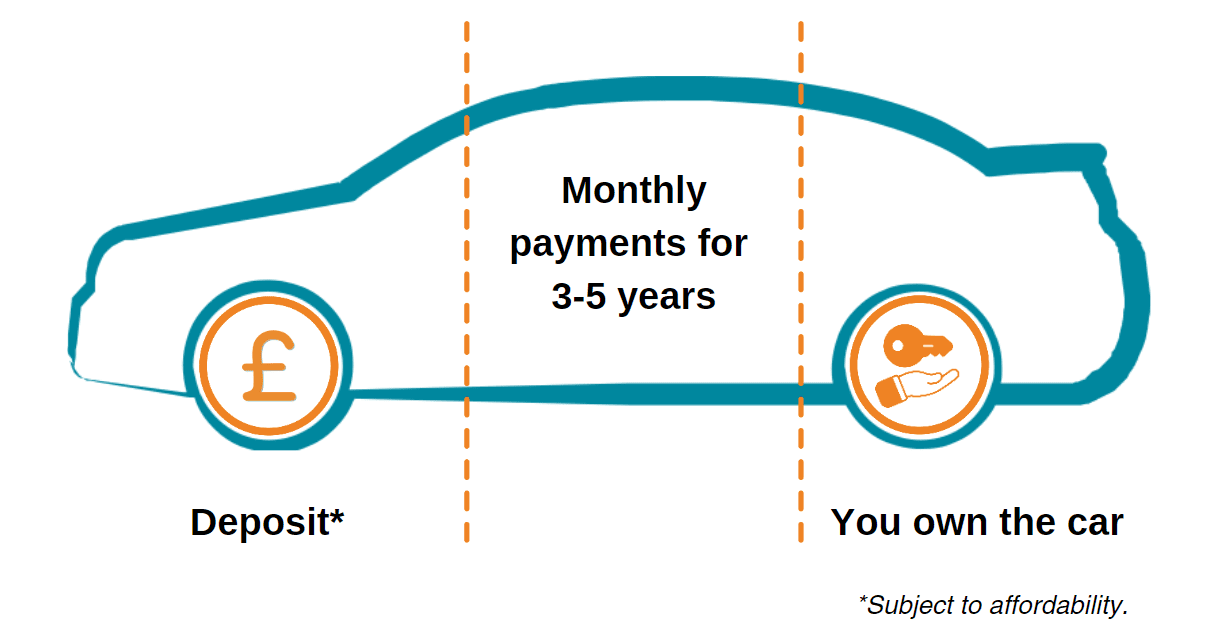

When you buy a car on finance, one of the things you can do to reduce your monthly payments is put down a deposit.

This guide explores the benefits of putting down a deposit and how putting down little or no deposit affects your agreement.

What is a car deposit?

A deposit is an amount of money paid upfront when buying a car. This could be a deposit paid to a dealership to reserve the car or a deposit paid to a lender if you’ve bought a car on finance.

In the context of car finance, your deposit amount is a percentage of the car’s price, which you may be able to negotiate with your finance provider.

When buying a car on finance, the lender may require you to make a deposit. This deposit can decrease the amount of money you borrow, or help you to buy a newer or bigger car.

What size deposit do I need for car finance?

There is no set deposit size to get car finance. Some lenders may offer no deposit car finance, while some may require a deposit of some kind.

Getting approved for car finance depends on several factors, including the lender’s eligibility criteria and your ability to make the monthly payments. In some cases, the lender may require you to put down a deposit in order to approve your application. This could be due to factors such as your credit history, affordability, or other personal circumstances.

According to MoneyHelper, the average deposit expected for HP, PCP, and CS car finance is around 10% of the value of the car.

Can I get my deposit back?

No, deposits for car finance aren't usually refundable

A deposit is essentially an initial payment that secures your agreement and can help reduce the amount of money you need to borrow.

A deposit is essentially an initial payment that secures your agreement and can help reduce the amount of money you need to borrow.

Do I need to put down a deposit for car leasing?

With Personal Contract Hire (PCH), you are leasing the car with no option of buying it at the end of the agreement. You are essentially renting the car for an extended period of time and will return it at the end of the lease.

Just like a deposit for car finance, the initial rental payment for leasing is non-refundable. It contributes to the overall cost of your lease agreement and helps you to secure the car.

What's the maximum deposit I can put down for car finance?

Car finance lenders have different criteria, including the minimum and maximum deposit that you can put down. It’s best to speak to your lender as they can show you how a bigger or smaller deposit will affect your monthly payments.

Can I use my current car as a deposit for my new one?

Do I need to put down a deposit for car leasing?

With Personal Contract Hire (PCH), you are leasing the car with no option of buying it at the end of the agreement. You are essentially renting the car for an extended period of time and will return it at the end of the lease.

Just like a deposit for car finance, the initial rental payment for leasing is non-refundable. It contributes to the overall cost of your lease agreement and helps you to secure the car.

What's the maximum deposit I can put down for car finance?

Car finance lenders have different criteria, including the minimum and maximum deposit that you can put down. It’s best to speak to your lender as they can show you how a bigger or smaller deposit will affect your monthly payments.

Can I use my current car as a deposit for my new one?

Yes, if your car is in positive equity

Many car dealerships offer part exchange schemes, which let you trade in your old vehicle and put the value of the car towards a new one.

If your current car is on finance and has positive equity, you can use it as a deposit. However, you’d need to settle your existing finance first. For more information, check out our guide to part exchanging a car on finance.

Yes, if your car is in positive equity

Many car dealerships offer part exchange schemes, which let you trade in your old vehicle and put the value of the car towards a new one.

If your current car is on finance and has positive equity, you can use it as a deposit. However, you’d need to settle your existing finance first. For more information, check out our guide to part exchanging a car on finance.

Should I put down a small or big deposit for car finance?

The amount of money you put down as a deposit depends on several factors:

- The car you’re looking to buy

- How long you want to finance it for

- Your preference for either a smaller deposit to make car finance more affordable at the beginning or a larger deposit to reduce the overall amount of interest you will be paying

Things to consider when deciding what deposit to make

Should I put down a small or big deposit for car finance?

The amount of money you put down as a deposit depends on several factors:

- The car you’re looking to buy

- How long you want to finance it for

- Your preference for either a smaller deposit to make car finance more affordable at the beginning or a larger deposit to reduce the overall amount of interest you will be paying

Things to consider when deciding what deposit to make

A larger deposit can help to lower your monthly payments, but saving up a big deposit might be tough. Choosing a low or no deposit might make it easier to get car finance at first, but your monthly payments could end up higher than someone who puts down a bigger deposit.

If you decide to pay a smaller deposit, it may seem more affordable at first. However, it could limit the number of car options available to you. Alternatively, you may need to borrow more money, which could result in paying more in interest. This could happen either because you are borrowing a larger sum of money or because the repayment term is longer.

By making a larger deposit, you can either shorten the length of your car finance agreement and pay less interest overall, or you can opt for lower monthly payments and spread out your car finance over a longer period of time.

A larger deposit can help to lower your monthly payments, but saving up a big deposit might be tough. Choosing a low or no deposit might make it easier to get car finance at first, but your monthly payments could end up higher than someone who puts down a bigger deposit.

If you decide to pay a smaller deposit, it may seem more affordable at first. However, it could limit the number of car options available to you. Alternatively, you may need to borrow more money, which could result in paying more in interest. This could happen either because you are borrowing a larger sum of money or because the repayment term is longer.

By making a larger deposit, you can either shorten the length of your car finance agreement and pay less interest overall, or you can opt for lower monthly payments and spread out your car finance over a longer period of time.

Can I get car finance with no deposit?

Can I get car finance with no deposit?

You may be able to get car finance without putting down a deposit. However, this depends on your credit history and the lender’s criteria.

We recognise that saving for a deposit might be difficult. To help you buy your next car, we may be able to offer you a Conditional Sale agreement with no deposit.

Car finance with Moneybarn

Being approved for zero deposit car finance with us depends on several factors, including your credit history and affordability. If you have very bad credit, you may need to put down a minimum deposit of £400 to get car finance with us.

Use our car finance calculator to see what your agreement could look like. Or, if you’re ready, get a personalised quote in less than 5 minutes and see how we could help you.

Representative 30.7% APR.

You may be able to get car finance without putting down a deposit. However, this depends on your credit history and the lender’s criteria.

We recognise that saving for a deposit might be difficult. To help you buy your next car, we may be able to offer you a Conditional Sale agreement with no deposit.

Being approved for zero deposit car finance with us depends on several factors, including your credit history and affordability. If you have very bad credit, you may need to put down a minimum deposit of £400 to get car finance with us.

Use our car finance calculator to see what your agreement could look like. Or, if you’re ready, get a personalised quote in less than 5 minutes and see how we could help you.

Representative 30.7% APR.

Car finance with Moneybarn

Bringing you guides that simplify the world of credit and answer common vehicle finance questions.

More from Moneybarn...

For a better road ahead

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.

Moneybarn is the trading style of Moneybarn No. 1 Limited, a company registered in England and Wales with company number 04496573. The registered address is Athena House, Bedford Road, Petersfield, Hampshire, GU32 3LJ.

Moneybarn’s VAT registration number is 180 5559 52.

Moneybarn No. 1 Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702780)