- Car finance Car finance

- Motorbike finance Motorbike finance

- Van finance Van finance

- How it works How it works

- FAQs and guides FAQs and guides

- About us About us

Home > Bad credit van finance > Guaranteed

Home > Bad credit van finance > Guaranteed

Guaranteed van finance

You may have seen lenders claiming to offer guaranteed van finance. However, there is no such thing as guaranteed van finance in the UK, so you should be cautious of this claim.

Guaranteed van finance

You may have seen lenders claiming to offer guaranteed van finance. However, there is no such thing as guaranteed van finance in the UK, so you should be cautious of this claim.

Showing our 4 & 5 star reviews

Showing our 4 & 5 star reviews

What is guaranteed van finance?

Guaranteed van finance is the idea that you can get approved for a van finance agreement regardless of your credit history, income, and affordability.

In reality, no regulated finance company will ever be able to guarantee you finance. This is because they must follow responsible lending regulations that ensures customers get a suitable and sustainable finance agreement.

A lender cannot offer you finance without looking at your personal financial situation. To do this they must do checks on you to see if you are able to afford the finance you are asking for. This all forms part of the Financial Conduct Authority (FCA) regulations.

If a company is saying they can offer you guaranteed van finance, then they are not following the Consumer Credit (Advertisements) Regulations. Knowing this, if you see companies promoting guaranteed van finance online, then be wary of their offer, as they won’t be upholding the UK advertising and lending regulations.

How can you improve your chances of being accepted?

Buying a reliable van is important, especially if you work for yourself. If you’re looking for van finance and you have a bad credit history, there are some things you can do that could improve your chances of being approved. These include:

Save for a deposit

Making a bigger payment upfront could reduce the amount you need to borrow, making your monthly payments smaller and more affordable.

Improve your credit score

A higher credit score could make you appear more reliable to lenders. To improve your credit score, you could:

- Register for the electoral roll

- Make payments on time

- Try to reduce your need for credit

Read our guide on how to improve your credit score for more information on the steps that could help boost your score.

Consider a joint application

Applying for van finance with someone else who lives at your address and has a stronger credit history might improve your overall application. Learn more about joint vehicle finance and whether it’s right for you.

Research specialist lenders

A bad credit score or less-than-ideal credit history doesn’t mean you can’t get van finance. We specialise in providing van finance to people who other lenders have let down.

Explore more ways to improve your eligibility in our guide: ‘How to increase your chances of getting finance.’

Or, use our van finance calculator to see what your repayments could look like.

Finance your new van with Moneybarn

We specialise in offering bad credit van finance, so if other lenders have rejected you, we could help.

When you make an application, we use a soft credit check. We only use a hard credit check when you’ve found a van you’d like to finance and contracts are drawn up for you to sign.

What is guaranteed van finance?

Guaranteed van finance is the idea that you can get approved for a van finance agreement regardless of your credit history, income, and affordability.

In reality, no regulated finance company will ever be able to guarantee you finance. This is because they must follow responsible lending regulations that ensures customers get a suitable and sustainable finance agreement.

A lender cannot offer you finance without looking at your personal financial situation. To do this they must do checks on you to see if you are able to afford the finance you are asking for. This all forms part of the Financial Conduct Authority (FCA) regulations.

If a company is saying they can offer you guaranteed van finance, then they are not following the Consumer Credit (Advertisements) Regulations. Knowing this, if you see companies promoting guaranteed van finance online, then be wary of their offer, as they won’t be upholding the UK advertising and lending regulations.

How can you improve your chances of being accepted?

Buying a reliable van is important, especially if you work for yourself. If you’re looking for van finance and you have a bad credit history, there are some things you can do that could improve your chances of being approved. These include:

Save for a deposit

Making a bigger payment upfront could reduce the amount you need to borrow, making your monthly payments smaller and more affordable.

Improve your credit score

A higher credit score could make you appear more reliable to lenders. To improve your credit score, you could:

- Register for the electoral roll

- Make payments on time

- Try to reduce your need for credit

Read our guide on how to improve your credit score for more information on the steps that could help boost your score.

Consider a joint application

Applying for van finance with someone else who lives at your address and has a stronger credit history might improve your overall application. Learn more about joint vehicle finance and whether it’s right for you.

Research specialist lenders

A bad credit score or less-than-ideal credit history doesn’t mean you can’t get van finance. We specialise in providing van finance to people who other lenders have let down.

Explore more ways to improve your eligibility in our guide: ‘How to increase your chances of getting finance.’

Or, use our van finance calculator to see what your repayments could look like.

Finance your new van with Moneybarn

We specialise in offering bad credit van finance, so if other lenders have rejected you, we could help.

We’re experts in helping people with bad credit or who have been refused by other lenders. However, we can’t guarantee van finance approval. As a responsible lender, we understand that you might have had difficulty with credit in the past. Our affordability checks ensure that our van finance is tailored to your circumstances.

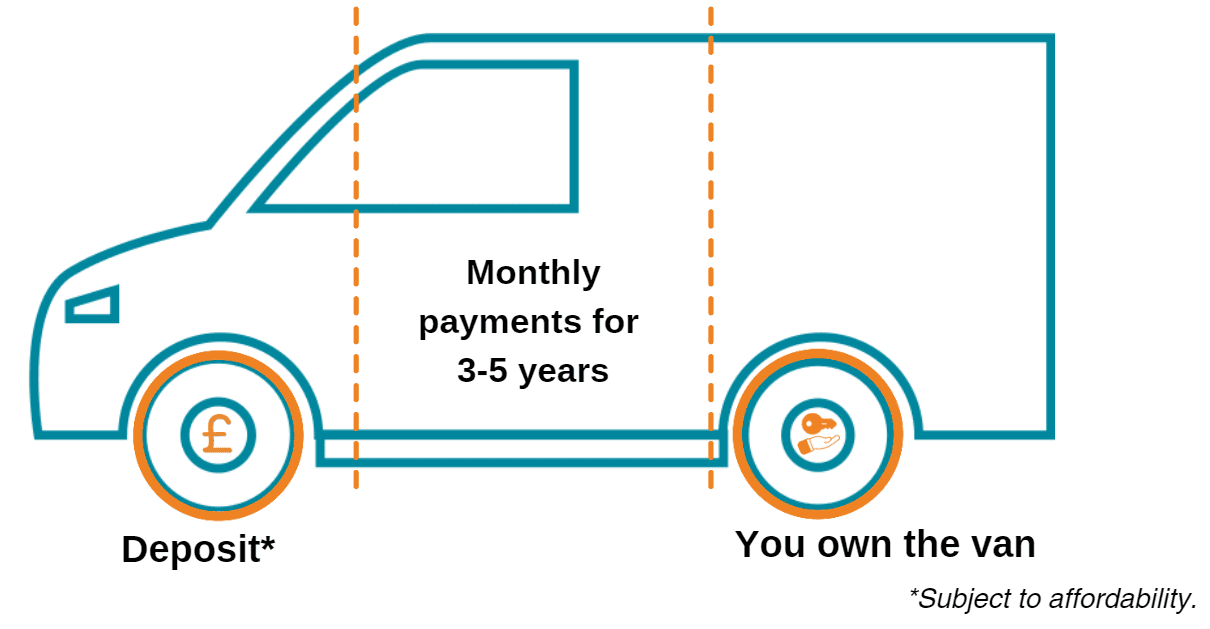

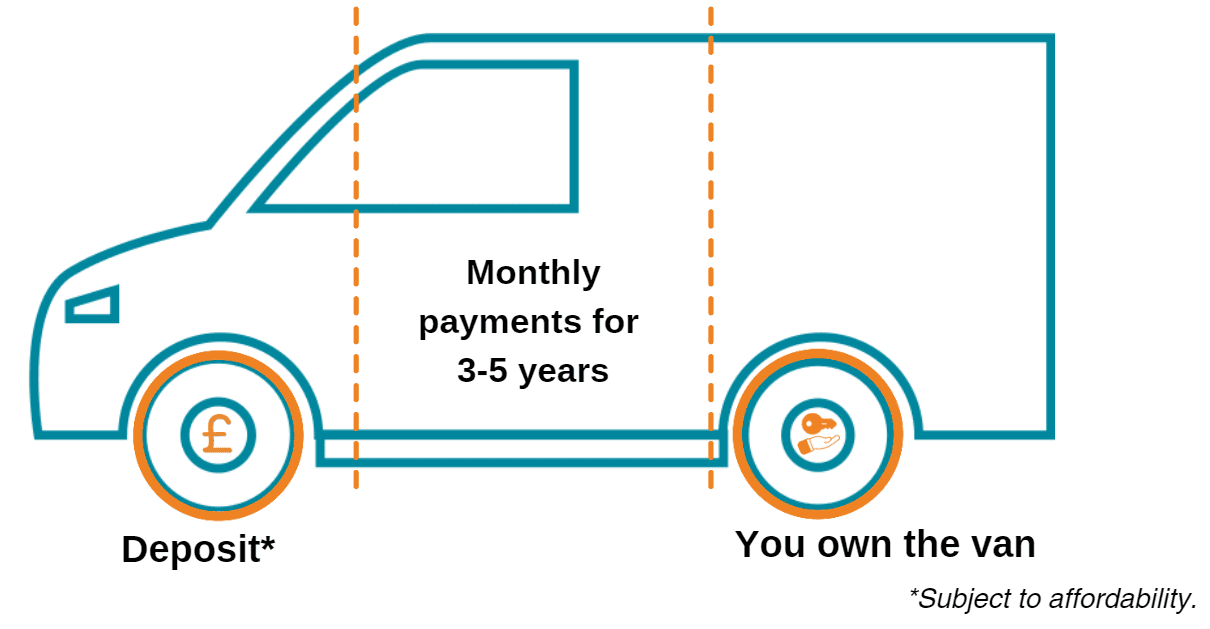

We offer Conditional Sale agreements that last up to 60 months (5 years) and let you spread out the cost of a new or used van. When you make the final payment, you’ll become the legal owner without any additional fee or balloon payment.

As a responsible lender, we understand that you might have had difficulty with credit in the past. Our affordability checks ensure that our van finance is tailored to your circumstances.

We offer Conditional Sale agreements that last up to 60 months (5 years) and let you spread out the cost of a new or used van. When you make the final payment, you’ll become the legal owner without any additional fee or balloon payment.

How our van finance works

With over 30 years of experience helping people onto a better road ahead, you could join the thousands of customers we help each month.

We could help, even if you:

- Have a CCJ (County Court Judgment)

- Are in or have had an IVA (Individual Voluntary Agreement)

- Have a poor or no credit history

- Are self-employed

- Have defaulted on credit before

- Have missed payments in the past

- Have been discharged from bankruptcy

- Have been refused by other lenders

How our van finance works

With over 30 years of experience helping people onto a better road ahead, you could join the thousands of customers we help each month.

How our van finance works

We could help, even if you:

- Have a CCJ (County Court Judgment)

- Are in or have had an IVA (Individual Voluntary Agreement)

- Have a poor or no credit history

- Are self-employed

- Have defaulted on credit before

- Have missed payments in the past

- Have been discharged from bankruptcy

- Have been refused by other lenders

Why can’t you get guaranteed van finance without a credit check?

Offering guaranteed finance without understanding your creditworthiness and affordability could lead to you ending up in a negative debt spiral.

Under FCA regulations, lenders must carry out thorough credit checks and affordability assessments before approving finance applications. They are not allowed to offer any form of guarantee before doing these. This keeps customers safe and promotes responsible lending practices.

No responsible finance company will offer guaranteed van finance. Learn more about the differences between hard and soft credit checks.

Why can’t you get guaranteed van finance without a credit check?

Offering guaranteed finance without understanding your creditworthiness and affordability could lead to you ending up in a negative debt spiral.

Under FCA regulations, lenders must carry out thorough credit checks and affordability assessments before approving finance applications.

They are not allowed to offer any form of guarantee before doing these. This keeps customers safe and promotes responsible lending practices.

No responsible finance company will offer guaranteed van finance.

When you make an application, we use a soft credit check. We only use a hard credit check when you’ve found the right van and contracts are drawn up.

Learn more about the differences between hard and soft credit checks.

Join thousands of monthly customers like Emma

“The service I received from Moneybarn was very easy right from the start. I did not feel pressured, I felt like somebody was actually listening to what I had to say” – Emma.

Join thousands of monthly customers like Emma

“The service I received from Moneybarn was very easy right from the start. I did not feel pressured, I felt like somebody was actually listening to what I had to say” – Emma.

What do so-called guaranteed van finance deals offer?

It’s important to remember that lenders aren’t allowed to provide guaranteed finance, so any adverts claiming to offer guaranteed van finance deals may be something else.

Sometimes, lenders may package different types of finance, rental, or lease agreements as ‘guaranteed van finance’. It’s important to review the terms and conditions of these offers carefully.

If you see adverts for guaranteed van finance, these may be one of the following options.

What do so-called guaranteed van finance deals offer?

It’s important to remember that lenders aren’t allowed to provide guaranteed finance, so any adverts claiming to offer guaranteed van finance deals may be something else.

Sometimes, lenders may package different types of finance, rental, or lease agreements as ‘guaranteed van finance’. It’s important to review the terms and conditions of these offers carefully.

If you see adverts for guaranteed van finance, these may be one of the following options.

Rent-to-buy schemes

Rent-to-buy schemes are lease-purchase agreements, not finance deals.

Under a rent-to-buy or rent-to-own scheme, you rent the van for a set period (usually 3-4 years) and then pay a final administration fee to become its legal owner. However, they still look at your income and affordability, so the ‘guaranteed’ nature of these agreements is subject to meeting their eligibility criteria.

Bad credit van finance

Sometimes, adverts for bad credit van finance might target people who are worried about getting accepted for finance by claiming to offer guaranteed approval.

Bad credit van finance can help you if you have a low credit score or limited credit history, but these deals aren’t guaranteed. All van finance applications must pass credit and affordability checks before they’re approved, and you’ll still need to meet the lender’s eligibility criteria.

Rent-to-buy schemes

Rent-to-buy schemes are lease-purchase agreements, not finance deals.

Under a rent-to-buy or rent-to-own scheme, you rent the van for a set period (usually 3-4 years) and then pay a final administration fee to become its legal owner. However, they still look at your income and affordability, so the ‘guaranteed’ nature of these agreements is subject to meeting their eligibility criteria.

Bad credit van finance

Sometimes, adverts for bad credit van finance might target people who are worried about getting accepted for finance by claiming to offer guaranteed approval.

Bad credit van finance can help you if you have a low credit score or limited credit history, but these deals aren’t guaranteed. All van finance applications must pass credit and affordability checks before they’re approved, and you’ll still need to meet the lender’s eligibility criteria.

Who are guaranteed van finance offers aimed at?

People who are concerned about their credit history or financial situation might find the idea of guaranteed finance appealing, as it claims to offer an easier way to borrow money.

Because of this, false advertising usually targets people with bad credit ratings or unstable incomes. This includes people:

- With bad credit scores

- With County Court Judgments (CCJs)

- Who are wondering how long after an IVA you can get car finance

- Who have declared bankruptcy in the past

- With bad or limited credit histories

- Who have been refused credit previously

- Who are self-employed looking for van finance

Guaranteed van finance vs guarantor van finance: what’s the difference?

Guaranteed van finance and guarantor van finance are two different things, but it’s easy to confuse them if you haven’t come across them before.

Who are guaranteed van finance offers aimed at?

People who are concerned about their credit history or financial situation might find the idea of guaranteed finance appealing, as it claims to offer an easier way to borrow money.

Because of this, false advertising usually targets people with bad credit ratings or unstable incomes. This includes people:

- With bad credit scores

- With County Court Judgments (CCJs)

- Who are wondering how long after an IVA you can get car finance

- Who have declared bankruptcy in the past

- With bad or limited credit histories

- Who have been refused credit previously

- Who are self-employed looking for van finance

Guaranteed van finance vs guarantor van finance: what’s the difference?

Guaranteed van finance and guarantor van finance are two different things, but it’s easy to confuse them if you haven’t come across them before.

Guaranteed van finance

- Often aimed at people with bad credit ratings or unstable incomes

- Claims to provide loans regardless of your credit history or financial situation

- Is a marketing tactic that doesn’t align with advertising and FCA regulation

Guarantor van finance

- Often aimed at people with bad credit ratings or unstable incomes

- Involves another person (the guarantor) agreeing to repay if the borrower defaults

- Is a legitimate form of van finance that could help those with poor credit scores

Guaranteed van finance

- Often aimed at people with bad credit ratings or unstable incomes

- Claims to provide loans regardless of your credit history or financial situation

- Is a marketing tactic that doesn’t align with advertising and FCA regulation

Guarantor van finance

- Often aimed at people with bad credit ratings or unstable incomes

- Involves another person (the guarantor) agreeing to repay if the borrower defaults

- Is a legitimate form of van finance that could help those with poor credit scores

With both of these types of agreements, approval is not guaranteed. Lenders must do credit and affordability checks on all applicants before providing loans.

Guarantor finance is less common now because bad credit finance options have become more readily available. Now, it’s easier for you to access van finance with a poor credit rating without the need for guarantors.

With both of these types of agreements, approval is not guaranteed. Lenders must do credit and affordability checks on all applicants before providing loans.

Guarantor finance is less common now because bad credit finance options have become more readily available. Now, it’s easier for you to access van finance with a poor credit rating without the need for guarantors.

FAQs around guaranteed van finance

Can I get guaranteed van finance if I'm self-employed?

Guaranteed van finance isn’t possible for anyone, regardless of whether they’re self-employed or in full-time employment.

If you are self-employed or on a zero-hours contract, you might find it harder to get van finance. This is because you may have a less stable income, which could impact a lender’s assessment of your ability to make regular repayments.

We consider applications from self-employed people. Find out more about self-employed van finance.

Can anyone be accepted for van finance?

Even if you have a bad credit score or little credit history, there should be a lender who can help you. However, no responsible lender can claim to offer guaranteed van finance because it doesn’t exist.

Being accepted for van finance is subject to credit and affordability checks and meeting the lender’s eligibility criteria. If a lender isn’t confident about your ability to repay what you borrow, they may not be able to offer you a loan.

If you have bad credit and are looking for van finance, you might need to use a specialist lender who offers bad credit van finance.

Can I get van finance with no credit check?

No, van finance deals with no credit checks don’t exist. Under FCA regulation, UK lenders must make credit and affordability checks before offering van finance.

Lenders have the final say over whether your application is approved based on their eligibility criteria. If you have a bad credit history, you may need to use a specialist lender who has experience helping people who have been rejected before.

What are the consequences for lenders who falsely advertise guaranteed van finance?

Lenders who claim to offer guaranteed finance agreements of any kind can face serious consequences. By engaging in deceptive practices, they may violate consumer protection laws and could face any of the following penalties:

- Fines issued under the Consumer Credit Act 1974, Consumer Protection from Unfair Trading Regulations, and Consumer Rights Act

- Being reported to the Advertising Standards Authority (ASA) for potentially misleading advertising

- Being reported to the Financial Conduct Authority (FCA) for irresponsible lending practices

Does guaranteed van finance with no guarantor exist?

Guarantor van finance is rare nowadays, as more specialist lenders can help people with bad credit. No lender can offer van finance without doing the appropriate checks, with or without a guarantor.

FAQs around guaranteed van finance

Can I get guaranteed van finance if I'm self-employed?

Guaranteed van finance isn’t possible for anyone, regardless of whether they’re self-employed or in full-time employment.

If you are self-employed or on a zero-hours contract, you might find it harder to get van finance. This is because you may have a less stable income, which could impact a lender’s assessment of your ability to make regular repayments.

We consider applications from self-employed people. Find out more about self-employed van finance.

Can anyone be accepted for van finance?

Even if you have a bad credit score or little credit history, there should be a lender who can help you. However, no responsible lender can claim to offer guaranteed van finance because it doesn’t exist.

Being accepted for van finance is subject to credit and affordability checks and meeting the lender’s eligibility criteria. If a lender isn’t confident about your ability to repay what you borrow, they may not be able to offer you a loan.

If you have bad credit and are looking for van finance, you might need to use a specialist lender who offers bad credit van finance.

Can I get van finance with no credit check?

No, van finance deals with no credit checks don’t exist. Under FCA regulation, UK lenders must make credit and affordability checks before offering van finance.

Lenders have the final say over whether your application is approved based on their eligibility criteria. If you have a bad credit history, you may need to use a specialist lender who has experience helping people who have been rejected before.

What are the consequences for lenders who falsely advertise guaranteed van finance?

Lenders who claim to offer guaranteed finance agreements of any kind can face serious consequences. By engaging in deceptive practices, they may violate consumer protection laws and could face any of the following penalties:

- Fines issued under the Consumer Credit Act 1974, Consumer Protection from Unfair Trading Regulations, and Consumer Rights Act

- Being reported to the Advertising Standards Authority (ASA) for potentially misleading advertising

- Being reported to the Financial Conduct Authority (FCA) for irresponsible lending practices

Does guaranteed van finance with no guarantor exist?

Guarantor van finance is rare nowadays, as more specialist lenders can help people with bad credit. No lender can offer van finance without doing the appropriate checks, with or without a guarantor.

Van finance explained

Learning about the different kinds of van finance and their pros and cons can help you pick the best option for you. Find out more by clicking the button below.

What is CS finance?

CS stands for Conditional Sale. This is the type of finance agreement we use for our van finance. Make sure you understand how it works with our guide.

Self-employed van finance

Being self-employed might make it difficult to get approved. We consider applications even if you’re self-employed. Find out more below.

For a better road ahead

Moneybarn is a member of the Finance and Leasing Association, the official trade organisation of the motor finance industry. The FLA promotes best practice in the motor finance industry for lending and leasing to consumers and businesses.

Moneybarn is the trading style of Moneybarn No. 1 Limited, a company registered in England and Wales with company number 04496573, and Moneybarn Limited, a company registered in England and Wales with company number 02766324. The registered address for these companies is: Athena House, Bedford Road, Petersfield, Hampshire, GU32 3LJ.

Moneybarn’s VAT registration number is 180 5559 52.

Moneybarn Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702781)

Moneybarn No. 1 Limited is authorised and regulated by the Financial Conduct Authority (Financial Services reference No. 702780)

Representative example: Total amount of credit £9015. Repayable over 56 months, 55 monthly payments of £287.74. Representative 30.7% APR (fixed). Deposit of £755.54. Total charge for credit £6810.70. Total amount payable £16,581.24. Subject to status and affordability. You could risk losing your vehicle if you do not keep up payments.